Polymarket Handles $3B Volume on Polygon, 338,000 Unique Traders

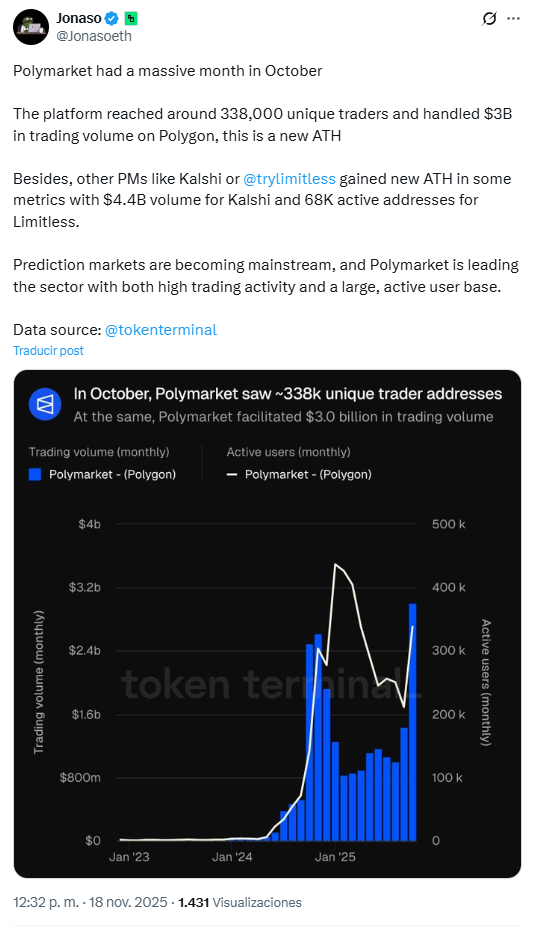

Polymarket—a crypto-native leading prediction market—registered a $3 billion trading volume in October, executed by 338,000 unique traders. The platform operations run natively on the Polygon network, facilitated mostly by Circle’s stablecoin USDC.

Data is from Token Terminal, shared by Jonaso, a DeFi analyst, who highlighted Polymarket’s “massive month in October.” “Prediction markets are becoming mainstream,” the analyst said in a post on X on November 18, “and Polymarket is leading the sector with both high trading activity and a large, active user base.”

Polymarket saw 338k unique trader addresses | Source: Jonaso, X.com

When looking at other prediction markets, Kalshi has made an even higher volume of $4.4 billion, and Limitless saw 68,000 unique traders in the last month, still according to Jonaso.

The competition in this industry is growing as the demand for the tool also grows, powered by clearer regulations and significant integrations like Yahoo Finance exclusively indexing Polymarket, Polymarket partnering with UFC for exclusive bets, or Google indexing some of its products to Kalshi and Polymarket, as Coinspeaker reported.

Revolut Partners With Polygon

Polygon is flying in adoption and integrations, led by successful products like Polymarket that are making the network’s DeFi ecosystem surge in volume, users, and revenue.

Together with recent numbers, the official Polygon account has announced that Revolut—Europe’s largest fintech—has chosen its network as the official rails for stablecoin payments on the platform. Additionally, Polygon will be used for crypto trading and POL staking on Revolut.

POL is Polygon’s native token, formerly known as MATIC. The token has positively reacted to Revolut’s news and is currently trading at $0.1522, up 1.63% in the last 24 hours and 8.7% from the $0.14 bottom intraday.

Polygon (POL) market data and 24-hour price, as of Sept. 18, 2025 | Source: CoinMarketCap

While POL fuels the ecosystem, secures the network via staking, and pays for gas fees, Circle’s USDC is Polygon’s most-transacted token and the one behind Polymarket’s bets.

nextThe post Polymarket Handles $3B Volume on Polygon, 338,000 Unique Traders appeared first on Coinspeaker.

You May Also Like

Sompo Group and Guidewire Enter Long-Term Agreement to Enhance Global Operations with Guidewire Cloud Platform

Paying Dividends In Tether Gold (XAUT) To Transform Investor Returns