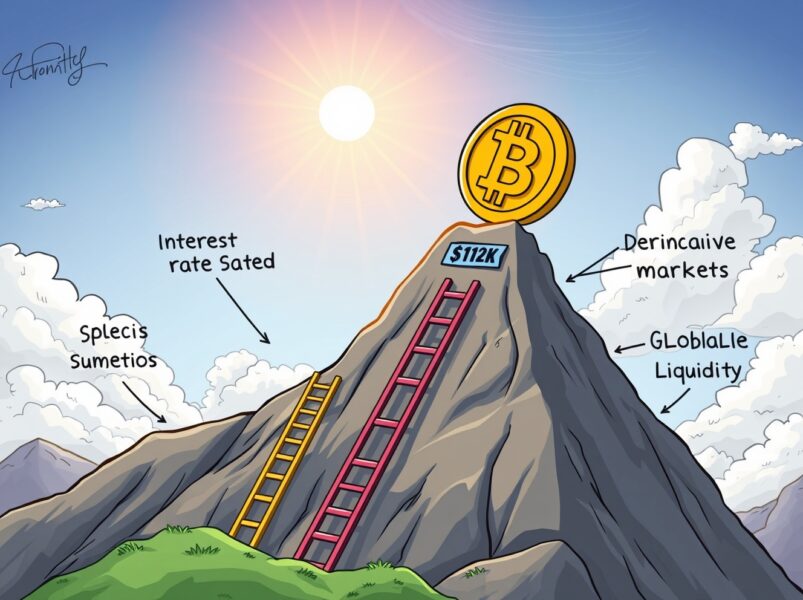

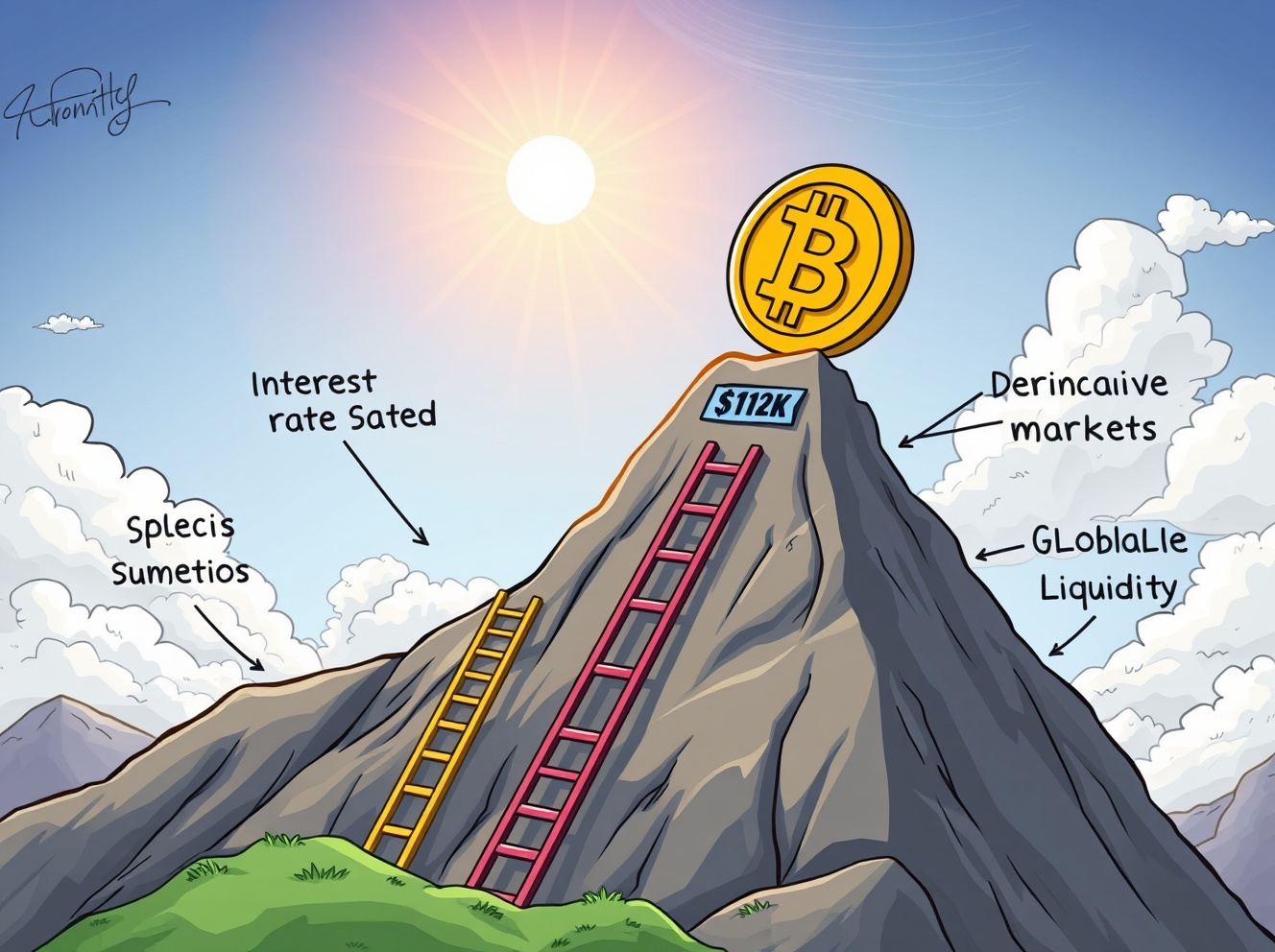

Unstoppable Bitcoin: 4 Key Factors Driving the Path to Reclaim $112K

BitcoinWorld

Unstoppable Bitcoin: 4 Key Factors Driving the Path to Reclaim $112K

Could Bitcoin really surge back to $112,000? Recent analysis highlights four critical elements that might just make this ambitious target achievable. Understanding these Bitcoin reclaiming $112K drivers helps investors navigate the volatile crypto landscape with greater confidence.

What Are the Four Factors for Bitcoin Reclaiming $112K?

Experts point to a combination of macroeconomic and market-specific conditions. These factors interact in complex ways, but together they create a potential pathway for significant price appreciation. Let’s break down each one to see how they could propel Bitcoin reclaiming $112K.

How Do Interest Rates and Inflation Impact Bitcoin?

Uncertainty surrounding interest rates and inflation remains a crucial element. When central banks raise rates to combat inflation, investors often reduce risky assets like Bitcoin. However, if inflation shows signs of cooling and rate hikes pause, we could see renewed interest in cryptocurrencies. This shift would support Bitcoin reclaiming $112K by improving investor sentiment.

Could MSCI Inclusion Boost Bitcoin’s Value?

MSCI’s potential inclusion of crypto firms in its indexes represents a major validation moment. This move would signal growing institutional acceptance amid a trend toward deregulation. The inclusion could:

- Attract substantial institutional investment

- Increase mainstream credibility

- Provide additional liquidity to markets

Such developments would significantly aid Bitcoin reclaiming $112K by bringing in new capital.

What Role Does the Derivatives Market Play?

Stress in the derivatives market currently creates headwinds for Bitcoin prices. When leverage levels become excessive, it often leads to increased volatility and potential liquidations. However, as the market stabilizes and risk management improves, derivatives could instead provide healthy price discovery mechanisms. Resolving these issues is essential for sustainable growth toward Bitcoin reclaiming $112K.

How Important Is Global Liquidity for Bitcoin’s Recovery?

Improving global liquidity serves as the final piece of the puzzle. When central banks inject liquidity into financial systems, some of that capital typically flows into cryptocurrencies. This phenomenon has historically correlated with strong Bitcoin performance. Therefore, monitoring liquidity conditions provides valuable clues about the timing of Bitcoin reclaiming $112K.

When Could We See Bitcoin Reach $112K?

Analysis suggests the first half of next year offers the most likely window for Bitcoin reclaiming $112K. This timeline depends on resolving policy, regulatory, and derivatives market risks. While the target appears ambitious, the convergence of these four factors makes it plausible. Investors should watch for progress in these areas as indicators of potential price movement.

The journey toward Bitcoin reclaiming $112K requires patience and careful monitoring of these key developments. While challenges remain, the underlying fundamentals suggest a compelling case for significant price appreciation. Staying informed about these factors will help investors make better decisions in the evolving cryptocurrency landscape.

Frequently Asked Questions

What is the most important factor for Bitcoin reaching $112K?

Global liquidity improvements likely hold the greatest influence, as increased capital availability typically drives investment into risk assets like Bitcoin.

How does MSCI inclusion help Bitcoin’s price?

MSCI inclusion brings legitimacy and attracts institutional investors who previously avoided cryptocurrencies due to regulatory concerns.

Can Bitcoin hit $112K without derivatives market stability?

While possible, sustained price growth requires derivatives market stability to prevent excessive volatility and liquidation events.

Why might interest rate decisions affect Bitcoin?

Higher interest rates make safer investments more attractive, potentially reducing capital flowing into cryptocurrencies.

What timeframe seems most realistic for $112K Bitcoin?

Most analysts point to the first half of next year, assuming positive developments across all four key factors.

Should investors be optimistic about Bitcoin’s prospects?

While cautious optimism is warranted, investors should monitor these factors closely and maintain diversified portfolios.

Found this analysis helpful? Share it with fellow crypto enthusiasts on social media to spread the knowledge about Bitcoin’s potential path to $112K!

To learn more about the latest Bitcoin trends, explore our article on key developments shaping Bitcoin price action.

This post Unstoppable Bitcoin: 4 Key Factors Driving the Path to Reclaim $112K first appeared on BitcoinWorld.

You May Also Like

Husky Inu (HINU) Completes Move To $0.00020688

US Senate Releases Draft Crypto Bill Establishing Clear Regulatory Framework for Digital Assets