Aster price forms early reversal pattern as $70M buyback and Coinbase listing boost sentiment

Aster price appears to be entering a potential early reversal phase, with fresh buybacks and a new listing shifting sentiment amid difficult week for the wider market.

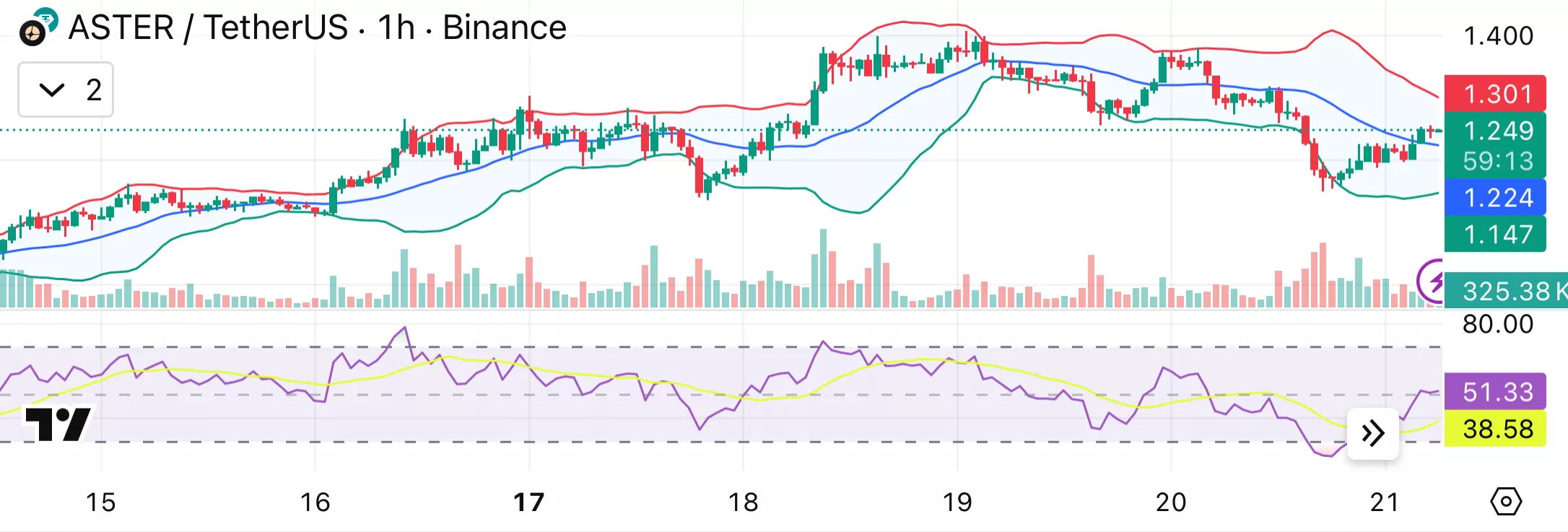

- A rounded bottom structure is forming as Aster rebounds from lower Bollinger levels.

- Buyback and Coinbase listing news has improved confidence.

- Technical indicators are largely constructive, but $1.50 remains the near-term test.

Aster traded at $1.25 at press time, down 4.2% over the past 24 hours but still holding a steady short-term structure that hints at an early reversal. The token has moved within a $1.02–$1.39 range over the last week, gaining 22% across seven days and 19% over the past month.

Trading activity has risen sharply, with $953 million in 24-hour volume, up 27%. Derivatives markets show a more cautious stance. Futures volume climbed to $2.4 billion, a 7% increase, but open interest slipped 6.6% to $552 million.

This likely suggests that traders are rotating out of older positions rather than adding fresh risk.

ASTER buybacks and Coinbase listing lift sentiment

Much of the recent optimism comes from a wave of activity that arrived on Nov. 20. Aster (ASTER) confirmed the completion of its Stage 3 buyback, acquiring 55.7 million ASTER and bringing the total to 155.7 million tokens.

At current prices, the latest tranche represents roughly $70 million. Half of those tokens, 77.8 million ASTER, or around 1% of supply, will be burned on Dec. 5, with the rest locked for future airdrops. Stage 4 buybacks begin on Dec. 10. 60–90% of protocol fees have been allocated for continued purchases.

The same day, Coinbase launched ASTER trading, opening access to U.S. retail and institutional flows. Early trading pushed spot prices from roughly $1.14 to $1.37 before settling back into the current range.

Coinbase generated over $1 million in volume within hours, a move that helped soften market anxiety during a tense week for digital assets. The listing also carries symbolic weight, linking a BNB Chain project with Binance’s largest competitor.

Aster price technical analysis

A developing rounded bottom is visible on the chart following a brief dip to the lower Bollinger Band. The price has levelled off, started to curve upward, and is now retreating towards the middle of the range.

This type of pattern often indicates that sellers are losing their hold on the market while buyers gradually return.

The relative strength index has bounced back sharply from oversold levels, forming a V-shaped recovery, and it’s now nearing neutral territory. Momentum indicators are showing a slight positive bias, though most oscillators are still neutral.

That said, there’s some upside potential, especially since both the MACD and short-term momentum have flashed buy signals. With the 10-, 20-, and 30-period moving averages all below the current price, Aster has a strong base if buyers keep defending the mid-range.

If the crypto market holds steady, the next target for a bullish move could be between $1.38 and $1.50. A breakout above that could push the price toward $2.

On the flip side, if the price falls below the $1.10–$1.15 support level, it would open the door to a lower range around $1.02, which would weaken the bullish setup and could signal a potential bearish turn.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

VIRTUAL Bearish Analysis Feb 10