How Story Protocol Aims to Rewrite the Economics of Intellectual Property

Intellectual property (IP) is quietly becoming one of blockchain’s most practical frontiers — not as digital art, but as programmable infrastructure linking AI, gaming, and creative rights. BeInCrypto spoke with Andrea Muttoni, President and Chief Product Officer of Story, an on-chain IP platform building the rails for global licensing and royalty automation.

In this interview, Muttoni explains why adoption may arrive as a cultural moment rather than a technical milestone, how the $IP token aligns value with creative activity, and what legal interoperability means for the next decade of digital rights.

The Rise of Programmable IP and the Architecture Behind Story

Story Protocol, the company behind the Story Network, launched in February 2025 and aims to become the “IP layer of the Internet.”

After raising $54 million in 2023 and another $80 million in 2024, led by a16z, the team launched a purpose-built layer-1 blockchain. It enables IP Assets (tokenized works), Programmable IP Licenses (PILs), and a Royalty Module for real-time, on-chain revenue distribution.

Supporters view this architecture as a foundation for transparent provenance and composable licensing. Critics question whether smart-contract licenses can hold up in court without legal recognition.

The Evolving Inflection Point for On-Chain IP

With over $80 trillion in creative assets globally, on-chain IP is emerging as a market layer linking creators, enterprises, and AI platforms. Story already hosts more than 200 teams and 20 million IP registrations across entertainment, gaming, and data applications.

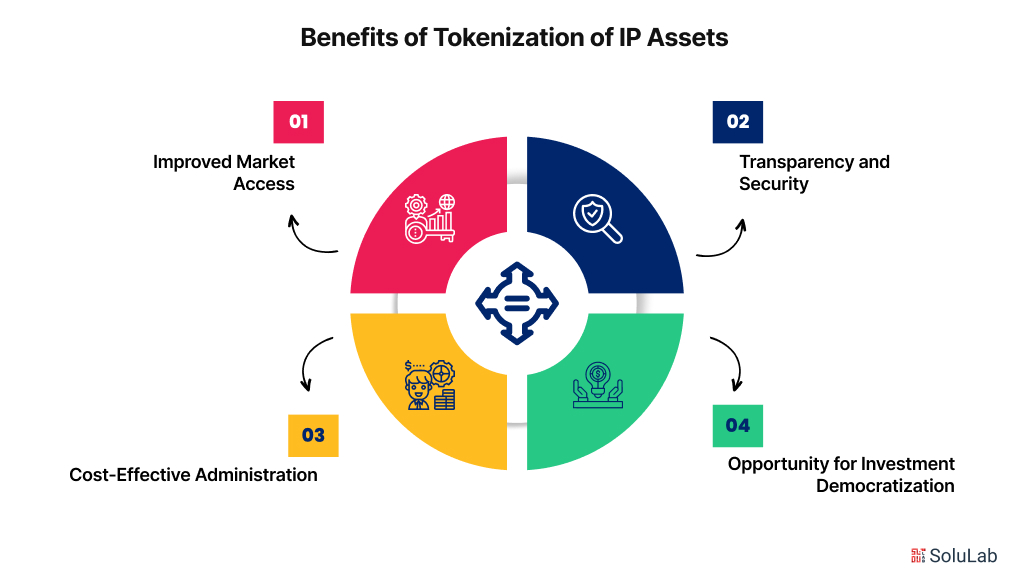

Benefits of Tokenization of IP Assets | SoluLab

Benefits of Tokenization of IP Assets | SoluLab

This view aligns with WIPO’s 2024 World Intellectual Property Report, which notes that global IP capacity remains concentrated in fewer than ten economies. Digital IP markets, it adds, still rely on institutional rather than technical integration. The inflection point for tokenized IP may depend as much on policy harmonization as product adoption.

Efficiency and New Royalty Rails on Story

Traditional royalty systems such as ASCAP pay creators quarterly through layers of intermediaries. Story aims to modernize that process.

Yet, as the IMF’s 2025 Fintech Note warns, real-time tokenized settlement can heighten systemic risk if oversight and liquidity buffers lag. Instant payout is powerful — but without safeguards, it can outpace regulation. Story’s long-term success may depend on integration with regulated financial rails.

Incentives and Integration Across the IP Economy

Legal battles between AI developers and rights holders expose a structural gap: the internet outpaced infrastructure protecting creative work. The World Economic Forum’s 2025 tokenization report notes that such markets evolve “non-linearly and in phases.” Adoption usually starts within permissioned, regulated environments — not open networks. Story’s claim of “legal interoperability” may thus require a phased rollout aligned with data privacy and jurisdictional norms.

UX Simplification and Creator Retention

Still, the US Patent and Copyright Offices’ 2024 Report to Congress stresses that blockchain transfers don’t alter IP law. Copyright and trademark assignments still need written, signed agreements. For now, Story’s on-chain licenses act as metadata layers, not binding instruments, until smart-contract enforceability is codified.

Reflexivity and Story Token Governance

The CFA Institute’s 2024 analysis offers a more reserved view: tokenization may unlock new asset classes but faces valuation opacity and custody risk. Institutional investors, it argues, will treat IP tokens as infrastructure evolution, not speculative plays — a stance that could temper hype around Story’s $IP token.

Data as a Market Signal

As AI’s need for rights-cleared data grows, new metrics may define IP value — licensing volume, royalty accruals, and provenance velocity.

This mirrors comments from Rayhaneh Sharif-Askary, Head of Product & Research at Grayscale, who described Story as “linking blockchain coordination to AI model training.” She noted that Poseidon’s model could turn everyday human activity into tokenized, rights-cleared data for machine learning. Her remarks show how programmable IP might unite creative economies and AI development within one infrastructure.

The overlap between IP and AI underscores a broader policy debate. The WIPO 2024 report notes that innovation thrives when law, research, and commerce evolve together. Story’s long-term success may depend less on token mechanics and more on whether global IP governance keeps pace with technology.

Conclusion

Programmable IP is shifting from concept to infrastructure. Story’s mix of automation, governance, and interoperability places it at the crossroads of culture and code. Yet as reports from WIPO, IMF, WEF, CFA, and the US Copyright Office emphasize, progress will be gradual and compliance-driven. If successful, Story could redefine how creative rights move through the global economy; if not, it may remain a prototype awaiting regulatory alignment.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Zero Knowledge Proof Stage 2 Coin Burns Signal a Possible 7000x Explosion! ETH Slows Down & Pepe Drops