CryptoQuant: Large deposits to exchanges increased significantly during Bitcoin price declines.

PANews reported on November 27th that, according to The Block, on-chain analytics firm CryptoQuant pointed out that following Bitcoin's price drop below $80,000 last week, the amount of Bitcoin transferred from large holders to exchanges surged. On November 21st, exchanges saw a single-day inflow of 9,000 BTC, with 45% coming from large deposits of 100 BTC or more in a single transaction—a proportion described as "abnormally high." Data shows that the average deposit size in November surged from 0.6 BTC to 1.23 BTC, a one-year high. On Binance, the average deposit size increased even more, from 12 BTC at the beginning of the month to 37 BTC recently. CryptoQuant points out that this further confirms the view that "large holders are reducing their Bitcoin holdings through exchanges," and that investor selling continues to put pressure on the market amid the current price correction.

Exchange activity for other major assets was also active. Although total Ethereum inflows did not increase significantly, the proportion of large deposits climbed. With the price of Ethereum falling to around $2,900, the average daily deposit per transaction reached 41.7 ETH, a new high in nearly three years. As for altcoins, the daily transaction volume transferred to exchanges has consistently exceeded 40,000 since July, reaching a peak of 78,000 transactions on October 17.

You May Also Like

US Set to Impose Tariffs on Chinese Semiconductor Imports by June 2027

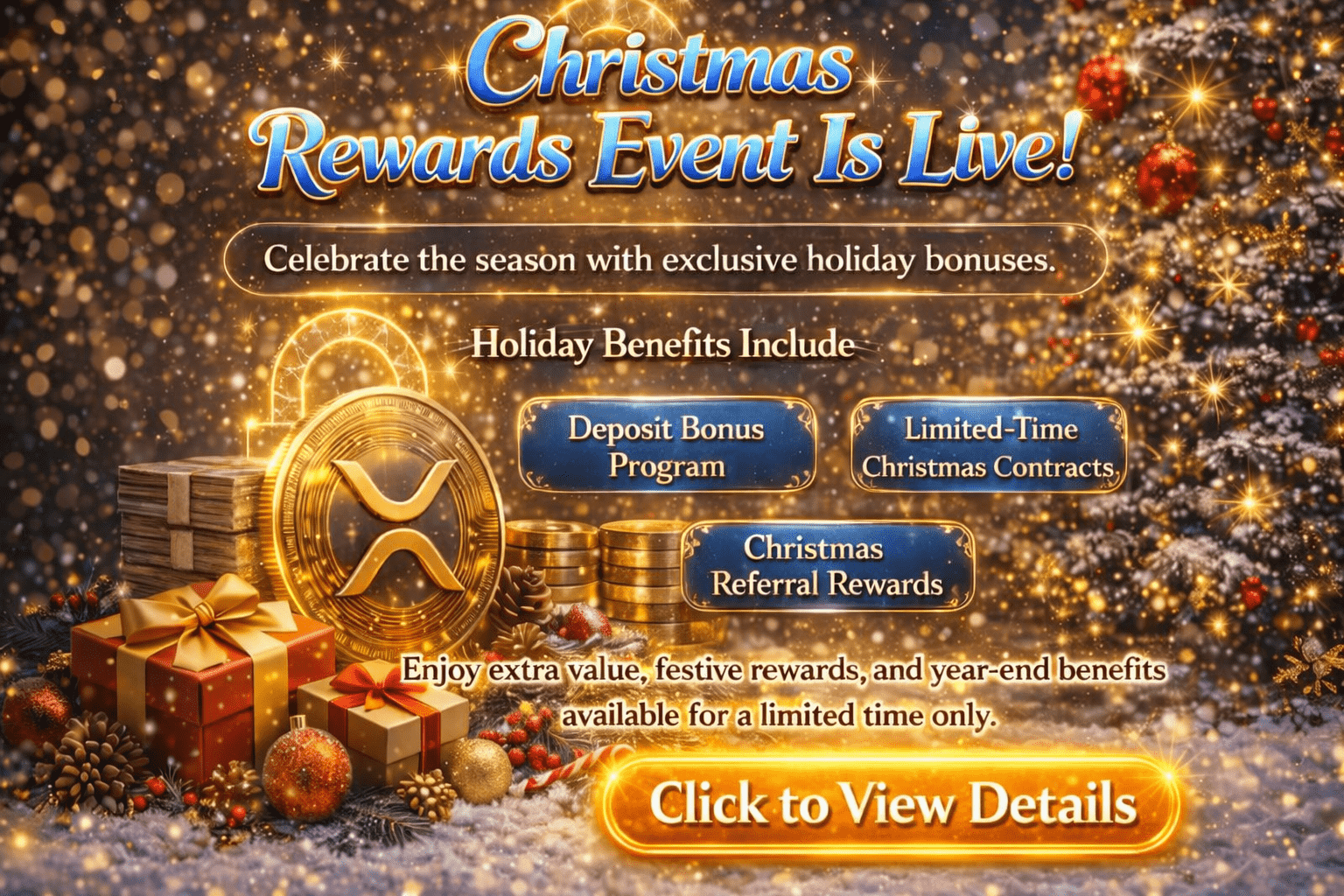

XRPstaking platform launches limited-time reward program to help users complete year-end asset planning