NEAR Surpasses AAVE, Trump-Backed WLFI Amid Intents Growth

NEAR NEAR $2.66 24h volatility: 37.2% Market cap: $3.39 B Vol. 24h: $1.17 B is now the 32nd most valuable cryptocurrency by market cap, recently surpassing Trump-backed WLFI and USD1, MemeCore, and AAVE AAVE $201.1 24h volatility: 3.2% Market cap: $3.06 B Vol. 24h: $385.85 M . The project is trending on X, receiving massive support from industry leaders as the NEAR Intents protocol presents notable growth data.

As of this writing, NEAR is trading at $2.45 with a market capitalization of $3.14 billion while experiencing a 24.33% surge in the last 24 hours. The Trump-backed World Liberty Financial stablecoin (USD1) and token (WLFI) have $2.84 billion and $2.90 billion market caps, respectively.

Aave, the leading lending platform, goes with $2.99 billion, trading at $196.22, while MemeCore has a $2.86 billion capitalization.

The most notable stat for NEAR, however, is the token volume being traded in the last 24 hours, registering a 232% increase at $858 million, accounting for nearly 27% of NEAR Protocol’s market cap, according to CoinMarketCap data on November 7.

NEAR price, market cap, volume, and rank as of November 7, 2025 | Source: CoinMarketCap

NEAR Intents Growth and More Chains Added

One of the main catalysts for this surge is that NEAR is trending among industry leaders thanks to NEAR Intents growth, as Coinspeaker reported on October 30. The public support and interest continue to rise in social platform trenches, like X, with many experts highlighting the growth.

Haseeb Qureshi, managing partner at Dragonfly, is one of these names, sharing data from Token Terminal showing “some serious fee numbers” from NEAR Intents, which is usually seen as protocol revenue.

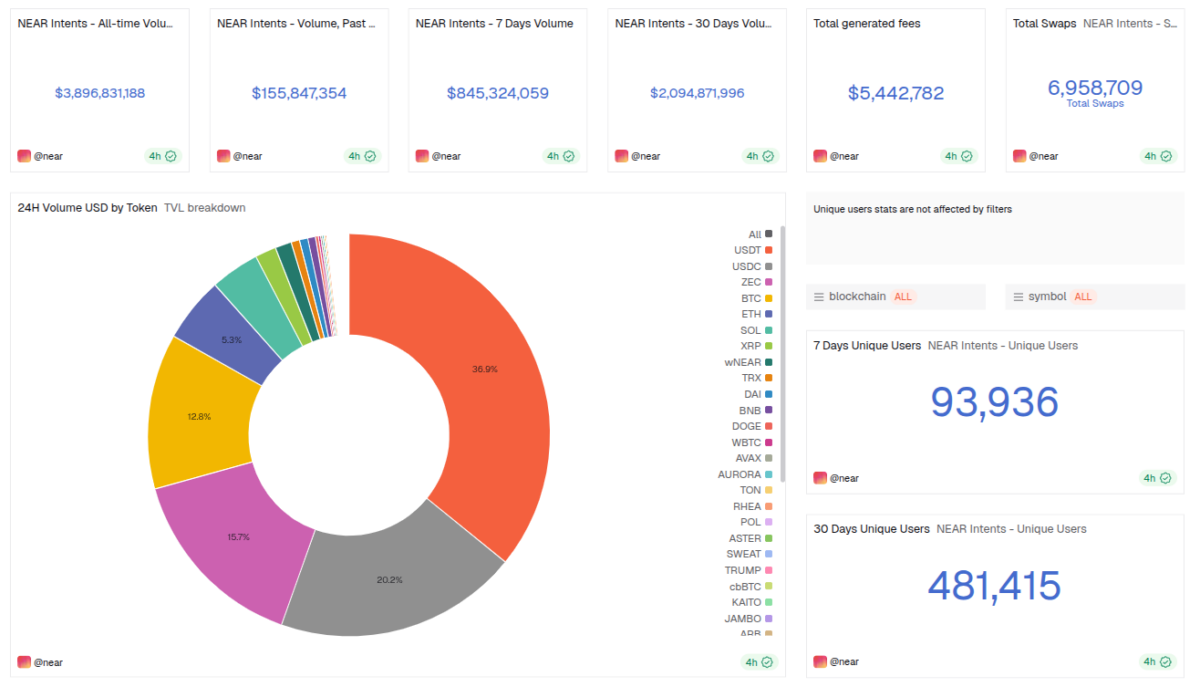

Data Coinspeaker gathered from the NEAR Intents Dune Analytics dashboard shows a total of $5.44 million in fees generated by the protocol since its launch. The all-time volume is currently nearing the $4 billion mark, just one week after reaching $3 billion. Seven-day and 30-day volumes are at $845 million and $2 billion, respectively, evidencing the strong momentum for the ecosystem, now partially translated into a price surge.

NEAR Intents dashboard, as of November 7, 2025 | Source: Dune Analytics

Moreover, Bowen Wang, CTO at the NEAR Foundation, teased six to seven more chains being added to NEAR Intents this month, November. A quick investigation suggests that Litecoin LTC $96.84 24h volatility: 11.9% Market cap: $7.28 B Vol. 24h: $838.47 M could be one of them, as an ltc.omft.near smart contract was created yesterday, on November 6. The same pattern was identified when the protocol added support to Aptos and later Cardano.

The momentum is favorable to NEAR from both an investment and utility perspective, especially now following the inflation halving approval that reduced NEAR’s annual tail emission from 5% to 2.5%, which could act as a catalyst for further growth as the available supply pressure is expected to diminish over time.

nextThe post NEAR Surpasses AAVE, Trump-Backed WLFI Amid Intents Growth appeared first on Coinspeaker.

You May Also Like

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge

Transocean stock is even more attractive following the Valaris deal