Bitcoin Price Slumps to $88,000 Near Seven-Month Low As Crypto Stocks Crash

Bitcoin Magazine

Bitcoin Price Slumps to $88,000 Near Seven-Month Low As Crypto Stocks Crash

Crypto markets are retreating more today as the Bitcoin price hovered near a seven-month low, with leading crypto stocks seeing notable declines.

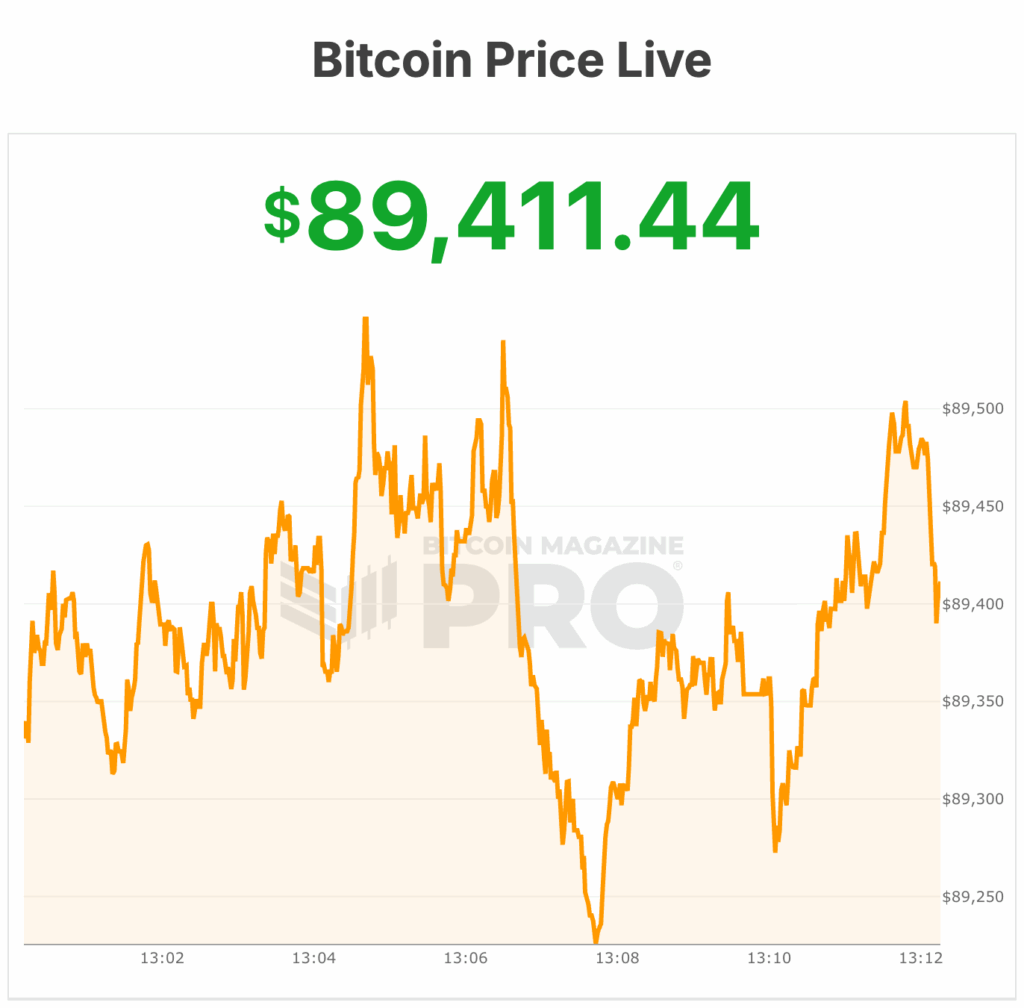

Bitcoin price is currently trading at $89,090, down 4% over the past 24 hours, with a 24-hour trading volume of $71 billion. The cryptocurrency is 4% below its seven-day high of $93,662 and roughly flat from its seven-day low of $88,800, according to Bitcoin Magazine Pro data. With a circulating supply of 19.95 million BTC out of a maximum 21 million, Bitcoin’s market capitalization stands at $1.78 trillion.

Coinbase Global dropped 4.9%, Bitfarms fell 7.5%, Strategy slipped 10.3%, Riot Platforms lost 3.7%, Hut 8 Mining fell 3.3%, and Mara Holdings dropped 6.6%, at the time of writing.

Market activity has been heavily influenced by investor flows in Bitcoin exchange-traded funds (ETFs). BlackRock’s spot Bitcoin ETF, IBIT, recorded a record single-day outflow of $523.2 million on Tuesday, marking the largest withdrawal since the fund launched in January 2024.

This came despite a modest 1% price increase for Bitcoin earlier in the week, which briefly pushed the cryptocurrency above $93,000.

On average, IBIT investors purchased Bitcoin at a Bitcoin price of $90,146, leaving them out of the green at current prices.

Bitcoin price analysis

Analysts caution that while short-term price swings are largely sentiment-driven, longer-term trends are shaped by macro positioning and liquidity conditions.

Current sentiment indicators are near multi-year lows, pointing to subdued trading activity but potentially attractive entry points for longer-term investors.

Meanwhile, Bitcoin miners appear to be adjusting strategies in response to market volatility. Following a period of heavy distribution, miners’ 30-day net BTC position has flipped to modest accumulation after recent capital raises in the sector, signaling renewed confidence in holding mined Bitcoin rather than selling.

Despite short-term turbulence in ETFs and price volatility, market observers note that Bitcoin’s broader fundamentals remain intact. Liquidity trends and continued institutional interest suggest that the Bitcoin price could maintain stability in the $90,000 range as investors navigate a volatile market environment.

Sentiment remains weak as rising volatility and thinning liquidity make the market sensitive to even small flows. Nicolai Søndergaard of Nansen noted to Bitcoin Magazine yesterday that market depth has dropped about 30% since the October 10 liquidation, meaning modest selling can sharply move Bitcoin, which recently fell below $90,000. Leverage further amplifies this volatility.

“When liquidity is this thin, it takes far less capital to push the market in either direction, and when you layer leverage on top, volatility becomes inevitable,” Søndergaard said.

Bitcoin price sentiment

Market sentiment has turned sharply bearish after the Bitcoin price broke below the key $96,000 weekly support level last week. Analysts from Bitcoin Magazine Pro and Feral Feral Analysis warned that a meaningful bounce was unlikely, noting thick resistance above $94,000 and persistent seller pressure.

They pointed to heavy support at $83,000–$84,000 and another zone at $69,000–$72,000, saying a drop into the mid-$80Ks was increasingly plausible amid rising volatility.

Upside scenarios remained limited; even a short squeeze would have hit major resistance at $106,000–$109,000. Only a weekly close above $116,000 would have challenged the prevailing bearish trend.

Earlier this week, New Hampshire became the first U.S. state — and the first government worldwide—to approve a municipal bond backed by Bitcoin, marking a potential gateway for digital assets into the $140 trillion global debt market.

The state’s Business Finance Authority (BFA) approved a $100 million conduit bond, enabling private companies to borrow against over-collateralized Bitcoin held by BitGo.

This follows New Hampshire’s earlier move to allow up to 5% of public funds in digital assets, creating the nation’s first strategic Bitcoin reserve.

At the time of writing, the Bitcoin price is hovering near $89,400.

This post Bitcoin Price Slumps to $88,000 Near Seven-Month Low As Crypto Stocks Crash first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

Satoshi-Era Mt. Gox’s 1,000 Bitcoin Wallet Suddenly Reactivated

Bitcoin 8% Gains Already Make September 2025 Its Second Best