Ripple’s XRP Nears Key Levels After Historic Technical Breakout

Ripple’s XRP is trading at $2.51 at press time, showing a slight increase over the past 24 hours. The price action follows a major breakout from a long-term technical pattern that had kept the asset in a range for seven years.

Since that move, XRP has been trading within a defined range, with strong interest holding it above previous resistance levels.

Breakout From Long-Term Chart Pattern

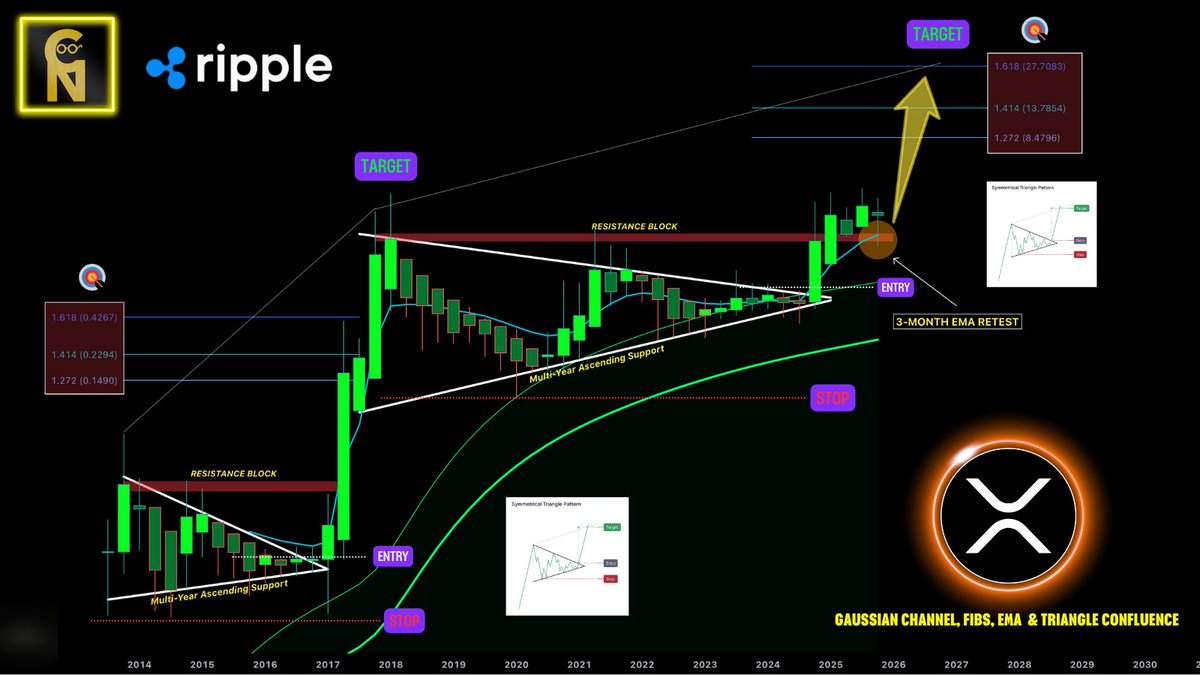

XRP recently moved above the upper trendline of a symmetrical triangle that had shaped its price for nearly a decade. This move pushed the asset past key levels, including the all-time high candle closes and 2021 peaks. Since the breakout, the market has entered a steady phase, with the price consolidating between $2.00 and $3.00.

According to market analyst ChartNerd, this area now acts as a key range for accumulation. The former resistance has turned into a support zone, which could form the base for future price moves. The analyst noted that this structure has remained stable for almost a year and shows no sign of weakness so far.

As previously reported, analysts have compared the current XRP structure to 2017, with models still pointing to a move above $5 this cycle.

Furthermore, price models built on Fibonacci extensions are pointing to possible future levels at $8, $13, and $27. These are drawn from past price activity and the height of the previous triangle pattern. In addition, a long-standing ascending trendline and a 3-month exponential moving average continue to guide the market upward.

ChartNerd remains confident in the outlook as long as the asset stays above the breakout zone. “The macro structure remains intact,” the analyst posted, suggesting that the longer-term chart still supports upward continuation.

Source: ChartNerd/X

Source: ChartNerd/X

Short-Term Uncertainty Around Key Price Levels

While the long-term picture remains stable, short-term charts are showing mixed signals. CRYPTOWZRD pointed out that XRP closed the last daily candle slightly lower and said the coming monthly close could influence the next move. Adding that any drop below that level could lead to more sideways action, the analyst said,

Meanwhile, there is near-term resistance at $2.75, which could lead to a sharp move higher if broken. On the downside, $2.27 is being watched as the next level of support.

Activity in the Market and ETF Update

Recent technical indicators, including the TD Sequential tool, have issued a sell signal following the recent rally. This tool has been used to forecast price changes and has worked well in previous XRP cycles. Alongside that, data shows that large holders have been reducing their positions over the last few weeks, as CryptoPotato reported.

Remarkably, there is also renewed attention on the potential launch of a spot XRP exchange-traded fund. Canary Capital recently updated its filing with the US Securities and Exchange Commission. The removal of a key delay clause suggests the ETF could go live as early as November 13.

The post Ripple’s XRP Nears Key Levels After Historic Technical Breakout appeared first on CryptoPotato.

You May Also Like

The Channel Factories We’ve Been Waiting For

XRP Price Prediction: Ripple CEO at Davos Predicts Crypto ATHs This Year – $5 XRP Next?