SEC Poised to Approve HBAR ETF — Hedera’s Gregg Bell Calls It ‘New Chapter’ for Regulated Crypto Access

The U.S. Securities and Exchange Commission (SEC) is expected to approve the first Hedera and Litecoin exchange-traded funds (ETFs), according to Bloomberg analyst Eric Balchunas, who confirmed that listing notices for Bitwise Solana, Canary Litecoin, and Canary HBAR have been posted and are scheduled to go live on October 28.

The development marks an important milestone for the digital asset industry in 2025, showing growing acceptance of blockchain networks with real-world use cases and institutional-grade infrastructure.

A Milestone for Regulated Digital Asset Access

Gregg Bell, Chief Business Officer at the Hedera Foundation, describes the approval as a watershed moment for both investors and the broader ecosystem. “With Hedera’s ETF filing approved, a new chapter opens for our ecosystem and the industry at large,” Bell said.

“For the first time, investors can gain regulated access to HBAR, a network powering real-world use cases at scale — from tokenized assets to sustainability markets. Supported by the Hedera Governing Council of Fortune 500 organizations, this milestone isn’t just about financial exposure; it’s about showcasing Hedera’s role as critical infrastructure for the future of global finance and accelerating adoption across both institutional and retail markets,” explains Bell.

Hedera’s governing body includes major global enterprises such as Google, IBM, Standard Bank, and Boeing, giving it one of the strongest enterprise governance frameworks in the blockchain industry.

The introduction of an HBAR ETF provides a regulated gateway for institutional investors to gain exposure to a network already facilitating enterprise-grade tokenization, carbon credit tracking, and digital identity solutions.

Industry Reaction: A Broader Shift in Institutional Access

The ETF approvals are part of a wider wave of regulated digital asset products entering traditional markets. Thomas Uhm, Chief Commercial Officer at the Jito Foundation, said the move represents a turning point for institutional crypto access.

“We’ve been sitting on the precipice of this moment, and I’m immensely proud we’re finally here. The approval of staked Solana ETFs is a significant step for institutional access to crypto. What most people see as success is a mountain of work under the surface,” explains Uhm.

Uhm added that JitoSOL’s early groundwork — including integration with custodians, building exchange liquidity, and addressing compliance challenges — has positioned it to serve institutional demand for yield-bearing digital assets.

The Beginning of a New Market Phase

With multiple crypto ETFs — including Solana, Litecoin, and Hedera — now set to launch, analysts anticipate a surge in institutional participation across the digital asset market.

These developments collectively expand regulated exposure beyond Bitcoin and Ethereum, creating diversified pathways for investors seeking compliance-ready blockchain exposure.

As Bell puts it, “The approval of the HBAR ETF is more than validation — it’s the start of a new chapter for onchain finance.”

HBAR Surges 17% as SEC ETF Approval Nears

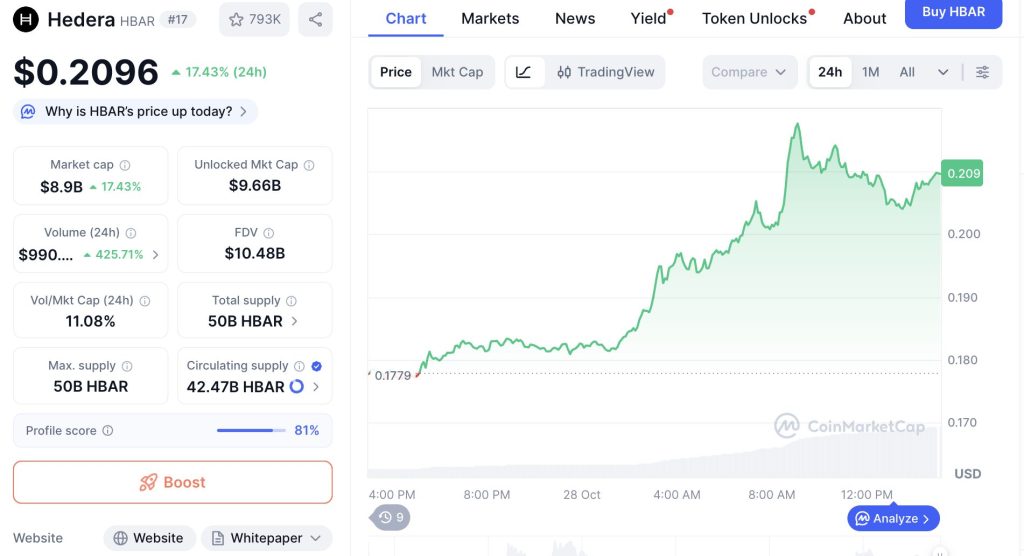

The price of Hedera (HBAR) surged 17.4% in the past 24 hours, trading at $0.2096 as traders priced in anticipation of the first HBAR ETF approval.

Hedera’s market capitalization rose to $8.9 billion, up 17.4%, while 24-hour trading volume skyrocketed 425% to nearly $1 billion — one of the largest daily increases in its history. The fully diluted valuation (FDV) now sits above $10.4 billion, reflecting renewed investor confidence in Hedera’s role within enterprise and institutional blockchain infrastructure.

The approval of an HBAR ETF would give institutional investors — who were previously restricted by compliance barriers — direct, regulated access to the asset. Market participants expect new inflows as asset managers and ETFs begin accumulating HBAR to back their funds.

You May Also Like

Haier Shines at Australian Open 2026: Official Partner Elevates the Game with Smart Innovation and Purpose

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets