Bitcoin Hyper Whale Buy Fuels 1000x Talk As Presale Nears Finish

What to Know:

- A single $HYPER purchase of $502.6K added credible whale validation to a late-stage presale narrative.

- Bitcoin Hyper aims to deliver SVM-level throughput while settling to Bitcoin, targeting fast, low-fee $BTC transactions and usable DeFi rails.

- The $HYPER presale raised over $27.5M so far with a token price of $0.013275 and a staking reward of 42%.

- Based on $HYPER’s current price, investing now could reward you with an ROI of 572% or 1,805% by 2026 and 2030 respectively.

Big money keeps circling fresh Bitcoin infrastructure plays.

This week, a single on-chain purchase worth roughly half a million dollars in $HYPER lit up whale trackers, throwing a spotlight on Bitcoin Hyper’s ($HYPER) layer-2 pitch just as its presale enters the final stretch.

The buy-in arrived at a moment when Bitcoin scaling narratives are driving capital flows across Layer-2s and sidechains. Faster settlement, cheaper fees, more programmable rails for $BTC – that’s where the puck is going, and that’s the lane Bitcoin Hyper wants to own.

Bitcoin Hyper positions itself as a Bitcoin Layer-2 built around a Solana Virtual Machine (SVM) execution layer, bridging $BTC into a high-throughput environment while committing its state back to Bitcoin for security.

The promise is simple: near-instant $BTC transactions and a workable home for Bitcoin-centric DeFi and apps without abandoning Bitcoin’s base-layer assurances. That combination – speed from an SVM stack, settlement discipline from Bitcoin – is the core of the project’s pitch.The momentum is already there, even without whales adding more fuel to the fire. Fresh capital validates the story, adds perceived scarcity pressure, and sets a reference point for what deep-pocketed traders are willing to risk ahead of a first listing.

Read more about this innovative project with 1000x potential in our detailed Bitcoin Hyper review.

Read more about this innovative project with 1000x potential in our detailed Bitcoin Hyper review.

SVM-Powered Bitcoin Layer-2 Targeting Real Throughput

Under the hood, Bitcoin Hyper’s ($HYPER) design will funnel $BTC through a canonical bridge, mint an equivalent value on its Layer-2, process transactions in an SVM environment for high throughput, and then commit proofs back to Bitcoin’s Layer-1.

The intent is to preserve Bitcoin-grade security while overcoming Layer-1 bottlenecks.

The Hyper roadmap references sequencing research, zero-knowledge proofs, and periodic state commitments – the right ingredients for a Layer-2 that wants to run payments, order books, and staking without grinding to a halt.

For developers, the SVM angle taps an ecosystem that already understands performant, parallelized runtime patterns. For users, the value prop is faster finality and lower fees while still settling to Bitcoin.

Utility is the point here. If the bridge and execution stack work as described, Bitcoin Hyper can become the place where $BTC actually moves at app speed.

That creates room for payments, market venues, and on-chain tools tied directly to the asset people already hold. The upshot for presale buyers is straightforward: useful block space tends to find demand, and demand is what sustains fees and token utility.

Presale Success as it Draws to a Close

Presales are about price, runway, and conviction. The Bitcoin Hyper presale has already cleared $27.5M+, with a current token price of $0.013275 and staking rewards set at 42% for early participants.

Our $0.08925 price prediction for $HYPER suggests a potential ROI of 572% if the hype momentum holds. By 2030, following a successful implementation, $HYPER could get to $0.253, for a return rate of 1,805% based on today’s price.

Read our guide to buying $HYPER if you’re thinking of buying in.

Read our guide to buying $HYPER if you’re thinking of buying in.

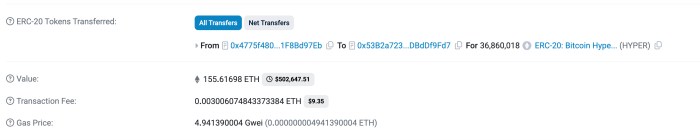

On signals, whale activity is setting the tone. Yesterday’s whale transaction saw 155.62 $ETH routed through the presale contract, with distributions to multiple recipient addresses and an associated $HYPER transfer of 36.86M tokens.

Historical cost accounting at the execution time puts the gross outlay at $502.6K – massive enough to register, spot on the ‘half a million’ mark to move sentiment. In presales, that matters. It tells mid-sized buyers the order book isn’t only retail.

Historical cost accounting at the execution time puts the gross outlay at $502.6K – massive enough to register, spot on the ‘half a million’ mark to move sentiment. In presales, that matters. It tells mid-sized buyers the order book isn’t only retail.

On runway, the presale’s $27.5M+ haul and 42% staking rewards set a clear incentive for early participants while the network spins up. If the staking mechanism draws sufficient lock-in ahead of TGE, it softens the initial float and can stabilize early price action if listings open with typical volatility.

Couple that with the SVM narrative and the broader hunt for Bitcoin-centric block space, and you get a presale with enough story, enough numbers, and now, enough whale interest to justify a closer look before the window shuts.

It’s no wonder that, in terms of numbers and community support, Hyper already qualifies as one of the best crypto presales of 2025.

Bitcoin Hyper is eyeing a Q4 2025/Q1 2026 release window, so there’s not much time left to join the presale. Plus the presale price goes up in stages, while the staking APY lowers as more holders join the pool.

Don’t delay – buy your $HYPER today.

Don’t delay – buy your $HYPER today.

Disclaimer: This isn’t financial advice. Always do your own research before making any investment.

Authored by Aaron Walker, NewsBTC – https://www.newsbtc.com/news/bitcoin-hyper-whale-buy-1000x-potential-presale-near-finish

You May Also Like

WLD Price Prediction: Targets $0.73 by February as Bullish Momentum Builds

Top Solana Treasury Firm Forward Industries Unveils $4 Billion Capital Raise To Buy More SOL ⋆ ZyCrypto