Hyperliquid Token Unlock Puts $314M At Risk As Transparency Fears Rattle Traders

Hyperliquid is heading into one of its most scrutinized moments yet, as a $314 million token unlock scheduled for Saturday intensifies concerns around transparency, market stability, and the long-term handling of its tokenomics.

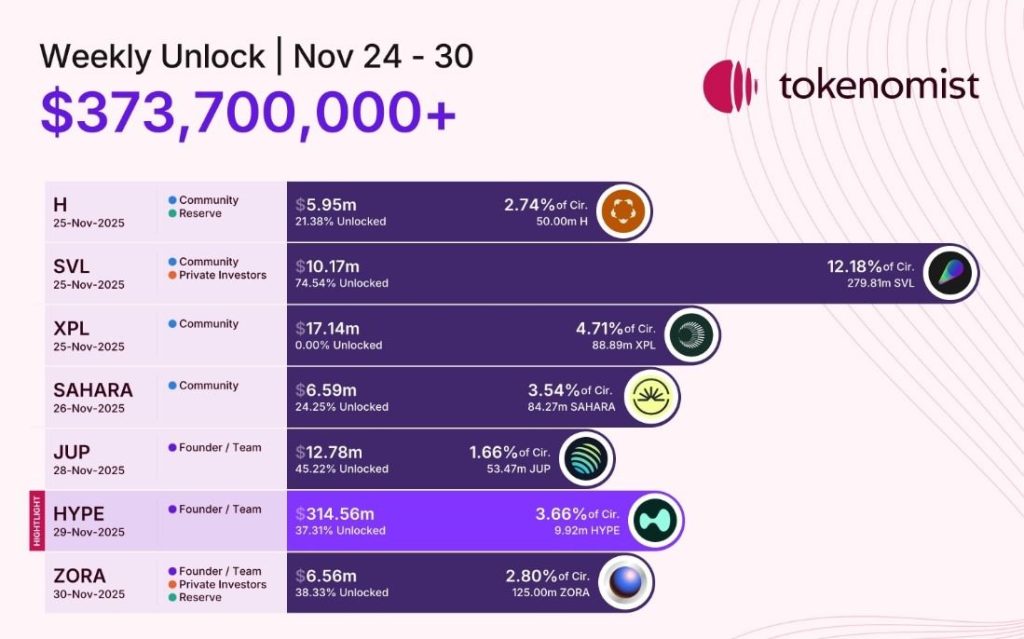

According to Tokenomist data, the perpetuals-focused decentralized exchange will release 9.92 million HYPE tokens in a single “cliff unlock,” equal to 2.66% of the total supply.

Source: Tokenomist

Source: Tokenomist

The entire allocation will be unlocked at once, a structure that has fueled questions over potential sell pressure and how the team intends to manage the newly released tokens.

Hyperliquid Faces Transparency Push as Community Fears Sell-Pressure

The unlock has ignited broad discussion within the Hyperliquid community. Earlier this week, an X user named Andy published an open letter urging the team to address the community before the release takes place.

He said that holders were already uneasy amid a wider market slump and a month-long decline in HYPE, which has fallen more than 23% over the past month and is now trading around $31.

“The team and airdrop recipients finally able to sell is going to ruffle feathers until you address the community head on,” Andy wrote, adding that many traders remain emotionally scarred from previous collapses following unlock events.

BitMEX co-founder Arthur Hayes also weighed in, warning that even if insiders commit not to sell, the market cannot rely on verbal assurances.

He pointed to Hyperliquid’s declining price-to-fully diluted valuation ratio since July, arguing that the market has already been pricing in dilution risk.

According to him, only substantial revenue growth can offset the uncertainty created by the increased supply.

Despite the concerns, not all community responses were aligned. Some argued that the team has no obligation to disclose how they plan to use their unlocked tokens, saying that publishing the schedule and allocation amount is sufficient.

Others labeled the open letter “desperation,” insisting that Hyperliquid’s contributors have “earned” their share and that the platform’s performance speaks for itself.

Hyperliquid remains one of the highest-volume venues in the decentralized perpetuals market, and traders note that it has maintained deep liquidity throughout the year.

Weak Momentum and Liquidity Outflows Keep HYPE Stuck Below Resistance

Market data shows that HYPE has struggled to keep bullish momentum ahead of the unlock. The token is down 14.2% over the past week and more than 22% in the last 14 days.

It currently trades nearly 46% below its all-time high of $59.30. Technical indicators also point to continued pressure.

HYPE attempted to climb above its 20-day EMA on Thursday but was rejected by sellers, and it slipped below the $35.50 support level on Friday.

Analysts warn that a daily close below that threshold could trigger a broader downtrend toward $28 and potentially $24.

Chart readings show that HYPE remains below major resistance zones, with supply clusters between $36 and $42 acting as a ceiling for recovery attempts.

Indicators such as a 34 RSI and negative Chaikin Money Flow show weakening momentum and persistent liquidity outflows.

According to market analysts reviewing the chart, buyers will need to quickly reclaim the $35.50 region to avoid a deeper breakdown, while stronger relief would require a move above the 50-day SMA near $41.

The unlock comes at a time when perpetual futures activity in the broader market remains elevated despite price declines across major assets.

According to data from DefiLlama, daily perp volume across decentralized exchanges fluctuates between $28 billion and $60 billion.

Over the last 30 days, the four largest platforms, Lighter, Aster, Hyperliquid, and edgeX, processed more than $1 trillion in cumulative volume.

Lighter posted the highest monthly figure at $300 billion, followed by Aster at $289 billion, Hyperliquid at $259 billion, and EdgeX at $177 billion.

Hyperliquid also leads the sector in open interest, with more than $6.3 billion in active positions, suggesting continued reliance on the platform even as its token faces downward pressure.

You May Also Like

SEC Backs Nasdaq, CBOE, NYSE Push to Simplify Crypto ETF Rules

United Kingdom CFTC GBP NC Net Positions declined to £-42.4K from previous £-25.8K