XRP News Today: If ETFs Are Approved, Ripple Could Hit $4.50 – Layer Brett Gears Up for a Major Breakout

The cryptocurrency market is ablaze with the anticipation that Ripple exchange-traded funds (ETFs) will be approved in the near future.

With XRP news today, the financial community is unanimous that, with such regulatory approvals, the XRP token could soar to new heights, even reaching $4.50.

However, Layer Brett is set to be an incredible combination of the power of memecoin and the seriousness of technological parts, preparing to break out massively. With the support of the community spirit and the creativity of the rewards offered through staking.

Ripple’s Path to $4.50 with ETF Approval

XRP news today has it that the launch of XRP ETFs has generally been viewed as a major boost. In terms of catalyzing institutional adoption and market liquidity for Ripple.

Analysts say recent green lights came after new SEC guidance that gave legal clarity for crypto ETFs, but XRP remains off the list. Lawyer Bill Morgan clarified that this is pointing to Ripple’s long history of regulatory setbacks.

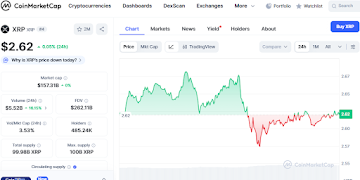

A potential XRP ETF approval would likely more than double the value of XRP, which is currently trading at $2.62 to $4.50 with average ETF participation.

According to XRP news today, the crypto has broken out of a consolidation wedge and holds above the $2.60 support zone.

Source: CoinMarketCap

Layer Brett: Not Just a Memecoin

Layer Brett is slowly gaining traction as a new form of Layer 2 project on Ethereum. In contrast to the conventional memecoins that circulated solely due to hype, Layer Brett (LBRETT) is designed to address the issues Ethereum is commonly known to have: low processing speeds and high gas charges.

Layer Brett takes the meme culture and combines it with practical use. A roadmap that has early backer benefits in the form of an attractive staking program with annualized returns of over 500%, but the benefits decline with the number of users who are early adopters. A factor that creates a sense of urgency.

Having raised more than $4.4 million in private funding rounds. The Layer Brett community is afforded low entry prices as it builds a platform aimed at fast, low-form transactions at a high cost of Ethereum to keep the security of transactions.

Building community-first and built for the future

Layer Brett is created with the aim of providing users with everything, and the principles of decentralization in the middle of it.

It does not necessitate any KYC and allows holders to self-custody their funds with the addition of a powerful incentives system. Combining staking rewards with the viral nature of meme-based communities.

The technical design of the project enables it to handle transactions off-chain. Then batch them to be settled quickly on Layer 1 of Ethereum to avoid congestion, and provide throughput of transactions per second with a fee as low as $0.0001.

Conclusion

A potential Ripple ETF green light would be a historic breakthrough that could open new price levels and attract institutional engagement. And with XRP news today, it is well-positioned for a possible upsurge to $4.50 and above.

Meanwhile, Layer Brett is preparing to make a breakout of its own. With success in private funding, Layer 2 technology, and a new community-based staking framework.

The early users of Layer Brett are in a unique position to reap the rewards of exponentially high returns. As the network grows and utility-based adoption continues.

For More Information:

Website: https://layerbrett.com

Telegram: https://t.me/layerbrett

X: (1) Layer Brett (@LayerBrett) / X

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post XRP News Today: If ETFs Are Approved, Ripple Could Hit $4.50 – Layer Brett Gears Up for a Major Breakout appeared first on Live Bitcoin News.

You May Also Like

Qatar wealth fund commits $25bn to Goldman investments

Positive view remains intact above 185.00, with bullish RSI momentum