Binance Dominates Volumes as Crypto Traders Pile Into Stablecoins During Market Correction: CryptoQuant

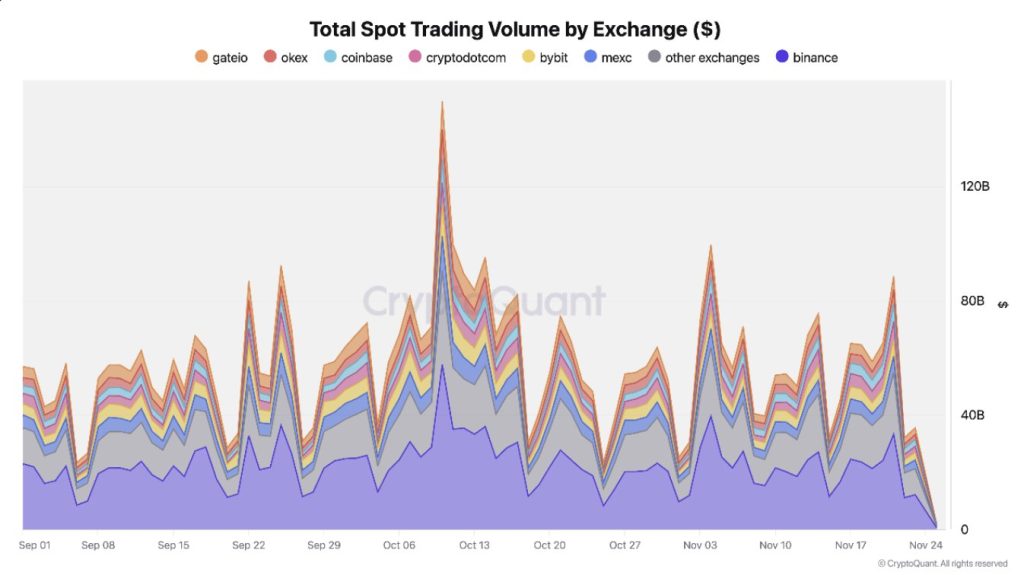

Crypto trading activity has slowed significantly in recent weeks as the broader market correction deepens, according to new data from CryptoQuant. At the same time, Binance has emerged as the key focal point of market flows, with traders increasingly shifting assets onto the exchange during the downturn.

Daily spot trading volume, which reached almost $100 billion on November 4, has since fallen to around $65 billion, reflecting reduced participation and cautious sentiment across major digital assets.

The perpetual futures market has followed a similar trajectory. Perp trading volumes peaked near $360 billion on October 10, dipped to $298 billion on November 4, and have since slid further to approximately $170 billion. The sustained decline shows lower risk appetite as traders reduce leverage and wait for clearer market direction.

Binance Maintains Dominant Lead in Global Trading Activity

Despite the drop in overall volumes, Binance continues to command a substantial share of global trading flows. Over the past 24 hours, the exchange recorded $25 billion in spot volume and $62 billion in perpetual futures volume, extending its lead as the industry’s largest trading venue.

By comparison, the next-largest exchanges remain far smaller in scale. Crypto.com posted $4.6 billion in spot market activity, while OKX processed $36 billion in futures volume—less than two-thirds of Binance’s total. The gap underscores Binance’s entrenched position as the primary liquidity hub, even during periods of market stress.

Stablecoin Reserves Surge as Traders Seek Safety

While trading volumes have contracted, stablecoin accumulation on exchanges has surged, pointing to defensive positioning among investors. Combined USDT and USDC balances on Binance reached a record $51.1 billion on November 15, the highest in its history.

OKX has also seen robust inflows, with its stablecoin reserves climbing toward $10 billion this month. The build-up reflects a broad rotation into dollar-pegged assets as traders hedge against volatility, lock in profits, or prepare for opportunistic re-entry at lower price levels.

Heightened Sell Pressure as BTC and ETH Inflows Spike

The value of Bitcoin and Ethereum flowing into exchanges has risen sharply, signaling selling pressure during the correction. In the last week alone, total BTC and ETH inflows reached $40 billion.

Binance once again captured the largest share, receiving $15 billion—more than one-third of all major-asset inflows—while Coinbase recorded $11 billion. Other exchanges collectively absorbed around $14 billion, reinforcing the trend of consolidation toward top-tier venues during turbulent market phases.

Altcoin Deposits Remain Elevated Despite Market Weakness

Notably, traders have continued moving altcoins onto exchanges. Daily altcoin deposits peaked at 77,000 on October 16, with Coinbase (26,000) and Binance (23,000) leading the inflow activity. The elevated levels suggest ongoing repositioning across the long tail of assets, even as market conditions remain choppy.

Despite the downturn in trading activity, exchange data shows investors are actively reallocating capital—shifting from risk to stability, and preparing for the next decisive move in market momentum.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Why Institutional Capital Chooses Gold Over Bitcoin Amid Yen Currency Crisis