Klarna Moves Into Stablecoins via Stripe-Backed Tempo Blockchain in Sweden

Swedish fintech giant Klarna is entering the stablecoin market, marking one of its biggest strategic shifts since going public.

The company said on Tuesday that it will launch a U.S. dollar-backed token called KlarnaUSD, positioning the move as a step toward faster and cheaper global payments at a time when the stablecoin sector is expanding under growing regulatory scrutiny.

Klarna Joins PayPal and Stripe in Stablecoin Push With 2026 Launch of KlarnaUSD

KlarnaUSD is currently in testing and is scheduled to go live on the Tempo blockchain in 2026.

Tempo, developed by Stripe and Paradigm, is designed specifically for payments and serves as the backbone for Stripe’s own blockchain infrastructure product, Bridge, which will issue the token.

Klarna said the asset will be fully backed by U.S. dollars and built for everyday commerce, including cross-border transactions that remain slow and expensive for many users.

The decision places Klarna among a rising group of global payment firms rolling out their own stablecoins.

PayPal launched its U.S. dollar token last year, while Stripe entered the market after its $1.1 billion acquisition of Bridge.

Klarna is now the first bank to adopt Stripe’s stablecoin stack for global payment settlement, expanding on an existing partnership in which Stripe processes a large share of Klarna’s transactions worldwide.

Klarna’s U.S. business remains its largest market, giving the company a broad user base for a potential stablecoin rollout.

Klarna’s entrance comes after CEO Sebastian Siemiatkowski, long skeptical of crypto, confirmed the firm’s shift in approach, saying in a statement that digital assets had reached a point where they are “fast, low-cost, secure, and built for scale.”

Klarna has more than 114 million users and processed $112 billion in gross merchandise value over the past year, giving it the scale to test blockchain payments at a global level.

The announcement also follows the company’s stronger-than-expected quarterly earnings, its first since its highly anticipated September listing.

Global Institutions Accelerate Stablecoin Adoption as Market Tops $300B

The launch is unfolding during a broader wave of institutional adoption of stablecoins. Western Union plans to release a dollar-backed token on Solana in 2026, seeking to reduce international remittance fees that total roughly $120 billion annually.

Visa has reported more than $140 billion in stablecoin and crypto payment flows since 2020 and plans to support additional tokens across multiple blockchains.

Cash App recently rolled out Lightning payments and said stablecoin transfers will soon be added to the platform.

JP Morgan and Citi are developing tokenized deposit systems, while China’s largest tech firms have begun exploring deposit-token models that comply with domestic rules.

Global governments are also moving in parallel. Kyrgyzstan launched a national som-backed stablecoin this year as it tests a CBDC.

Wyoming deployed 700,000 state-issued stablecoins across seven blockchains, the first initiative of its kind in the United States.

Also, South Korea is preparing new legislation for a won-backed stablecoin, and Japanese megabanks plan to issue one trillion yen worth of digital tokens over three years.

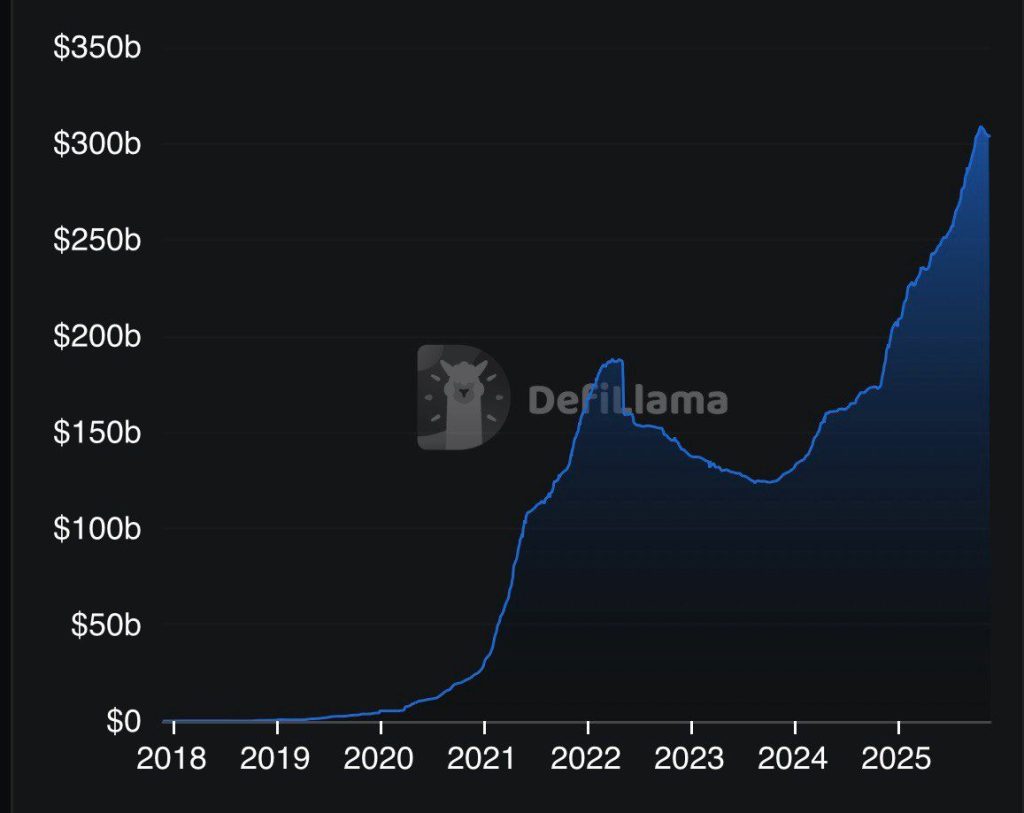

The stablecoin market now stands at roughly $309 billion, according to DefiLlama, up more than 6,000% since late 2019.

Source: DefiLlama

Source: DefiLlama

Tether leads with $184 billion in circulation, followed by USDC at $74 billion.

Analysts at Citigroup expect issuance to reach $1.9 trillion by 2030 in their base case, reflecting accelerating institutional demand.

As Klarna prepares to enter the sector, the firm joins a rapidly expanding field of banks, payment processors, and tech platforms shifting toward blockchain-based settlement.

The company says KlarnaUSD will not replace existing payment methods but will serve as a faster alternative for users moving funds across borders or between platforms.

You May Also Like

Crucial Fed Rate Cut: October Probability Surges to 94%

Jett Nisay, endorser of Marcos impeach complaint, is a public works contractor