Tether Enters Strategic Partnership with Bitcoin-backed Loanmaker Ledn

Stablecoin issuer and fintech platform Tether has announced a strategic investment in Bitcoin BTC $91 334 24h volatility: 0.5% Market cap: $1.82 T Vol. 24h: $78.60 B -backed consumer lending firm Ledn.

The partnership comes as Tether continues to expand its services and agreements throughout the sector and Ledn caps off a banner company year. According to a Nov. 18 press release, Ledn had its strongest year-to-date in 2025, originating more than $1 billion in loans with $392 million issued in the third quarter alone.

Paolo Ardoino, CEO of Tether, said in a statement that the partnership would expand global access to credit without requiring individuals to sell their digital assets. “This approach strengthens self-custody and financial resilience,” he added.

Cross-domain crypto cooperation

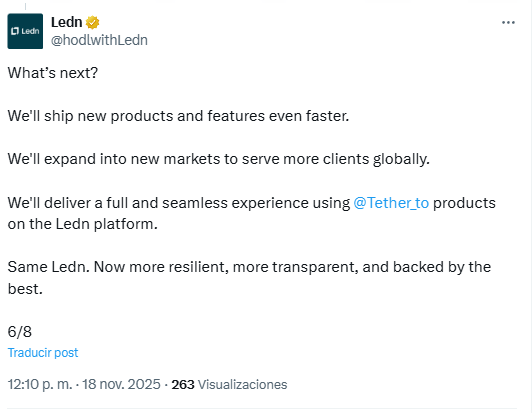

Tether and Ledn have not disclosed the amount of the strategic investment. However, a post on Twitter indicated that Ledn intended to use the funds to ship new products and features, expand into new markets, and seamlessly integrate Tether products into its platform.

Ledn announcement | Source: X.com

Ledn also offers high-interest, growth-oriented savings accounts which support USDC, USDT, and Bitcoin. Combined with the firm’s lending services, which allow individual holders to take out loans backed by their holdings, the firm offers end-to-end crypto growth services.

For its part, Tether has continued its streak of rapid expansion and partner investing. As Coinspeaker reported on Nov. 15, Tether is considering a $1.16 billion investment in German AI-powered robotics firm Neura. The potential deal would reportedly value Neura at around $12 billion.

Tether has also recently announced plans to partner with investment firm KraneShares and El Salvador-based Bitfinex Securities to create blockchain infrastructure for tokenized securities through the formation of a formal alliance.

nextThe post Tether Enters Strategic Partnership with Bitcoin-backed Loanmaker Ledn appeared first on Coinspeaker.

You May Also Like

Here’s How Consumers May Benefit From Lower Interest Rates

Cardano Price Prediction 2026 vs Tron: European Exchange Giant Merges Crypto Units, but DeepSnitch AI Has the Chance of Performing 60x Better Than the Cardano Price Prediction