Crypto News: Solana Has Lost Its Yearly Uptrend, According to Analysts – Crash To $120 Incoming?

Solana ETFs have attracted over $400 million in inflows, yet SOL seems to have broken its long uptrend and now risks falling toward $120.

Solana ETFs are off to a strong start and have attracted hundreds of millions in inflows since their debut.

Despite this surge in investor demand, the price of SOL has fallen after breaking its long-standing uptrend. Traders are now watching the $155 support level closely as losing it could send the token toward $120.

Solana ETFs Draw Record $400 Million in Inflows

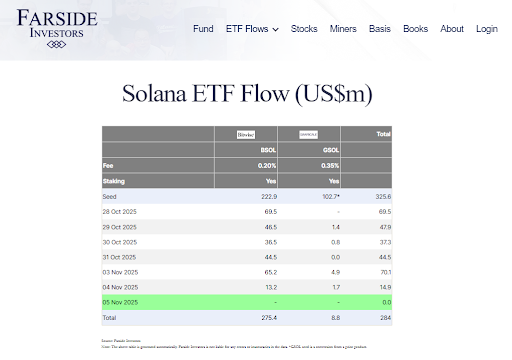

Spot Solana ETFs have seen impressive demand since launching on October 28. According to data from Farside and Bitwise, weekly inflows have been above $400 million, marking one of the strongest starts for a digital asset ETF.

Bitwise’s BSOL ETF has been the clear leader. It accumulated $401 million in assets under management (AUM) by the end of October. This represents about 9% of global Solana ETF assets and 91% of weekly inflows.

Solana ETF investors have been increasing their exposure lately | source- Farside

Solana ETF investors have been increasing their exposure lately | source- Farside

Grayscale’s GSOL ETF also attracted new capital but at a smaller scale, pulling in roughly $2.18 million. Together, the two products accounted for nearly $200 million in net inflows within the first week, excluding seed capital.

Globally, Solana-based ETFs now hold about $4.37 billion in assets.

US-listed funds account for most of that total and are showing strong domestic interest. Bitwise analysts estimate that every $1 billion in net inflows could drive a 34% price increase in SOL assuming normal market conditions.

SOL Price Breaks Yearly Uptrend

Despite record ETF inflows, SOL’s price has struggled. The token has dropped 16% this week, after falling to $148 as its lowest point since July. The move ended a 211-day uptrend that began in April and now leaves the token below several important moving averages.

Solana has broken its yearly uptrend and risks continuing lower | source- TradingView

Solana has broken its yearly uptrend and risks continuing lower | source- TradingView

The $170 to $156 zone has become a high-stakes area of support. If buyers fail to defend $155, analysts are warning that the next target could fall between $120 and $100.

That would represent a deep correction that erases much of SOL’s gains from the summer.

Solana’s Network Loses Ground to New Competitors

Solana’s recent price weakness also comes as its network activity cools. Data from DefiLlama shows Solana’s share of the Layer-1 transaction fee market has fallen from above 50% earlier this year to just 9%.

New networks like Hyperliquid and BNB Chain have gained market share after capturing 40% and 20% respectively. Their rise has been fueled by strong derivatives trading and active defi ecosystems.

This drop in network dominance may be reducing investor confidence despite positive news around the network.

Institutional Partnerships Remain Strong

Meanwhile, Solana continues to attract major corporate partners even as price and activity fluctuate.

Visa and Shopify are expanding their integrations with Solana’s payment infrastructure, and are aiming to deliver faster and cheaper transaction processing.

Western Union has also announced plans to build stablecoin remittance rails exclusively on Solana. This move could make international transfers cheaper for millions of users.

Meanwhile, Forward Industries (which manages one of the largest Solana treasuries) holds about 6.82 million SOL purchased at an average price of $232. The position is currently down more than 24% and is showing the market pressure more clearly.

The post Crypto News: Solana Has Lost Its Yearly Uptrend, According to Analysts – Crash To $120 Incoming? appeared first on Live Bitcoin News.

You May Also Like

The Channel Factories We’ve Been Waiting For

Market data: ICP rose 4.54% intraday, while GLM fell 5.44% intraday.