Bitcoin crash: Why BTC price dropped below $100k today

Bitcoin crashed through the key psychological level of $100,000, taking the rest of the crypto market with it.

- Bitcoin fell below the key psychological level of $100k

- This was the lowest point for the BTC price since June

- Shares of Strategy were down 6%, mirroring the BTC price

Why? Fear is once again running the crypto markets. Against the backdrop of a government shutdown, traders are fleeing from risk assets.

For the first time since July, Bitcoin plunged below $100,000, triggering a broader crypto market sell-off. The decline came after worsening macro conditions triggered a wave of liquidations and ETF flows.

On Tuesday, Nov. 4, the BTC price reached a daily low of $99,954, the lowest level in several months. The price has since rebounded to $100,269, with Bitcoin registering a 6% daily decline. The drop triggered a significant decline, with the crypto market cap losing 6.4% — or over $300 billion in value.

$100,000 served a key psychological level for BTC, especially since the token held above it for months. The last time the BTC price was below $100,000 was on June 23, when it reached a daily low of $99,705.

Why did Bitcoin plummet?

The decline occurred after macro conditions worsened, reducing appetite for risk assets. Threats of new tariffs, as well as the likely pause to new Federal Reserve rate cuts, made crypto assets less attractive to investors.

This outlook then caused a cascade of effects that culminated in consistent ETF outflows and a spike in liquidations.

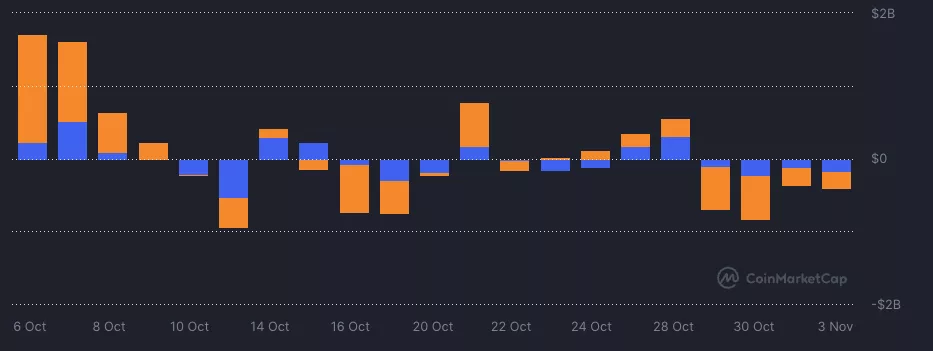

For one, Bitcoin (BTC) and Ethereum (ETH) ETFs are on track to register their fifth consecutive day of negative flows. At the same time, 24-hour liquidations reached $1.4 billion on Nov. 4, with longs dominating with $1 billion.

After Bitcoin’s price fell below this key level, further breakdown is possible. Traders will be looking at the $98,000 support level, which is both the low end and a high-liquidity zone.

Meanwhile, the U.S. dollar has rebounded slightly since the Fed cut interest rates in September.

You May Also Like

Siren Token Sheds 16.4% After 54% Retreat From All-Time High

Privacy is ‘Constant Battle’ Between Blockchain Stakeholders and State