Game On with the Titans of Gaming: Global Games Show 2025 Unveils Star Speaker Lineup

Abu Dhabi, UAE – VAP Group has officially unveiled the lineup of power-packed global speakers for The Global Games Show 2025, scheduled to take place on December 10–11, 2025, in association with Times of Games at Space42 Arena in Abu Dhabi. Following the success of last year’s debut event, this year’s event gets even more exciting. It combines high-impact content from game developers, creators, and visionaries across the gaming world. Supported by the Abu Dhabi Convention & Exhibition Bureau, this event strengthens the mission to bring world-class innovation and thought leadership to the heart of the UAE.

Why Abu Dhabi & Why Space42 Arena? Abu Dhabi is quickly becoming the Middle East’s gaming and eSports capital. It is backed by a $1.5 billion market and major government-led initiatives, such as AD Gaming and twofour54. With world-class venues, top-tier infrastructure, and a tax-free, business-friendly setup, the city has everything that global studios, streamers, and developers need. The Space42 Arena is a newly established hub for immersive events and new-age technology. The Arena provides a unique and inspiring backdrop for this global event to unfold in December.

Bringing together gamers, developers, and thought leaders, the show includes AI-generated game design, the future of esports in the UAE, Unreal Engine advances, e‑sports, and the next frontier in gaming.

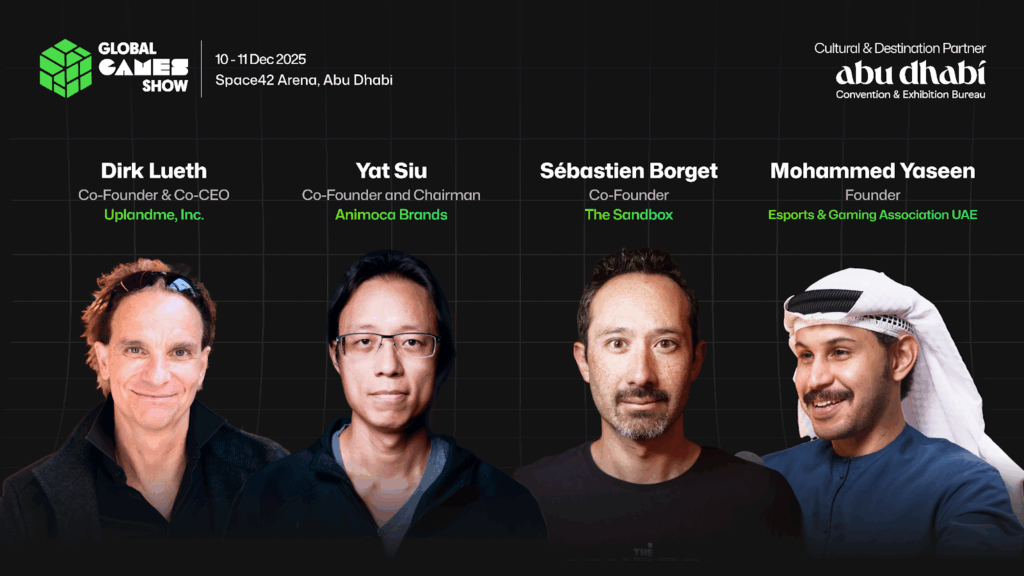

This year’s edition will present a powerhouse speaker lineup, including:

- Dirk Lueth is the co-founder and Co-CEO of Upland, one of the most successful metaverse platforms that integrates digital real estate, gaming, and Web3 economies. Lueth is a recognized thought leader on virtual economies and digital ownership, pushing the boundaries of how communities and businesses engage in the metaverse.

- Sébastien Borget is the Co-founder of The Sandbox, which is a leading decentralized gaming platform that enables players to create, own, and monetize virtual experiences. Borget has been recognized globally for his contributions to NFTs, gaming, and the open metaverse, including being ranked #4 on CoinTelegraph’s Top 100 Most Influential People in Crypto in 2022.

- Mohammed Yaseen, Founder of the Esports & Gaming Association UAE, is a pioneering initiative dedicated to cultivating the region’s esports ecosystem through education, consulting, and industry development. As a Twitch-partnered streamer and community builder, Yaseen has been instrumental in driving grassroots programs, influencer training, and gaming-focused workshops that are laying the foundation for a thriving esports economy in the Middle East.

- Yat Siu, Co-founder of Animoca Brands, is a global leader in digital property rights for gaming and the open metaverse. Siu has played a pivotal role in advancing blockchain-based gaming and NFTs, positioning Animoca at the forefront of the digital entertainment revolution.

This year, the event is geared towards creating conversations around

- Beyond the Game: How Esports Will Define Abu Dhabi’s Tech & Game-Economy

- The Future of Gaming Engines: Unreal Engine 6 and Beyond

- AI Gen Game Design: Can Machines Replace Human Creativity

- How Metaverse is Reshaping Multiplayer Gaming Experiences

Tickets are now available, with early-bird pricing available for a limited time. Register Now

About VAP Group: A leading AI, Blockchain, and Gaming consulting giant driving AI and Web3 solutions over the past 12 years under the flagship events that are globally renowned under the brand of Global AI Show, Global Games Show, and Global Blockchain Show. With a strong foothold in the UAE, UK, India, and Hong Kong, our expert team of over 170 professionals ensures that our clients remain at the forefront of innovation. We drive innovation through Strategic PR and Marketing, Bounty Campaigns, and Global Events that showcase the brightest minds in the transformative fields of Web3, AI, and Gaming. We also offer services in advertising and media, as well as staffing.

You May Also Like

Will Bitcoin Soar or Stumble Next?

House Judiciary Rejects Vote To Subpoena Banks CEOs For Epstein Case