Last Chance to Get In Early: SpacePay Emerges as a Top Crypto to Buy Before 2026

The post Last Chance to Get In Early: SpacePay Emerges as a Top Crypto to Buy Before 2026 appeared first on Coinpedia Fintech News

SpacePay ($SPY) combines working payment infrastructure, merchant-focused technology, and token holder benefits into a complete crypto payment ecosystem.

The presale ends by November’s end and could be the final opportunity to acquire $SPY before the exchange listing.

With $1.4 million raised and a live testnet already operational, this crypto to buy delivers functional technology rather than roadmap promises.

SpacePay’s Complete Payment Infrastructure: 325+ Wallets, 0.5% Fees, Instant Settlement

SpacePay supports over 325 cryptocurrency wallets including MetaMask, Trust Wallet, Coinbase Wallet, Ledger, Trezor, and hundreds of regional applications.

Users pay with their existing wallet applications without downloading proprietary software or transferring funds between platforms. This compatibility creates immediate access to the entire cryptocurrency user base rather than a limited subset.

The platform charges a set 0.5% merchant fee for every transaction. This is regardless of payment volume, size, or network congestion.

Traditional payment processors impose fees ranging from 1.5% to 3.5% in addition to charges for chargebacks, PCI compliance, and monthly bills.

Key Payment Features:

- Instant settlement with zero processing delays for all transactions

- QR code scanning simplifies payment authorization to a single step

Merchants receive payments in their chosen fiat currency through instant crypto-to-fiat conversion at transaction time.

This volatility protection removes the primary reason retailers refuse to accept cryptocurrency payments.

NFC Security and Android Integration Make This Crypto to Buy Merchant-Ready

SpacePay implements NFC (Near Field Communication) technology for contactless payment processing. The tap-to-pay functionality reduces physical touchpoints while maintaining security standards used by major financial institutions.

NFC integration provides familiar payment experiences that match consumer expectations from modern payment systems.

Security and Integration:

- Device authentication restricts transactions to pre-registered hardware only

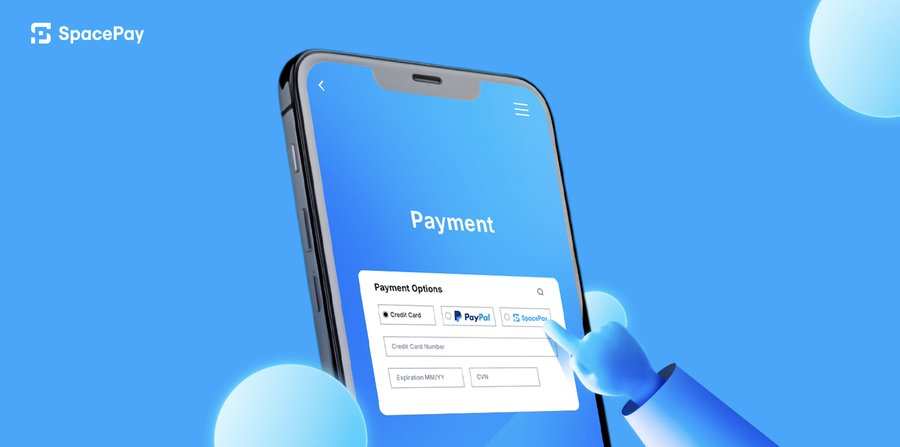

- Android POS compatibility eliminates merchant hardware replacement costs

The platform runs on existing Android point-of-sale terminals without the need for new equipment purchases. Merchants install the software application on current terminals and begin accepting crypto payments immediately.

SpacePay’s testnet launched with V1 of the Payment API running on Base Sepolia and Ethereum Sepolia networks.

The multi-chain architecture processes transactions across different blockchain networks based on efficiency and network conditions.

Revenue Share, Governance Rights, and Loyalty Rewards for $SPY Token Holders

$SPY token holders receive distributions from platform transaction revenue as passive income tied to business performance. The revenue-sharing model creates direct alignment between token holder returns and merchant adoption growth.

Token holders vote monthly on platform proposals affecting features, partnerships, strategic direction, and token economics.

Each holder receives voting power proportional to their token holdings. On-chain voting provides transparent records of all proposals and outcomes.

Token Holder Benefits:

- Monthly loyalty airdrops reward the most active wallets based on platform usage

- Quarterly 45-minute webinars provide direct access to leadership team

The loyalty airdrop program monitors wallet behavior in terms of ecosystem involvement, payment volume, and transaction frequency.

Token holders can ask founders and executives direct questions about the company’s development, strategic intentions, and new advancements at quarterly webinars.

Early feature access gives holders preview periods for testing new functionality before public release.

Token holders also participate in charitable donation matching programs where SpacePay matches contributions to pre-selected charities.

Final Days to Join Top Crypto Presale Before November Deadline at $0.004210

The presale ends by November end with tokens available at $0.004210 before exchange listing.

Participants can purchase using USDT, USDC, ETH, BNB, MATIC, AVAX, and BASE tokens. Bank card payments provide options for buyers without existing cryptocurrency holdings.

The process requires connecting a MetaMask or compatible Web3 wallet to the presale platform. After selecting purchase amounts and completing transactions with gas fees, tokens transfer directly to wallet addresses.

Presale Details:

- $1.4 million raised validates investor confidence in payment infrastructure approach

- 34 billion token supply allocates 20% to public sale, prioritizing community participation

SpacePay operates with full regulatory compliance across all unsanctioned nations, providing legal certainty for merchant adoption.

Why SpacePay Stands Out Among the Crowd?

The platform received the “New Payment Platform of the Year” award at the CorporateLiveWire Global Awards 2022/23.

The recognition from established payment industry organizations adds third-party validation beyond crypto community endorsements.

The project raised $750,000 from private investors before launching the public presale. This institutional backing validated the business model and technical approach before offering tokens to retail participants.

Payment platforms typically succeed or fail based on merchant adoption rates and transaction volume growth.

SpacePay addresses both metrics through features that remove adoption friction while creating financial incentives for businesses to accept crypto.

The November presale deadline creates a narrow window for acquiring tokens before public market pricing begins. Few crypto presale projects combine operational testnet infrastructure with award recognition and regulatory compliance before token listing.

This altcoin to buy stands apart through execution rather than marketing. This makes the remaining presale period valuable for investors who prioritize substance over promotional narratives.

Discover the future of crypto payments with SpacePay:

Presale: https://presale.spacepay.co.uk/

Website: https://spacepay.co.uk/

Social: https://x.com/spacepayltd

You May Also Like

Fed Acts on Economic Signals with Rate Cut

Ray Dalio Raises Alarms on Potential State Overreach with Digital Currencies