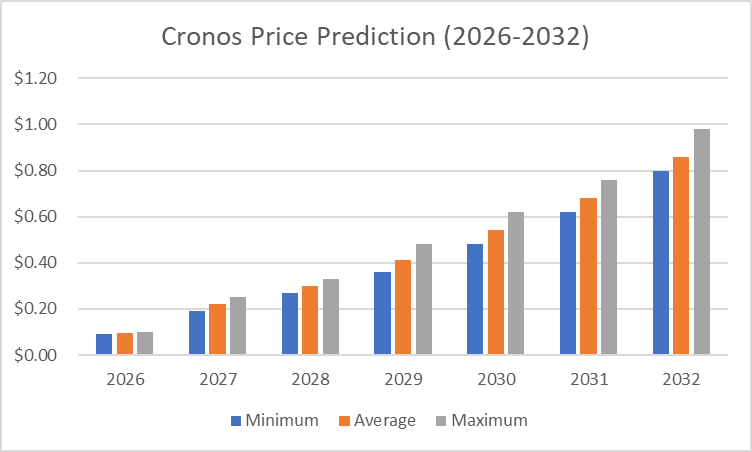

Cronos price prediction 2026-2032: Will CRO reach $1?

Key takeaways

- The CRO price prediction for 2026 shows it will reach a maximum level of $0.15 and an average price of $0.1005.

- By 2029, CRO could reach a maximum value of $0.48, with an average trading price of $0.41.

- Cronos is expected to reach a maximum level of $0.98 in 2032.

Cronos (CRO) is the native cryptocurrency token of the Cronos chain, a decentralized, open-source blockchain developed by the Crypto.com payment, trading, and financial services company. CRO aims to power the next generation of decentralized crypto assets and applications, serving as a utility token. And enable real-time, low-cost transactions globally.

Cronos cross-bridge mainnet beta suggests a bright future for CRO. This feature aims to improve interoperability between significant blockchain ecosystems, potentially increasing CRO’s attractiveness to developers and users. CRO’s recent performance reflects robust market sentiment and confidence. These factors, combined, make Cronos a compelling investment opportunity within the dynamic crypto market, thereby increasing the demand for CRO.

Eminem’s involvement comes as Crypto.com has been actively expanding its visibility through various high-profile partnerships, including those with actor Matt Damon, major sports teams, and even Trump Media.

In this Cronos price prediction, we’ll focus on exploring the future market trends of CRO, its current price momentum, and its past performance, using in-depth technical analysis and a price prediction model.

Overview

| Cryptocurrency | Cronos |

| Token | CRO |

| Price | $0.1049 |

| Market Capitalization | $4.05B |

| Trading Volume (24-hour) | $23.18M |

| Circulating Supply | 38.59B CRO |

| All-time High | $0.9698 Nov 24, 2021 |

| All-time Low | $0.01149 Dec 17, 2018 |

| 24-h High | $0.1077 |

| 24-h Low | $0.09896 |

Cronos Price Prediction: Technical Analysis

| Metric | Value |

| Price Volatility (30-day variation) | 5.28% |

| 50-Day SMA | $ 0.09792 |

| 14-Day RSI | 63.78 |

| Market Sentiment | Bearish |

| Green Days | 23 (Fear) |

| 200-Day SMA | $ 0.1370 |

| Price Prediction | $ 0.1127 (8.66%) |

Cronos price analysis: CRO slips into bearish territory after rejection at $0.1067 resistance

- Repeated rejection at this level confirms strong selling pressure and keeps CRO locked in a bearish structure.

- Although buyers have defended this zone so far, weak demand raises the risk of a downside break.

- Lower highs and fading volume suggest rebounds are corrective rather than the start of a sustained recovery.

On 8 January 2026, Cronos (CRO) trades at $0.09975, recording a 5.78% decline over the past 24 hours, according to the chart data provided. The move placed CRO firmly in bearish territory after failing to sustain gains near the $0.1067 resistance, with sellers regaining control as broader market sentiment remained cautious.

Cronos 1-day price chart: CRO bearish structure holds below key resistance

On the 1-day timeframe, Cronos (CRO) continues to trade in a clearly defined bearish structure, with price locked below the $0.1067 resistance after the latest rejection. The daily chart shows a sequence of lower highs, confirming that sellers remain in control following the 5.78% decline that pushed CRO down to $0.09975.

CRO/USDT Chart: TradingView

CRO/USDT Chart: TradingView

This zone has absorbed selling pressure so far, but the lack of a strong bullish reaction suggests demand remains weak. Momentum on the daily chart continues to favor the downside, and unless CRO can reclaim and hold above the $0.100–$0.102 region, the broader trend remains vulnerable to further losses. A sustained daily close below support would likely open the door to extended downside continuation.

Cronos 4-hour price chart: CRO consolidation follows sharp intraday sell-off

On the 4-hour chart, CRO reflects short-term stabilization after a sharp intraday drop from the $0.103–$0.104 region. Price action compressed into a narrow range just above $0.09877, indicating a temporary equilibrium between short-term buyers and sellers following aggressive downside momentum earlier in the session.

CRO/USDT Chart: TradingView

CRO/USDT Chart: TradingView

Lower highs remain visible on this timeframe, showing that recovery attempts are being sold into rather than sustained. Volume has tapered during consolidation, suggesting hesitation rather than accumulation. As long as CRO remains below short-term resistance near $0.102, downside risks persist. A breakdown below intraday support would likely accelerate selling pressure, while a move above minor resistance could only signal short-lived relief unless confirmed by stronger follow-through.

Cronos technical indicators: Levels and action

Daily simple moving average (SMA)

| Period | Value | Action |

| SMA 3 | $ 0.1846 | SELL |

| SMA 5 | $ 0.1570 | SELL |

| SMA 10 | $ 0.09305 | BUY |

| SMA 21 | $ 0.09465 | BUY |

| SMA 50 | $ 0.09792 | BUY |

| SMA 100 | $ 0.1256 | SELL |

| SMA 200 | $ 0.1370 | SELL |

Daily exponential moving average (EMA)

| Period | Value | Action |

| EMA 3 | $ 0.09974 | BUY |

| EMA 5 | $ 0.1066 | SELL |

| EMA 10 | $ 0.1303 | SELL |

| EMA 21 | $ 0.1572 | SELL |

| EMA 50 | $ 0.1591 | SELL |

| EMA 100 | $ 0.1428 | SELL |

| EMA 200 | $ 0.1271 | SELL |

What to expect from Cronos?

Cronos is expected to remain under pressure while trading below the $0.1067 resistance, as the broader structure continues to favor sellers. Price behavior near $0.09877 support will be critical in the short term, with a sustained break below this level likely to trigger further downside extension.

If support holds, CRO may continue consolidating in a tight range, but upside attempts are likely to face selling pressure near $0.100–$0.102. A meaningful shift in outlook would require stronger volume and a decisive reclaim of key resistance levels, which remain absent for now.

Is Cronos a good investment?

From a short-term trading perspective, Cronos currently faces headwinds. The repeated rejections at $0.1067 resistance and ongoing lower highs suggest that sellers are still firmly in control. With momentum favoring the downside, CRO may struggle to make significant gains until it can break above key resistance levels with strong volume.

For long-term investors, CRO’s outlook depends on broader market conditions and the project’s fundamentals. While temporary dips may offer entry opportunities, caution is advised as the token remains in a bearish phase. Investors should closely monitor the $0.09877 support level; a sustained breach could accelerate losses, whereas a hold at this level may lead to sideways consolidation.

Why Is Cronos (CRO) Down Today?

Cronos (CRO) is experiencing a downturn due to a combination of technical and market factors. The repeated rejection at the $0.1067 resistance level highlights strong selling pressure, preventing the token from sustaining upward momentum. Lower highs and fading trading volume indicate that buyers are hesitant, with rebounds appearing corrective rather than signaling a genuine recovery.

Broader market sentiment also plays a role, as risk-off conditions in the crypto market have weighed on CRO along with other altcoins. Investors remain cautious amid ongoing macroeconomic uncertainties and volatile market conditions, which contribute to weaker demand and increased selling pressure. Until the token can reclaim key resistance levels and attract stronger buying interest, downside risks are likely to remain the dominant trend.

Will Cronos reach $0.5?

Based on long-term forecasts, Cronos (CRO) is projected to reach $0.50 by 2030, potentially increasing its market capitalization as its ecosystem and user adoption continue to grow.

Will Cronos reach $100?

It is unlikely that Cronos’s price will reach $100, as this would require an extremely high market capitalization, surpassing the current CRO coin price prediction for the cryptocurrency sector.

Does Cronos have an excellent long-term future?

Cronos CRO holds promising long-term potential due to Crypto.com’s ongoing innovations, such as DEX expansions, NFT integration, and metaverse applications, collectively enhancing CRO’s appeal and utility. These strategic initiatives, along with CRO’s liquidity, staking rewards, and network governance, position it as a solid investment for those with a long-term perspective, especially considering institutional adoption.

Cronos price prediction January 2026

The Cronos price forecast for January is a maximum price of $0.1077 and a minimum price of $0.0989. The average price for the month will be $0.1001.

| Month | Potential Low | Potential Average | Potential High |

| January | $0.0989 | $0.1001 | $0.1077 |

Cronos price prediction 2026

Experts suggest that in 2026, Cronos will trade at a minimum price of $0.090 and a maximum price of $0.15. The average trading price is expected to be around $0.1005.

| Cronos Price Prediction | Potential Low | Potential Average | Potential High |

| Cronos Price Prediction 2026 | $0.090 | $0.1005 | $0.15 |

Cronos price prediction 2027-2032

| Year | Minimum Price | Average Price | Maximum Price |

| 2027 | $0.19 | $0.22 | $0.25 |

| 2028 | $0.27 | $0.30 | $0.33 |

| 2029 | $0.36 | $0.41 | $0.48 |

| 2030 | $0.48 | $0.54 | $0.62 |

| 2031 | $0.62 | $0.68 | $0.76 |

| 2032 | $0.80 | $0.86 | $0.98 |

Cronos price prediction 2027

The Cronos price prediction for 2027 suggests a minimum predicted price of $0.19, a maximum level of $0.25, and an average price of $0.22.

Cronos price prediction 2028

In 2027, Cronos’s price is predicted to reach a minimum of $0.27. CRO can reach a maximum level of $0.33, with an average trading price of $0.30.

Cronos price prediction 2029

The Cronos price prediction for 2029 suggests a minimum value of $0.36, a maximum value of $0.48, and an average trading price of $0.41.

Cronos price prediction 2030

According to the findings, the CRO price could range from a minimum of $0.48 to a maximum of $0.62, with an average forecast price of $0.54.

Cronos price prediction 2031

In 2031, Cronos’s price is predicted to reach a minimum of $0.62. CRO can reach a maximum cost of $0.76, with an average trading price of $0.68.

Cronos CRO price prediction 2032

The price of CRO is predicted to reach a minimum of $0.80 in 2032. It can also get a maximum cost of $0.98, with an average price of $0.86.

Cryptopolitan’s Cronos CRO price prediction

According to our Cronos price forecast, the coin’s market position is bullish, and its price is expected to reach a maximum value of $0.15 by the end of 2026. By 2029, investors can anticipate an average price of $0.41 and a maximum price of $0.48, assuming a bullish market. It is advisable to seek investment advice and determine the future price targets of Cronos to achieve a profitable return. To trade Cronos, one should go for leading CEXs.

Cronos market price prediction: Analysts’ CRO price forecast

| Firm | 2026 | 2027 |

| DigitalCoinPrice | $0.17 | $0.25 |

| Coincodex | $0.113 | $0.2503 |

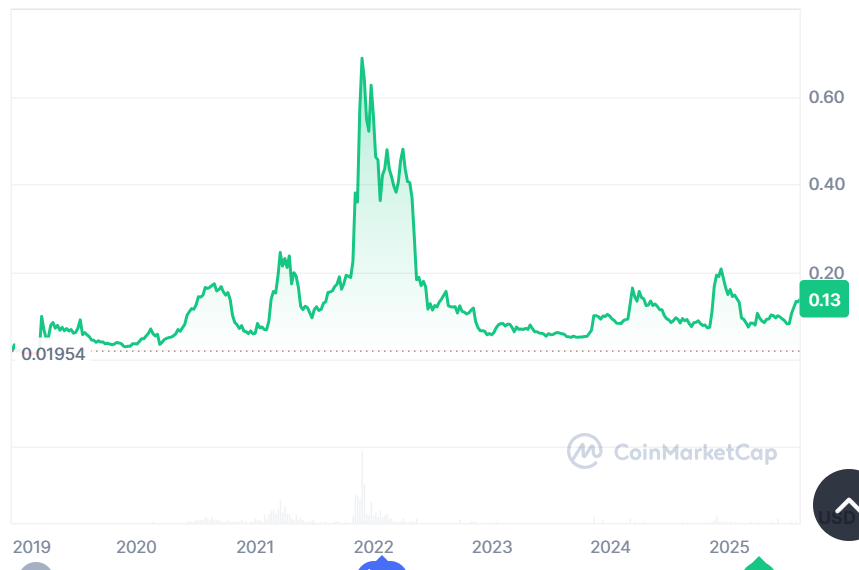

Cronos’ historic price sentiment

CRO price history | Coinmarketcap

- CRO launched at $0.01977 in December 2018 and saw early fluctuations, hitting $0.07344 by March 2019, but ended 2019 at $0.03358. In 2020, CRO rose steadily, reaching above $0.20 by August before dropping to $0.06 by year-end.

- In 2021, CRO followed the crypto bull run, surpassing previous highs and achieving an all-time high of $0.9698 on November 24, boosted by listings on Coinbase Pro and Bitrue.

- CRO opened 2022 at $0.5575 but fell to $0.4409, partially due to concerns over a potential security breach on the Crypto.com platform, which temporarily suspended withdrawals in January.

- In 2023, Cronos experienced a peak in mid-March at around $0.80, followed by a steep decline and stabilization at around $0.20 by mid-year. It maintained a slight oscillation around this range in the following months.

- CRO started 2024 at $0.10, rallied to a yearly high of $0.18 in March, and declined to $0.12 by June. It stabilized between $0.08 and $0.10 from July to October, traded at $0.07193 and $0.09521 in November, and ended the year in a range of $0.138 and $0.234 in December.

- In January 2025, Cronos traded within the range of $0.158 to $0.163 but lost momentum towards the end of the month, resulting in a trading range of $0.1005 to $0.160 in February.

- Later in March, Cronos traded within the range of $0.08076 and $0.0950. However, after touching the $0.1 mark by the end of March, the Cronos price triggered a bearish rally.

- In April, the CRO price declined heavily due to the rising trade war between the US and China. The Cronos price dropped to a low of $0.08. However, it has been surging toward $0.09 in recent weeks of May.

- In June, Cronos (CRO) declined from approximately $0.098 to $0.081, experiencing a steady downtrend with brief attempts at recovery near $0.085 in July.

- By the end of August, the price of Cronos skyrocketed toward $0.38, but it later declined below $0.25 in early September.

- In September 2025, Cronos (CRO) traded near $0.22 before climbing modestly to around $0.25 in October 2025.

- In November 2025, Cronos (CRO) traded around $0.126 after recovering from a dip near $0.120.

- Cronos dropped from about $0.12 in early November to around $0.10 by the end of the month, stabilizing at the same level in early December.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

![[Tambay] Tres niños na bagitos](https://www.rappler.com/tachyon/2026/01/TL-TRES-NINOS-NA-BAGITOS-JAN-17-2026.jpg)