Cardano News: What’s Next for ADA Price After Dropping Below $0.30 Support?

Cardano breaks key support at $0.50, forming a bearish pennant. ADA faces further downside amid strong selling pressure.

Cardano (ADA) has recently fallen below its key support level of $0.50, raising concerns among investors. The cryptocurrency’s price is now testing new lows, with analysts watching closely to see if it can recover.

ADA has previously shown strong rebounds from this level, but the recent decline could signal a deeper downtrend. As of now, the price stands at $0.472, and traders are focused on whether the asset can find support and stabilize or if further declines are imminent.

Cardano Breaks Long-Held Support Level

Cardano’s price has dropped below a crucial support zone that has held since early 2024. This support level has seen multiple successful rebounds in the past, with ADA showing signs of strength after touching it.

In April, ADA rose by nearly 60% after retesting this level, and the same happened in June and July, with ADA seeing rallies of 80% and 70%, respectively.

However, the current drop to $0.472 is the first time ADA has broken this support. This break indicates that the previous support may no longer be as reliable, leaving ADA vulnerable to further declines.

Analysts now expect the price to test new support zones, possibly at $0.40 or lower, if the bearish trend continues. The loss of this support level marks a distinct shift from previous cycles, suggesting the start of a new phase in Cardano’s price action.

Traders are now watching closely for any signs of a potential rebound. However, breaking this key support level raises concerns about ADA’s ability to regain its previous strength.

Bearish Pennant Formation Signals Further Downside

On the four-hour chart, Cardano is forming a bearish pennant pattern, which suggests a continuation of the downward trend. The pennant shows tight consolidation followed by a sharp break under the lower boundary.

ADA’s failure to break above the $0.50 resistance level has added to the bearish pressure. The price is now firmly below the broken trendline, indicating no significant buyer support in the market.

The breakout from the pennant formation suggests further downside movement, potentially pushing ADA toward the $0.40 level. The absence of a strong buyer defense makes it likely that ADA will face additional declines before any potential recovery.

Until ADA breaks back above the $0.50 mark, the bearish trend will likely continue to control the price action.

As the market consolidates in this bearish formation, traders are focused on key price levels for potential reversal points. However, without significant buying pressure, the outlook remains negative.

Related Reading: Cardano Trader Loses $6M in ADA in Faulty Stablecoin Swap

DMI Indicator Confirms Strong Selling Pressure

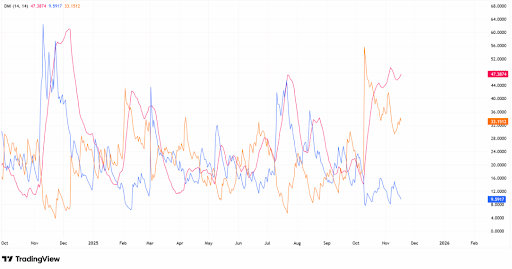

The Directional Movement Index (DMI) indicator shows that sellers currently dominate the market. The +DI, which represents buying strength, is at 9.85, far below the -DI at 33.15, indicating strong selling pressure.

Additionally, the ADX, which measures the strength of the trend, is reading 47.38, confirming a strong downward trend.

DMI indicators show strong selling pressure and bearish trend continuation. Source| TradingView

DMI indicators show strong selling pressure and bearish trend continuation. Source| TradingView

These DMI readings suggest that any upward movements will likely be short-lived. With selling pressure remaining high, ADA could continue to struggle in the short term. The DMI’s strong bearish signal indicates that buyers will need to step in to reverse the current trend. Until then, the downside pressure remains in control.

The DMI confirms that the market is currently in a strong downtrend, with sellers holding the upper hand. For ADA to recover, the trend will need to shift, but for now, the outlook remains bearish.

The post Cardano News: What’s Next for ADA Price After Dropping Below $0.30 Support? appeared first on Live Bitcoin News.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Shiba Inu (SHIB) Price Reset Point: Three Oversold Indicators, 20% Potential