BTC at Risk as Analyst Says More Leverage Liquidations May Drag Price Under $80K

This article was first published on The Bit Journal.

Bitcoin price continues to face pressure following a significant sell-off. As reported, an analyst warned that the recent decline might still be ongoing and that remaining leveraged positions could drive Bitcoin lower.

Investors and traders watch closely as crypto markets digest heavy losses. The recent drop wiped out over $24,000 in value in just ten days.

What’s Going On With Bitcoin Price

Bitcoin dropped from over $106,000 earlier this month to around $82,000 as of November 21, 2025. That move triggered one of the most significant long liquidation events in recent months.

In that crash, nearly $1 billion in leveraged positions got liquidated in a single hour.

That created a sudden drop in Bitcoin price and left many traders underwater. Despite the central flush, the analyst warned the market may still “sniff out the final hold-outs.” He suggested it would not be surprising if price dips into the $70,000–$80,000 zone once more.

Key Risk Factors: What Could Drive Another Drop

| Risk Factor | What It Means for Bitcoin Price |

|---|---|

| Leftover leveraged longs | If more long-margin positions unwind, price could fall further toward $70,000–$75,000. |

| Large transfers from whale wallets to exchanges | Indicates more selling pressure from large holders. |

| High futures open interest + negative funding rates | Market bias may tilt toward more shorts or forced liquidations. |

| Weak macroeconomic sentiment or tightening liquidity | Could depress demand across risk assets, including BTC. |

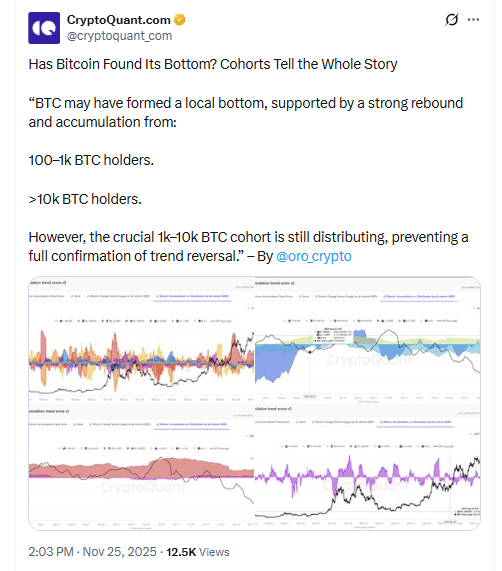

A persistent concern is that large “whale” investors hold 1,000–10,000 BTC. On-chain data shows many of these addresses still sending coins to exchanges, a likely sign of further selling.

If those flows do not quiet down, any bounce could remain fragile.

Source: X

Source: X

Is There Any Ground for a Bounce Yet?

Some analysts argue that price may have found a short-term floor near $80,000.

One former exchange CEO singled out the $80,000–$82,000 zone as a “hold” level for Bitcoin.

If liquidity improves or macro conditions ease, buying interest could return.

Still, sentiment remains fragile. Spot ETFs and institutional money flows have shown signs of outflow. That makes a strong rebound less likely until distribution slows.

What Could Happen Next

A realistic path forward includes:

- A further decline, toward $70,000–$75,000 is possible if leveraged trades unwind and selling momentum persists.

- If whales halt and purchasers intervene stabilization is expected between $80,000 and $85,000.

- A gradual recovery, toward $90,000–$95,000 is expected if macroeconomic factors get better and confidence returns.

Participants tracking futures open interest, funding rates, large wallet transactions and ETF capital movements are likely to receive indications of the upcoming shift.

What This Means for Traders and Investors

- Traders using leverage should reduce exposure or stay out until price action stabilizes. A bounce may feel tempting, but a fresh flush could strike at any time.

- Exposed investors should watch on-chain flows and significant exchange deposits. If whale wallets keep dumping, risk remains high.

- Long-term holders might see any dip to $70,000 as an opportunity to buy at a lower price, but only if they accept volatility and avoid leverage.

Conclusion

Bitcoin price enters a range as the first drop wiped out a portion of risky wagers, yet the remaining leverage and continued whale selling increase the likelihood of another decline.

A decline, to the $70,000–$75,000 range is still possible before the market pauses. Traders and investors need to remain vigilant refrain from choices and monitor on-chain metrics and capital movements.

Glossary of Key Terms

Leverage: Python code. Borrowed capital is used to increase trading exposure. Enables bigger gains and bigger losses.

Liquidation: Forced closing of leveraged positions when the market moves against them. Traders lose capital or collateral.

Whale: Large investor or entity that holds substantial amounts of cryptocurrency, enough to influence market direction.

Funding Rate: Cost paid between long and short traders in futures markets. Negative funding often signals pessimism or expectation of further decline.

FAQs About Bitcoin Price

Could Bitcoin price really drop to $70,000?

Yes. If leftover leveraged positions unwind and whales continue selling, a dip toward $70,000–$75,000 remains a realistic scenario.

Is $80,000 a solid floor now?

Possibly. Certain analysts consider $80,000 as a floor for the moment though a drop, under that threshold would weaken that perspective.

Is it advisable for traders to utilize leverage at this time?

That would involve risk. Volatility is still elevated and fluctuations, in price might severely impact positions.

What should long-term holders do?

Holders looking for a lower entry point might consider adding gradually if the price drops. Leverage should be avoided.

References

Cointelegraph

Yahoo Finance

FX Leaders

Read More: BTC at Risk as Analyst Says More Leverage Liquidations May Drag Price Under $80K">BTC at Risk as Analyst Says More Leverage Liquidations May Drag Price Under $80K

You May Also Like

![[Tambay] Tres niños na bagitos](https://www.rappler.com/tachyon/2026/01/TL-TRES-NINOS-NA-BAGITOS-JAN-17-2026.jpg)

[Tambay] Tres niños na bagitos

Massive Whale Buying Spree Could Trigger XRP Supply Shock as Exchange Balances Drop to Lowest Since 2023 ⋆ ZyCrypto