Aster price hints at bullish Elliott Wave structure: Bottom developing?

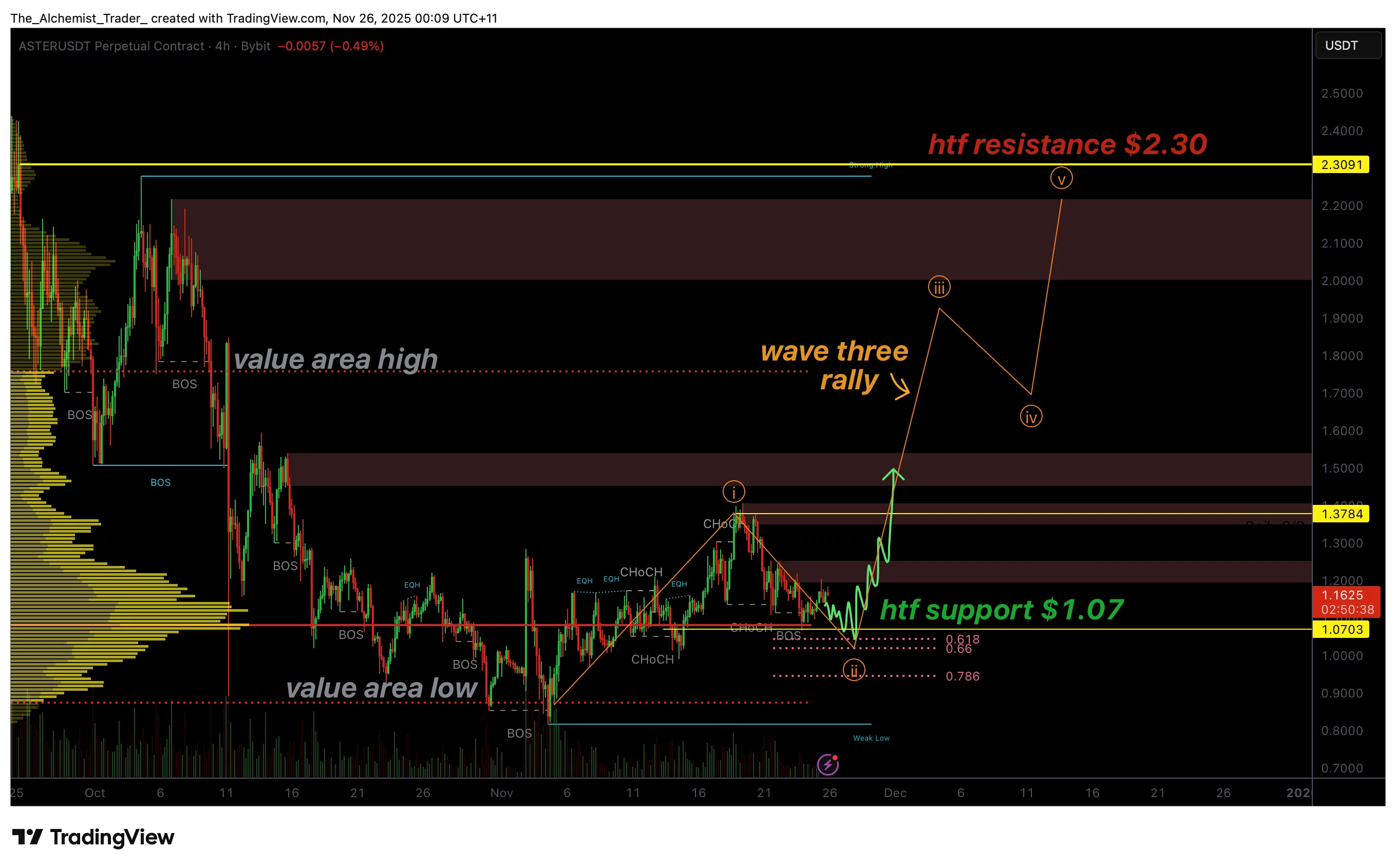

Aster price is trading at a crucial support zone with multiple technical confluences aligning, hinting that a bullish Elliott Wave structure may be forming if the level continues to hold.

- Market sentiment toward Aster is improving as selling pressure slows across multiple time frames

- Recent volume behavior reflects growing interest around current lows, supporting a potential shift in momentum

- Broader altcoin market recovery could provide additional support for Aster’s next move

Aster’s (ASTER) recent price action is beginning to show the early signs of a potential Elliott Wave expansion as the asset trades directly on a central multi-confluence support zone.

With momentum stabilizing and structure shifting after a strong reaction from the value area low, market conditions may now be constructing the foundation for a bullish breakout sequence, especially as on-chain data recently refuted the $35M ASTER transfer allegation linked to Changpeng Zhao, helping ease speculation around the project.

Aster price key technical points

- Aster is holding a critical support cluster formed by the 0.618 Fibonacci, point of control, and daily HTF support

- Initial structure break signals a potential transition into a Wave 3 expansion

- A higher low at the current support may trigger a rally toward $2.30 resistance

Aster is showing early indications that a bullish Elliott Wave structure may be forming. The asset is currently positioned on a high-value support zone that aligns the 0.618 Fibonacci retracement, the point of control, and a major daily timeframe support level. Historically, these types of multi-layered confluence zones have marked significant pivots for Aster, providing strong bases for expansion phases.

The first indication of a structural shift occurred when price bounced sharply from the value area low and proceeded to break the immediate market structure, forming a new swing high. This is a classic signal seen at the beginning of an Elliott Wave transition.

For this pattern to continue validating, Aster now needs to establish a higher low in the current support range. Doing so would solidify the Wave 2 retracement and set the stage for a potential Wave 3 push.

Wave 3 expansions are typically the strongest and most impulsive in the Elliott Wave cycle, and in Aster’s case, such a move would target the value area high and extend toward the key high-time-frame resistance at $2.30. This region has historically acted as a primary reaction area and would be the first significant upside objective if the structure continues to unfold.

So from a technical perspective, Aster is sitting at one of its most critical structural levels. If the asset can maintain strength above this zone and confirm a higher low, it would support the idea that a bullish Elliott Wave expansion is underway, especially as some observers note that Aster’s recent spotlight may reflect how influential reputations like Changpeng Zhao’s continue to shape market visibility.

What to expect in the coming price action

If the current support holds and a higher low forms, Aster could initiate a Wave 3-style breakout toward $2.30. Losing this support, however, would invalidate the structure and delay any bullish continuation.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Vitalik Buterin Supports Native Rollup Integration on Ethereum