Canary’s Staked SEI ETF Moves to DTCC ‘Active and Pre-Launch’ Category

-

Canary’s Staked SEI ETF is now listed in DTCC’s “Active & Pre-Launch” category, signaling key operational steps toward a potential launch.

-

New U.S. regulatory guidance on staking ETFs reduces previous barriers, improving the chances for approval of staking-based products like the SEI ETF.

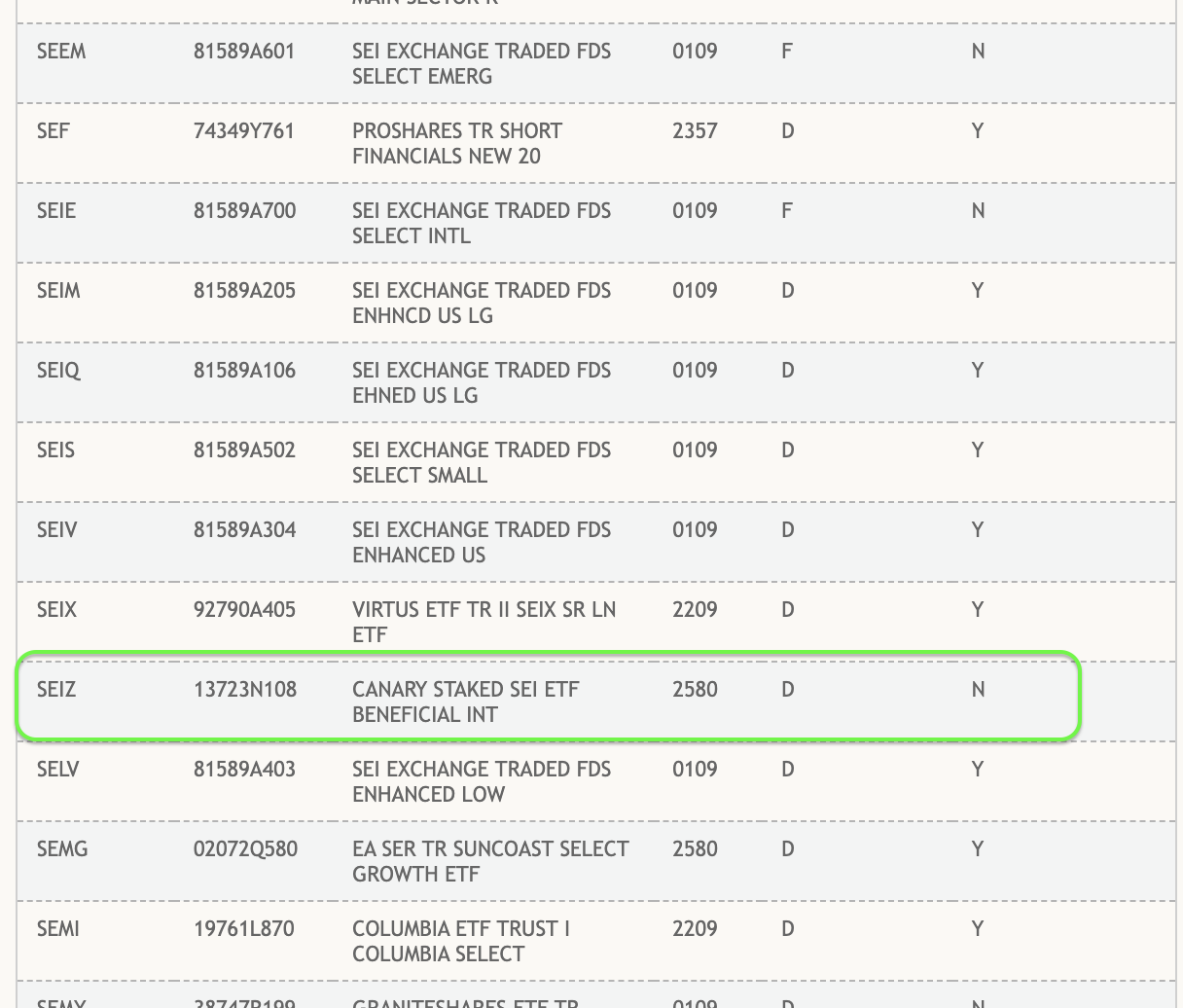

Canary Capital’s proposed Staked SEI ETF (ticker SEIZ) has been officially listed on the Depository Trust & Clearing Corporation (DTCC) under its “Active & Pre-Launch” registry. The listing does not indicate approval from the U.S. Securities and Exchange Commission (SEC). However, the listing on the DTCC is a sign that the ETF issuer has completed important operational steps toward launch.

Earlier this week, NASDAQ gave the XRP ETF issued by Canary Capital Group a green light to start trading. Sei is one of the many ETFs expected to launch soon and join Bitcoin, Ethereum, Solana, and XRP ETFs. As we previously reported, DTCC has also listed the Chainlink ETF. Alongside Canary, both Rex-Osprey and 21Shares have filed for SEI-based funds.

SEI ETF in the “Active and Pre-Launch”

According to DTCC records, the Staked SEI ETF is currently placed in the “active and pre-launch” category. This means the ETF is technically prepared for future electronic trading and clearing once regulatory approval is granted.

Source DTCC

Source DTCC

Other Canary ETFs in the “Active and Pre-Launch” list include SUI ETFs, Trump coin ETF, Litecoin ETF, among others. Despite this progress, the fund cannot yet be created or redeemed, meaning it remains non-operational at this stage.

Still, this step is often interpreted as a sign of confidence from the issuer. As one analyst put it, DTCC manages the back-end settlement operations for most U.S. stocks and ETFs. Appearing in its system places the SEI ETF into the typical onboarding flow ahead of potential brokerage availability.

Staking ETF Restrictions Continue to Loosen

Canary Capital first filed for the staked SEI ETF earlier this year, at a time when the SEC was cautious about staking mechanisms in exchange-traded products. However, the regulatory obstacle is less tight now.

Recent updates from U.S. regulators, including Revenue Procedure 2025-31 from the Treasury Department and IRS, have introduced a safe-harbor framework for crypto ETFs that use staking and distribute staking rewards. Under the new guidelines, products must meet strict criteria: hold only one digital asset plus cash, use qualified custodians, follow SEC-approved liquidity rules, and limit their role to holding, staking, and redeeming assets.

These rules also remove tax ambiguity around staking within ETFs, potentially clearing the way for approval of products like Canary’s Staked SEI ETF.

While the DTCC listing does not grant trading approval, it is a good sign for a possible approval.

]]>You May Also Like

Shows support for Fed’s Powell

Russia’s Central Bank Prepares Crackdown on Crypto in New 2026–2028 Strategy