$4M On The Move: Libra Scandal Addresses Make A Surprising Solana Play

Libra-linked wallets quietly pulled roughly $4 million from a failing memecoin and used part of their stash to pile into Solana, according to on-chain tracking and news reports.

The move comes amid fraud probes and renewed scrutiny of the token’s launch, which earlier this year saw large withdrawals that rocked investor confidence and drew legal attention.

Wallets Rotate Funds Into Solana

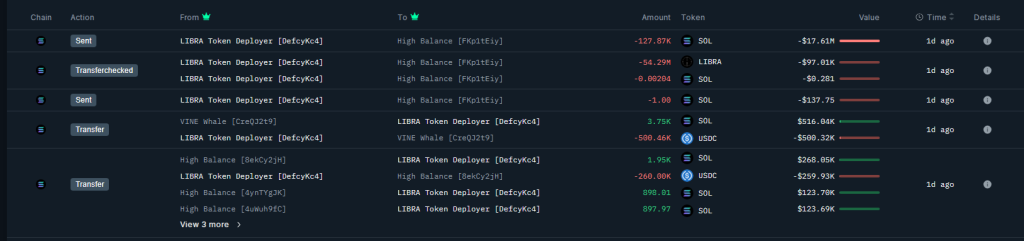

Based on on-chain data, two addresses tied to the Libra project — labeled “Libra Deployer (Defcy)” and “Libra Wallet (61yKS)” — bought about $61.5 million worth of SOL at an average price near $135.

Before these purchases, the same addresses reportedly held roughly $57 million in USDC, enabling a quick rotation from stablecoin holdings into a major Layer-1 token.

Blockchain analysts flagged the activity after tracing a string of transfers that drained the last remaining liquidity from the token’s market.

The withdrawals of nearly $4 million followed earlier large cash-outs tied to the coin’s creators that investigators say removed as much as $99 million from circulation at the token’s launch. That wave of exits and the token’s sudden collapse prompted several probes in Argentina and the US.

What The Purchases Mean For Markets

Market watchers said the swap into SOL is notable because it moves money from a controversial, politically linked memecoin into a mainstream crypto asset.

Meanwhile, the political angle has not faded. The Libra token’s launch drew attention after Argentine President Javier Milei publicly promoted the coin and then tried to distance himself as losses mounted.

The broader pattern of meme tokens tied to politicians has raised fresh worries about transparency and investor protection, with some lawmakers and regulators taking a closer look.

Legal And Control Questions RemainReports have asked who finally controls the wallets now and whether authorities can freeze the new SOL holdings. Fraud investigations are active, but on-chain moves show the addresses retained control long enough to shift assets across chains.

That gap between probe announcements and actual seizure powers has prompted calls for faster cross-border coordination in crypto enforcement.

The episode adds to a string of high-profile memecoin blowups tied to public figures. Analysts say these events underline the danger for everyday investors who pile into tokens after a celebrity mention or viral hype.

Featured image from Gemini, chart from TradingView

You May Also Like

Unleashing A New Era Of Seller Empowerment

WIF Price Prediction: Targets $0.46 Breakout by February 2026