Analyst: Quantum Computers Will Break Bitcoin Politics, Unleashing Flood of Lost Coins

A prominent on-chain analyst has warned that the arrival of powerful quantum computers could trigger one of the most disruptive moments in Bitcoin’s history, not because of the technology itself, but because of the political gridlock surrounding how the network responds.

James Check, founder of Checkonchain, said on Monday that Bitcoin faces a consensus challenge that could ultimately determine the fate of millions of coins that have remained untouched for years.

Analyst Warns Bitcoin’s Dormant Supply Faces Highest Risk in Quantum Era

In a post on X, Check argued that there is “no chance” the Bitcoin community will reach an agreement to freeze coins that are not migrated to quantum-resistant addresses.

He said development politics and the network’s decentralized governance structure make rapid coordination nearly impossible, leaving old coins vulnerable.

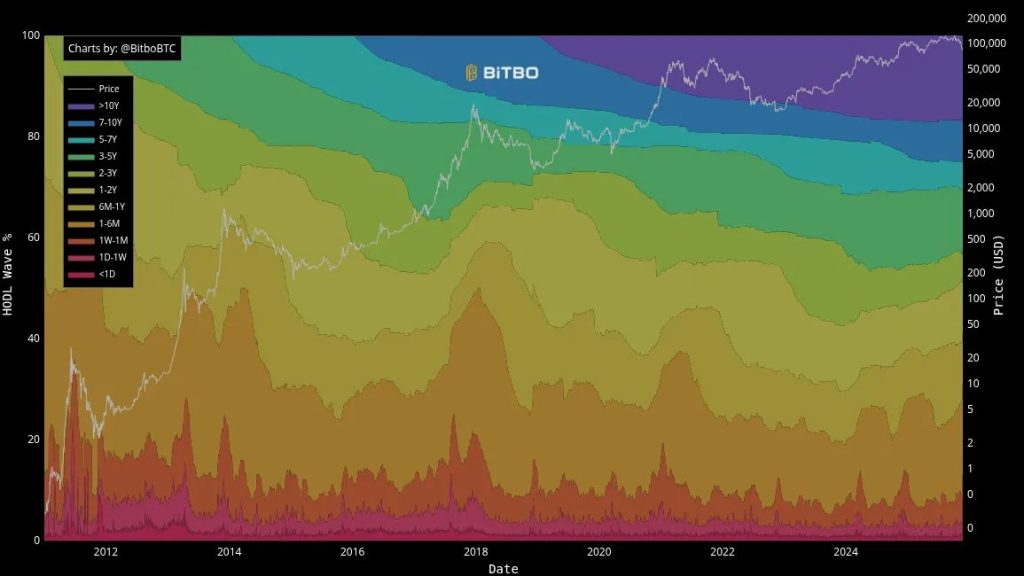

According to BitBo data, 32.4% of all Bitcoin has not moved in the past five years, while 16.8% has remained dormant for more than a decade.

Source: BitBo

Source: BitBo

How much of this supply is lost, inaccessible, or simply being held long-term remains unresolved, but Check warned that these unmoved coins would be the first targets if quantum computers crack Bitcoin’s current signature schemes.

Check’s comments were made in response to Delphi Digital’s Ceteris Paribus, who noted that Bitcoin’s quantum problem is “not technological” and that post-quantum versions of Bitcoin will be feasible.

The unresolved issue, he said, is what happens to the vast reserves kept in non-quantum-resistant formats.

Bitcoin currently relies on elliptic curve cryptography via ECDSA and Schnorr signatures, both of which are vulnerable to Shor’s algorithm once a sufficiently advanced quantum machine is built.

While the U.S. National Institute of Standards and Technology has already approved several quantum-resistant signature schemes, including those referenced in Bitcoin Improvement Proposal 360, adopting such standards requires community-wide agreement.

The underlying threat has been a point of growing discussion across the industry, fueled by concerns that emerging quantum hardware could rapidly narrow the timeline for a workable quantum attack.

Quantum machines today have roughly 1,000 physical qubits, but major technology firms, including IBM, Microsoft, Amazon, and Google, have announced initiatives intended to reach hundreds of thousands or even millions of qubits within the next decade.

Governments and Institutions Adjust Strategies as Quantum Threat Warnings Grow

Some researchers now estimate that specialized machines with around 126,000 physical qubits could break the elliptic curve signatures that secure Bitcoin wallets.

Others project that around 2,300 logical qubits could be enough to break Bitcoin’s encryption, potentially placing a workable attack window within the late 2020s or early 2030s.

Cybersecurity specialists warn that adversaries may already be preparing for future breakthroughs using “harvest now, decrypt later” strategies, collecting data from public blockchains today in anticipation of later quantum advances.

Naoris Protocol CEO David Carvalho said this risk makes older address formats especially vulnerable, noting that roughly 6–7 million BTC are stored in address types that expose public keys directly.

Some governments and institutions have begun adjusting their practices in response to these warnings.

In September, El Salvador split its 6,284 BTC national reserve across 14 addresses to reduce exposure to potential quantum attacks. Major financial firms have also acknowledged the risk.

BlackRock mentioned quantum threats in Bitcoin ETF filings, and Tether CEO Paolo Ardoino recently cautioned about long-inactive wallets.

Despite the growing concerns, not all experts believe the threat is imminent.

Blockstream CEO Adam Back said last week that quantum attacks are unlikely for at least two to four decades, arguing that today’s machines are far too noisy and require heavy error correction.

He pointed out that Bitcoin could adopt post-quantum standards long before a machine capable of breaking SHA-256 becomes viable.

The debate mirrors a broad divide in the industry over how quickly Bitcoin must act.

Solana co-founder Anatoly Yakovenko has urged the community to accelerate its quantum-resistant roadmap, warning earlier this year that AI-driven research could cut expected timelines in half.

Former Ethereum contributor John Lilic has likewise predicted that quantum threats may become meaningful before the end of the decade.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

China Launches Cross-Border QR Code Payment Trial