Canton Network Welcomes Solv Protocol to Boost Institutional BTC and RWA Growth

Solv Protocol, a large onchain Bitcoin asset management platform, has announced that it is expanding to the Canton Network, which is a privacy-enabled blockchain supported by Goldman Sachs, Citadel Securities, and other major investors.

This move would position Solv Protocol to institutionalise its institutional-grade Bitcoin offering, SolvBTC, into the sophisticated Canton-based financial ecosystem, and open new potentials in real-world asset (RWA) markets and stablecoin lending.

The Canton Network, which was recently funded with 135 million dollars, is a transition between traditional finance (TradFi) and decentralized finance (DeFi). Through this integration, Solv will become more entrenched in institutional blockchain solutions and will be catalyzing more capital efficiency via tokenized Bitcoin assets.

SolvBTC: Fueling Collateral Mobility Across Blockchains

The core of this growth is SolvBTC, a 1:1 Bitcoin-backed wrapper at Solv Protocol. It allows users to borrow, trade, and earn interest on BTC as collateral in a range of decentralized markets. Today, Solv operates on over 605 million SolvBTC and xSolvBTC liquidity, which serves more than 300 million active loans across Lista DAO and Venus on BNB Chain.

With the integration of SolvBTC into the ecosystem of Canton, they will now be able to trade BTC-backed lending and stablecoin trading both in DeFi and in the traditional financial system. Such integration improves the collateral movement, which is a major component of Long term Solv strategy.

This vision was highlighted by the co-founder Ryan Chow who said, Collateral mobility has been a core part of Solv Protocol’s strategy. The bitcoin must circulate across borders, systems and economies freely. He further stated that getting integrated with the ecosystem of Canton with its RWA of $4 trillion is a significant step in the direction of institutional grade yield and liquidity solutions.

Unlocking Global Yield and Onchain Trading Strategies

By integrating with the Global Synchronizer Foundation, Solv Protocol and Canton will support advanced onchain yield and trading. JPY-USD carry trades can be done by institutional investors, exposure to the emerging-market T-Bills are possible and full auditability of cross-border liquidity is enabled.

This collaboration introduces legacy strategies into the environment of decentralization, where there will be privacy, compliance, and scalability amongst institutional actors. The architecture of the Canton Network enables confidential transactions, which is why market makers can trade on the regulatory frameworks and use the efficiency of blockchain.

Canton Network’s Institutional Ecosystem Welcomes Solv Protocol

Melvis Langyintuo, Canton Foundation Executive Director, was excited about the partnership, saying that Bitcoin-backed products of Solv would increase the BTC asset base in the network.

According to him, the adoption of Solv into the privacy and compliance system of Canton improves the institutional DeFi environment. This collaboration will drive collateral mobility, RWA yield strategies and continuation of TradFi convergence with crypto.

As its list of international financial partners continues to expand, Canton is quickly emerging as a blockchain solution provider of choice by institutional clients interested in solutions that comply. The introduction of SolvBTC will increase the liquidity foundation of the network and enhance its attractiveness as an innovation hub in a regulated DeFi.

Building the Foundation for Institutional DeFi

Combining Bitcoin, stablecoins, and RWAs on a common blockchain platform, Solv Protocol and Canton Network are leading the future of institutional finance. Their combined solutions will offer a seamless, secure movement of assets with complete transparency and accountability to aid the emergence of institutional DeFi.

It is a step toward a crucial milestone of bridging the digital and traditional finance, with Bitcoin-backed liquidity having the potential to fund regulated and globally scaled financial activities.

You May Also Like

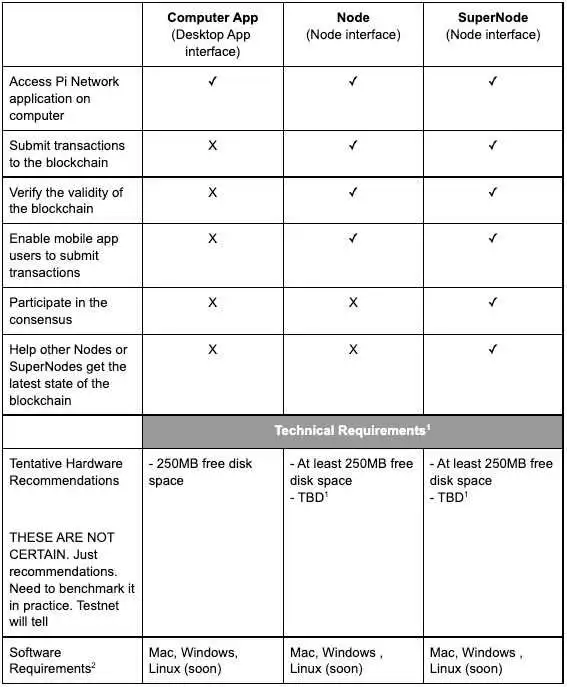

Pi Network Sets Feb 15 Deadline for Mainnet Node Upgrade

Pi Network Sets February 15 Deadline for Mandatory Mainnet Node Upgrade