Newly Released Documents Detail Epstein’s Influence on Bitcoin’s Early Development

- New revelations have surfaced that Jefferey Epstein supported MIT’s DCI with funds for Bitcoin Core Development.

- Epstein’s influence reached deeper into Bitcoin circles, including ties with Brock Pierce, with whom he had conversations.

The U.S. House Committee on Oversight and Government Reform recently released new documents that revealed Jeffrey Epstein’s hidden financial influence. The records showed that Epstein assisted MIT’s Digital Currency Initiative by providing funding for Bitcoin Core development.

Epstein Accused of Funding Bitcoin Core Development

At the center of this development is Joichi Ito, the former director of the MIT Media Lab. The Media Lab is a renowned interdisciplinary research hub focusing on media, technology, and innovation. Ito was instrumental in steering the lab toward blockchain and digital currencies.

In 2015, amid Bitcoin’s volatile early years, Ito launched the Digital Currency Initiative (DCI) under the Media Lab. The DCI aimed to advance blockchain research and provide stable and sustainable funding for long-term Bitcoin Core developers.

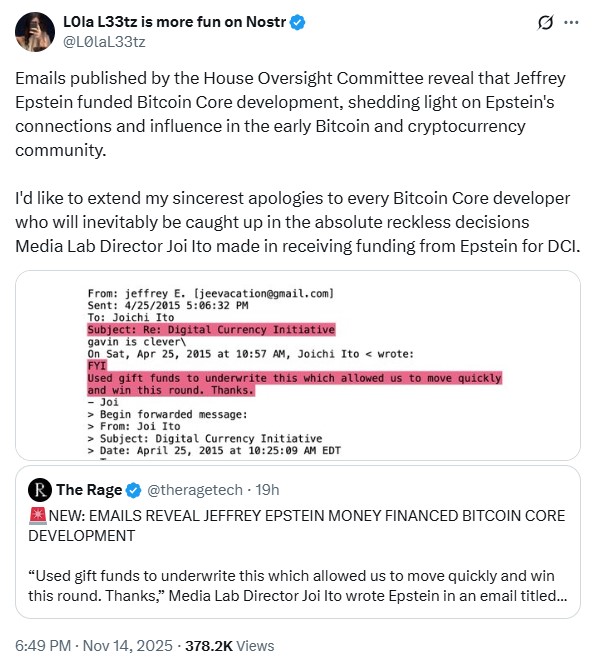

The new documents from the House Committee on Oversight now reveal that Ito relied on funds from Epstein to launch DCI.

Jeffery Epstein Ties to Bitcoin | Source: L0la L33Tz

Jeffery Epstein Ties to Bitcoin | Source: L0la L33Tz

In 2017, Epstein facilitated at least $750,000 in donations to the DCI. This included “gift funds” that Ito thanked Epstein for in an email titled “Digital Currency Initiative.”

Ito wrote, “Used gift funds to underwrite this, which allowed us to move quickly and win this round. Thanks.” These funds enabled the rapid recruitment and payment of salaries for Bitcoin Core developers.

He explained that three major developers, including Wladimir van der Laan and Cory Fields, agreed to join MIT. The email highlighted that some money came from prominent academics, including IMF economist Simon Johnson and cryptographer Ron Rivest. The document also uncovered Epstein’s early fascination with Bitcoin (BTC).

Ito handed in his resignation in September 2019, after the investigations revealed that the prestigious research facility had received funding from Epstein.

More Details Unraveled and Implications for Bitcoin

MIT had disclosed that Epstein had donated a total of $850,000 to the institution, of which $525,000 was directed at the Media Lab.

However, investigative journalist Ronan Farrow claimed that the MIT Media Lab had received $7.5 million via Epstein. This is, besides an anonymous $5 million donation from Epstein associate Leon Black.

Furthermore, the documents reveal Epstein’s influence reached deeper into Bitcoin circles than previously acknowledged. Epstein had early conversations with Brock Pierce, another figure with documented ties to the controversy surrounding early crypto foundations.

The revelation also exposes MIT’s internal unease around anonymous or reputationally risky donations. MIT tightened donation policies after the scandal broke, warning that “everything becomes public” eventually.

This disclosure does not alter the Bitcoin technical foundations. Core remains the consensus software, maintained by a global, pseudonymous community since Satoshi Nakamoto‘s 2008 Whitepaper.

However, it fuels ongoing debates between Bitcoin maximalists and altcoin advocates. Epstein’s involvement amplifies conspiracy theories and highlights risks in open-source funding, where anonymous donors can influence trajectories.

In a parallel development, the Bitcoin blockchain network is all set to get a new proposal dubbed BIP-444. As detailed in our last news piece, this proposal seeks to cap OP_RETURN outputs at 83 bytes and restrict other data embedding methods.

]]>You May Also Like

Morning Crypto Report: 'I Am Capitulating': What's Vitalik Buterin Talking About? Bitcoin Quantum Threat Drama Gets 20,000 BTC Twist, Cardano out of Top 10 as Bitcoin Cash Wins Back 25% of BCH Price

Federal Reserve Lowers Interest Rates Again