Trump Praises Crypto for Easing Dollar Burden – Ironically, That Could Hurt Bitcoin

President Donald Trump declared crypto “takes a lot of pressure off the dollar” during a speech at Miami’s America Business Forum on November 5, 2025, positioning the U.S. as “the bitcoin superpower” and “crypto capital of the world.”

Speaking to thousands of attendees, Trump credited his executive orders with ending what he called the federal government’s “war on crypto,” contrasting his approach with the Biden administration’s enforcement-heavy stance, which he said left industry figures “under indictment.”

Beyond regulatory relief, Trump framed crypto adoption as economically strategic, suggesting digital assets could alleviate strain on the dollar while positioning America as the global leader in both crypto and artificial intelligence, where he claimed the U.S. leads China “by a lot.”

The Dollar-Bitcoin Paradox

Trump’s endorsement reflects growing momentum behind stablecoins and strategic Bitcoin reserves in Washington, yet economic fundamentals suggest an inherent tension.

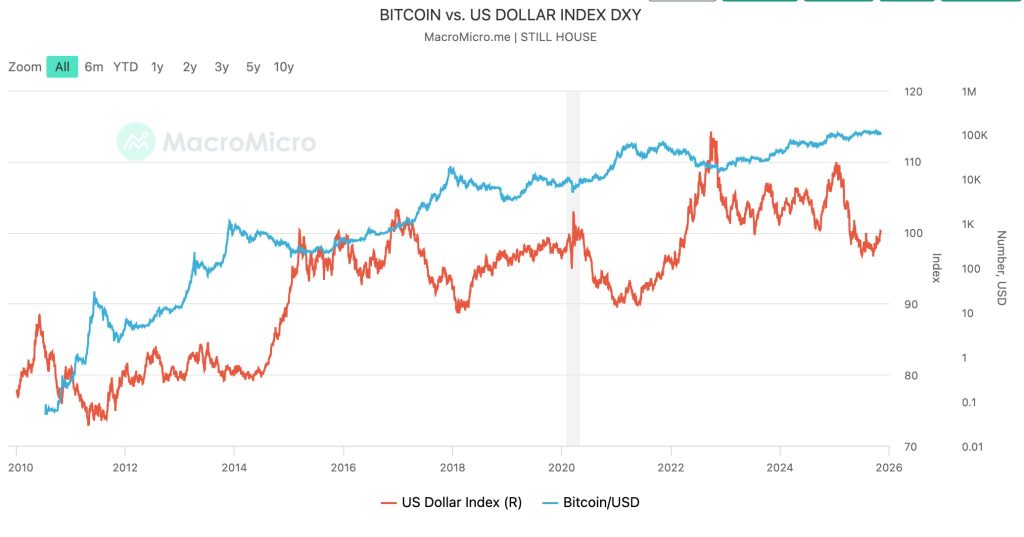

Bitcoin has historically exhibited an inverse correlation of approximately -0.7 with the U.S. Dollar Index (DXY), meaning a strengthened dollar typically suppresses Bitcoin prices while dollar weakness tends to boost them.

Source: MacroMicro

Source: MacroMicro

During the Federal Reserve’s 2022 tightening cycle, the DXY surged to 114, while Bitcoin crashed from $47,000 to below $17,000, a textbook demonstration of this inverse relationship.

Conversely, the 2020-21 easing period saw dollar weakness coincide with Bitcoin’s rally to then-record highs around $64,000.

Market observers note Bitcoin behaves more like a high-beta risk asset than a safe haven, rising with loose financial conditions and falling during liquidity withdrawals.

If cryptocurrency genuinely reduces pressure on the dollar by offering alternative transaction and store-of-value mechanisms, a stronger dollar could paradoxically undermine Bitcoin’s appeal.

The crypto typically attracts capital when investors seek alternatives to weakening fiat currencies, not when traditional money strengthens.

Academic research using wavelet analysis confirms Bitcoin’s out-of-phase dynamics with the dollar, though the relationship remains “more sporadic” than with conventional assets.

Strategic Reserve and Stablecoin Push

Senator Cynthia Lummis recently called a Strategic Bitcoin Reserve “the only path“ to meaningfully offset America’s $35 trillion debt burden, praising the Trump administration for embracing the concept.

She revealed Treasury Secretary Scott Bessent and White House staff are exploring structures beyond simply revaluing gold certificates, though financing details remain unclear.

The administration’s March fact sheet indicated the reserve would start with over 130,000 BTC already held through criminal forfeitures, worth approximately $34 billion, without requiring new taxpayer spending.

Similarly, Eric Trump recently told the New York Post that stablecoins could “save the U.S. dollar” by channeling “trillions from around the world” into U.S. markets through World Liberty Financial’s USD1 token.

However, critics, including Representative Maxine Waters and Senator Elizabeth Warren, have warned of what they see as conflicts of interest, noting the GENIUS Act stablecoin framework signed in July contains no provisions preventing the president or family members from profiting.

Market Dynamics Reveal Dollar-Bitcoin Tension in Real Time

Recent market action demonstrates the paradox between the dollar and Bitcoin.

When surprisingly strong U.S. jobs data emerged in late September, initial claims dropped to 218,000, and Q2 GDP was revised upward to 3.8%. The U.S. Dollar Index surged to a three-week high while Bitcoin tumbled below $111,000.

The pattern repeated on Thursday when better-than-expected services activity and payroll figures lifted the dollar to a five-month peak, capping Bitcoin’s recovery even as it climbed back above $103,000.

Current trading reflects this dollar dominance. Despite Bitcoin’s Thursday bounce, traders described a “buy the dip, sell the rip” bias, with rapid profit-taking, as the higher-for-longer rate narrative and firm dollar limit follow-through persisted.

Rate expectations for a December Fed cut slipped to 60% from 70% earlier in the week, keeping yields firm and the dollar elevated.

Notably, in the early hours of today, Turkey’s lira plunged to a record 42.1 per dollar on November 6, a 97% depreciation since 2010, as persistent inflation drives capital toward the US dollar.

Alok Jain described this saying, “they will keep adding paper till people keep considering it of any value.”

You May Also Like

Why It Could Outperform Pepe Coin And Tron With Over $7m Already Raised

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt