Will Bitcoin Price Crash to $60K? Peter Brandt Weighs In

The post Will Bitcoin Price Crash to $60K? Peter Brandt Weighs In appeared first on Coinpedia Fintech News

Bitcoin price today is trading near $92800 after a small rebound, but the market mood remains tense. Even with this recovery, fear is rising as traders try to understand whether this is only a temporary bounce or the start of a deeper fall.

Peter Brandt Signals Possible Bitcoin Price Crash

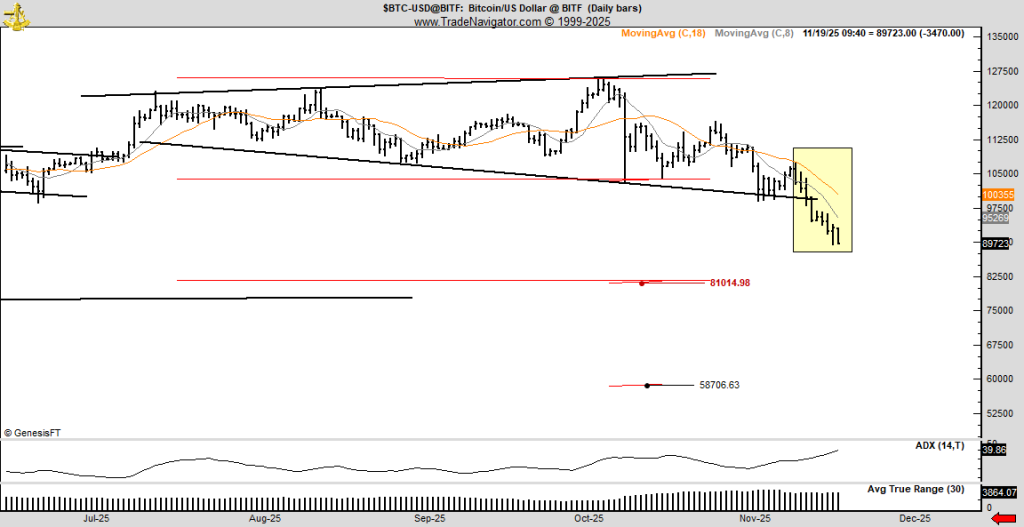

Veteran analyst Peter Brandt has issued a strong warning. His latest charts show a broadening top pattern, a formation that often leads to sharper declines. Brandt says the reversal began around November 11 and has continued with a clear series of lower highs, showing fading momentum.

According to him, the first support lies near $81000, but if selling pressure continues, Bitcoin could slip to $58000.

This warning comes at a time when altcoins are beginning to outperform Bitcoin, and critics like Peter Schiff are returning to the spotlight, which adds to the market anxiety. Brandt’s caution has intensified the debate over whether Bitcoin is entering a larger downtrend or simply cooling off after a strong run.

Market Structure Shows Stress Across Multiple Indicators

The recent crash wiped out more than 1 billion dollars in leveraged positions across Bitcoin, Ethereum, and XRP. Prediction market data from Kalshi shows a rising probability of Bitcoin falling below $80000 this year, now around 44 percent.

Bitcoin rejected supply and tapped a major demand zone. From there, a local accumulation pattern appeared, suggesting market makers stepped in. The price then bounced sharply, but the lower time frame structure has flipped back to bearish, keeping traders cautious.

Correlation patterns also add to the confusion. Bitcoin often moves positively with the DXY over longer time frames but shows negative correlation in the short term. If DXY continues higher from its long channel base, it may signal stronger momentum for Bitcoin. Turning points in DXY have historically aligned with Bitcoin trend shifts.

Other analysts point out a hidden bullish divergence forming while Bitcoin holds inside a fair value gap. The structure resembles a move seen in the previous cycle, hinting at a possible relief rally unless the divergence fails.

However, downtrend resistance remains a problem. Traders say Bitcoin must hold above $90000 to attempt a push toward the $95000 to $96000 liquidation zone. Losing 90000 again could bring weak structure and a move to the $84000 to $86000 region.

Bitcoin may form a temporary bottom this week, but the larger trend could still be down. BTC price may have already topped on October 6 and could still drop 40 to 50 percent by early next year. Historically, early bear market moves have seen drops of 45 to 60 percent, and full bear cycles have fallen much deeper. This view suggests that even a bounce could simply be a countertrend rally before another leg down.

The Road Ahead: Is 60000 the Next Big Test?

With so many mixed signals, the big question is whether Bitcoin will indeed fall toward Peter Brandt’s $58000 target. The key level to watch is the $90000 support. Holding above this zone could give Bitcoin room for a relief rally. Falling below it may confirm the broader bearish outlook and open the door to deeper losses.

You May Also Like

Top 5 Crypto Jurisdictions in 2026 from Offshore to Onshore

The Intelligent Flow: Autonomous Corridors, Hyper-Logistics, and the Self-Healing Supply Chain of 2026