Bitcoin Stuck in a Tight Range, But Deep Accumulation Signals a Bigger Move

Key Takeaways:

- Bitcoin remains stuck in the $100,000–$105,000 range as leverage rapidly unwinds.

- ETF outflows have paused, but inflows remain weak and sentiment is fragile.

- Whales accumulated over 45,000 BTC this week while exchange reserves fell to multi-year lows.

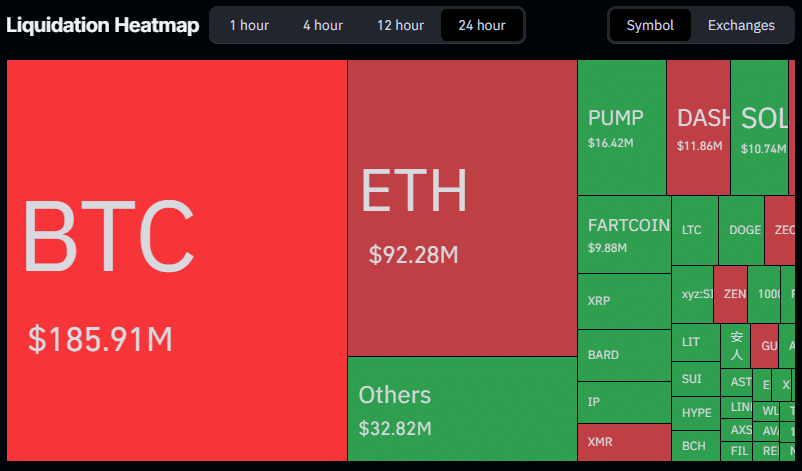

- Nearly $583M in liquidations and a 34% drop in open interest show a major derivatives reset.

- Macro relief from the U.S. reopening and softer U.S.–China signals supports cautious optimism.

Leverage has been flushed out, ETF outflows have finally paused, exchange reserves have plunged to multi-year lows, and deep-pocketed investors are accumulating aggressively.

After opening Thursday near $101,900, Bitcoin has remained glued to the lower band of its persistent $100,000–$105,000 range. Analysts say the narrow price action masks a tug-of-war between washed-out derivatives traders and long-term buyers steadily taking supply off the market.

ETF Outflows Break Their Streak – But Inflows Still Weak

Fresh data shows that the long run of Bitcoin ETF outflows has finally ended. A chart circulating widely on social media highlights that after six straight days of redemptions, funds have shifted into a mixed environment of small inflows and outflows. Still, sentiment remains fragile and inflows have yet to meaningfully return.

Spot ETFs shed an estimated $278 million on Wednesday, extending what analysts describe as “hesitant institutional flows.” Ethereum ETFs dropped another $184 million, while Solana ETFs stood out by adding a modest $18 million.

Market watchers caution that ETF flows continue to dictate near-term direction, with even small sentiment shifts capable of triggering sharp volatility.

Over-Leveraged Longs Wiped Out as Open Interest Collapses

Across the derivatives market, the unwind has been dramatic. Open interest has fallen by roughly 34% from its October peak above $64 billion to under $42 billion as of Nov. 13. A wave of forced long unwinds pushed total liquidations to nearly $583 million over the past 24 hours.

A heatmap from Alphractal shows the market flushing out over-leveraged long positions accumulated during the past three days. The wipeout leaves Bitcoin structurally “cleaner,” with a lower risk of cascading liquidations on the next move.

Exchange Reserves Crash to Multi-Year Lows – Whales Accelerate Buying

Despite shaky sentiment, one dataset is flashing a powerful long-term signal: the amount of BTC sitting on exchanges continues to collapse.

According to CryptoQuant data, exchange reserves have dropped to ~2.4 million BTC — the lowest level since 2022, and a 14% decline since the start of the year. Historically, such low reserve levels have been associated with major price expansions due to reduced sell pressure.

Meanwhile, whales appear to be capitalizing on the de-risked environment. BRN research head Timothy Misir noted that more than 45,000 BTC — roughly $4.6 billion — has been accumulated this week alone, marking the second-largest weekly accumulation of 2025.

On-chain activity also shows heavy withdrawals from exchanges into cold storage, reinforcing the picture of institutional accumulation rather than retail speculation.

On-Chain Analysis: “Seller Exhaustion” Meets Heavy Resistance

Glassnode’s weekly outlook describes the market as sitting in a “mild bearish range” defined by seller exhaustion near $100,000 and a thick resistance cluster between $106,000 and $110,000. Until that zone is cleared, analysts expect Bitcoin to remain directionless.

The current environment reflects an unusual balance: long-term holders continue to absorb supply, while short-term traders struggle to drive momentum amid weak spot inflows and shrinking leverage.

Macro Relief Helps – But Optimism Remains Fragile

Outside crypto, broader risk sentiment has improved just slightly.

The U.S. government has officially reopened after Congress passed long-delayed spending legislation, ending a 41-day shutdown and unlocking roughly $40 billion that had been frozen. At the same time, China signaled a willingness to deepen economic cooperation with the U.S., reducing pressure on global trade expectations.

These developments give markets some breathing room, but analysts warn that the recovery is delicate. Renewed political gridlock, inflation surprises, or further ETF outflows could easily weaken sentiment again.

A Market Resetting, Not Yet Trending

For now, the message from analysts is that Bitcoin is in a rare state of equilibrium. Leverage has been purged, supply is being drained from exchanges, and whales are accumulating into weakness — but the absence of strong inflows means a new uptrend has yet to form.

As Misir summarized, “The market is cleaner, but not yet liquid enough to trend.”

Until ETF inflows return or macro conditions strengthen further, Bitcoin appears set to extend its consolidation phase — a quiet calm that may not last long in a market known for sharp reversals.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Bitcoin Stuck in a Tight Range, But Deep Accumulation Signals a Bigger Move appeared first on Coindoo.

You May Also Like

ICP Extends Rally to 35% as Mission 70 White Paper Targets 70% Inflation Cut

Why Little Pepe (LILPEPE) Under $0.003 Is a Better Buy Than Cardano (ADA) Below $3