El Salvador Buys The Dip: Adds 1,090 Bitcoin on Top of Daily Purchases

Bitcoin has entered one of its most critical phases of the year as intense selling pressure briefly pushed the price below the $90,000 level, shaking market confidence and triggering widespread fear. Bears argue this breakdown marks the beginning of a deeper bearish cycle, with liquidity worsening and risk sentiment collapsing across global markets.

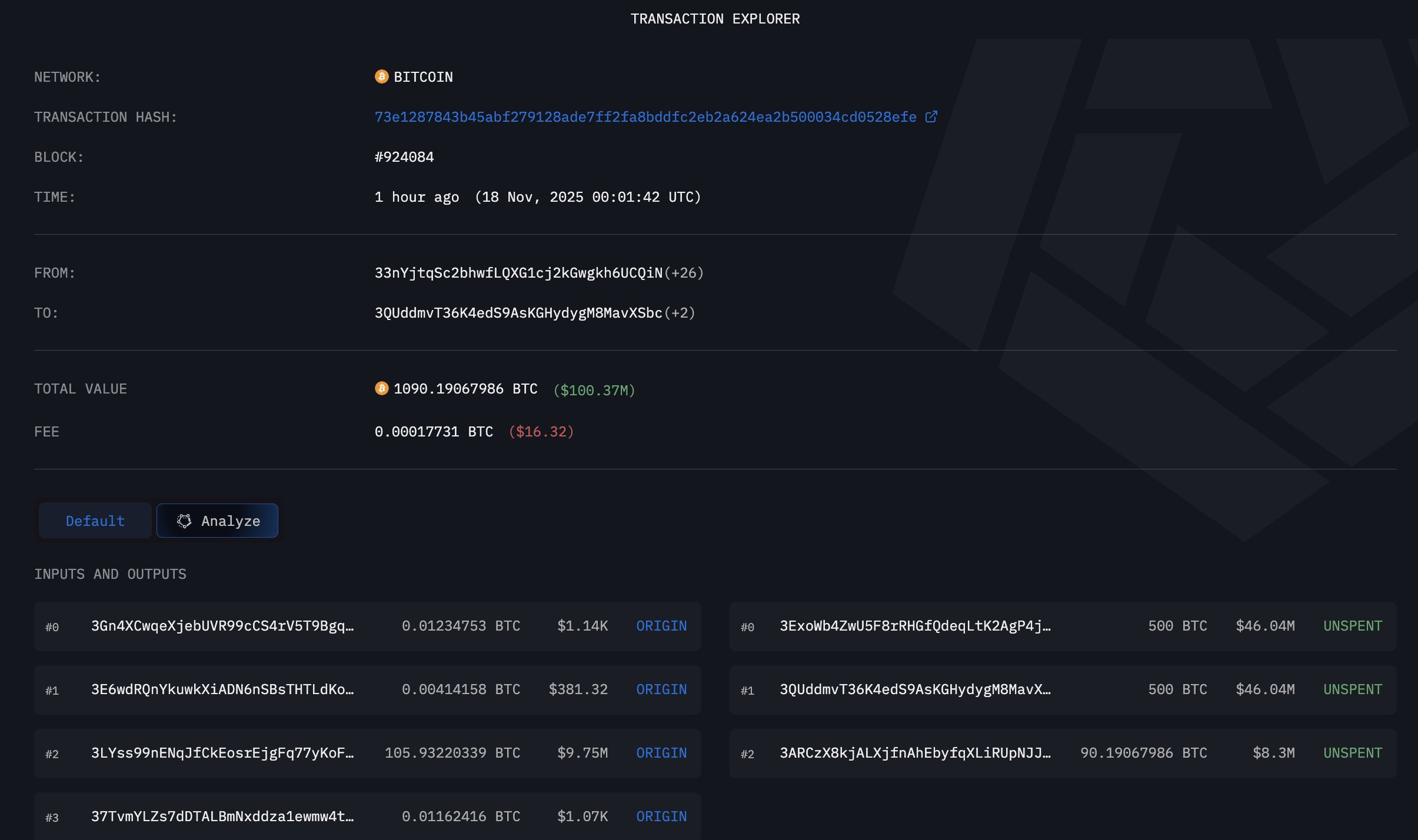

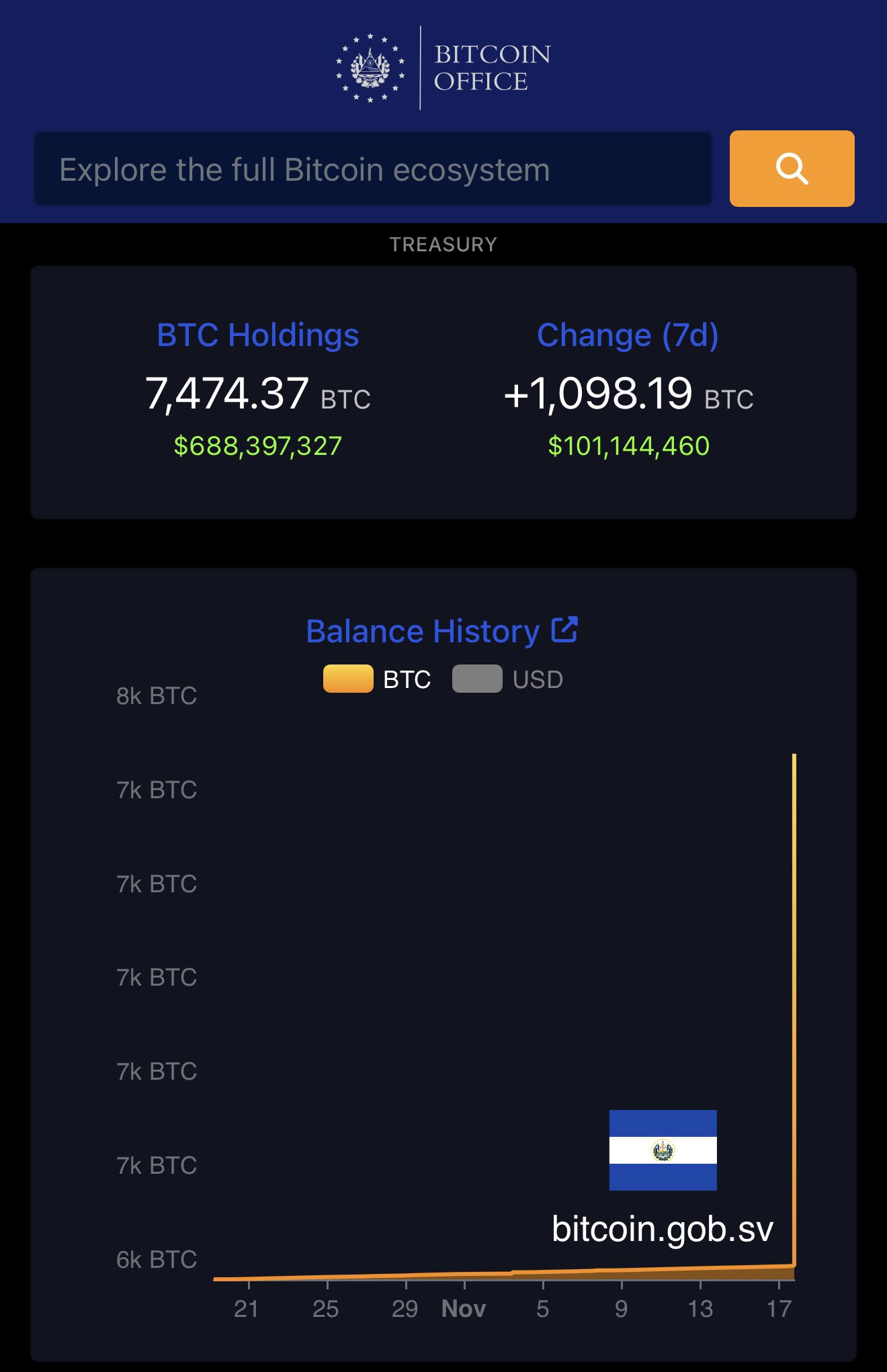

Yet, despite the growing bear-market narrative, major players are signaling the opposite — long-term conviction. According to Lookonchain, El Salvador is aggressively buying the dip, reinforcing its commitment to Bitcoin even as volatility surges. Beyond its ongoing program of purchasing 1 BTC per day, the government executed a significant buy just a few hours ago, adding 1,090.19 BTC worth approximately $101 million to its holdings. This unexpected accumulation stands in stark contrast to the broader market panic.

While retail sentiment remains fearful, moves like this highlight the growing divide between short-term traders reacting to price swings and strategic buyers focusing on long-term value. As Bitcoin hovers near key support levels, the market now faces a defining moment: capitulation or accumulation.

El Salvador’s Bold Move Amid Panic

El Salvador’s unexpected Bitcoin purchase has added a dramatic twist to an already tense market environment. President Nayib Bukele shared a screenshot of the transaction and BTC holdings (7,474.37 BTC) on X, accompanied by a simple but telling caption: “Woa.”

The message, brief yet powerful, instantly captured the attention of the crypto community. At a moment when fear is dominating sentiment and traders are scrambling for safety, Bukele’s reaction reflects a markedly different mindset — one grounded in conviction rather than panic.

With Bitcoin breaking below $90,000 earlier today, many market participants interpreted the move as confirmation of a looming bear market. Liquidations surged, volatility spiked, and social sentiment hit extremes not seen since earlier corrections this year.

Strong hands — long-term investors, sovereign entities, and institutional accumulators — are increasingly framing the recent pullback as a strategic entry point. This stands in stark contrast to short-term traders capitulating under pressure. Historically, such divergences have marked pivotal cycle moments where distribution flips to accumulation.

Bitcoin Price Analysis: A Critical Breakdown Near Multi-Month Lows

Bitcoin’s latest price action shows a sharp deterioration in market structure, with BTC now trading near $91,000 after a steep rejection from the $110K–$115K region. The chart reflects a clear loss of momentum: lower highs, accelerating sell volume, and a decisive breakdown below the key 200-day moving average, a level that had acted as macro support throughout most of 2025.

The most concerning signal is the clean break under $95K, a zone that previously served as a strong demand region during multiple pullbacks. Losing this level has opened the door to deeper downside, and BTC is now testing the next critical support area between $88K and $90K, marked by the 300-day MA and prior consolidation structure from early 2025.

Volume has spiked on the sell-off, confirming that this is not a low-liquidity dip but a broad risk-off move. The pattern resembles a cascading liquidation event, with consecutive long squeezes intensifying the decline.

Despite the bearish pressure, BTC remains above the broader bull-market base structure formed around $80K–$85K, meaning the macro trend isn’t fully broken yet. Still, bulls must reclaim $95K quickly to prevent momentum from slipping further.

Featured image from ChatGPT, chart from TradingView.com

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Shiba Inu (SHIB) Price Reset Point: Three Oversold Indicators, 20% Potential