Dream11 to open-source tech stack; BII’s funding playbook for Indian startups

Hello,

After losing the pricing battle, Tesla’s strategy to win the EV war in India hinges on the long game: maintenance and fuel costs.

Tesla's low running costs, including maintenance and fuel, can help Indian buyers recoup about one-third of the Model Y's $67,000 price tag over four to five years, according to the company's India head.

But is that enough to look past sticker shock from India’s 100% import tariff?

Since starting deliveries in September, Tesla has sold just over 100 Model Y cars in the country, government registration numbers show.

Meanwhile, Ola, too, is finding it difficult to secure backers for its new fundraising plans, owing to the EV maker’s deteriorating sales and financial health, Bloomberg reported.

Quick commerce, though, is as capital-rich as ever. Blinkit has secured about Rs 600 crore from its parent entity Eternal, joining the race to fund aggressive dark store expansion across major Indian cities.

In other news, things are coming full circle for global sporting events. The flame for the Milano Cortina 2026 Olympic Winter Games was lit today in Ancient Olympia, the historic birthplace of the Olympic Games.

India got its moment to shine, too, after Ahmedabad was formally named the host of the 2030 Centenary Commonwealth Games on Wednesday.

In today’s newsletter, we will talk about

- Dream11 to open-source tech stack

- BII’s funding playbook for Indian startups

- Women who defined India’s digital story

Here’s your trivia for today: What name did Neil Armstrong give to the spot where man first touched down on the Moon?

Technology

Dream11 to open-source tech stack

After the ban on real-money gaming earlier this year, sports tech company Dream Sports is again venturing into a new area: an open-source initiative under a new brand 'Horizon'.

The initiative’s first offering, HorizonOS, will offer a host of functions: from tools to help developers build, test and deploy faster through building blocks for application development to systems and platforms. As part of the offering, it will open-source the tech stack of Dream11 to startups, MSMEs, and the global developer community.

New territories:

- For now, the software stack will be free for use, said Amit Garde, CEO at Horizon, adding that the offering has the potential to be monetised in the long term.

- At the moment, the company is evaluating how its tech stack can be useful to the startup community. Garde noted that if the platform takes off and onboards a lot of users, that would indicate potential for monetisation.

- Dream11 built its own tech stack to keep up with the overwhelming traffic on its platform. Over the past decade, the platform has served over 300 million users, and has seen 16 million concurrent users, and up to 100,000 transactions per second in some instances.

Funding Alert

Startup: Blinkit

Amount: Rs 599.94 Cr

Round: Equity

Startup: 3ev

Amount: Rs 120 Cr

Round: Series A

Startup: Mirana Toys

Amount: Rs 57.5 Cr

Round: Series A

Investor

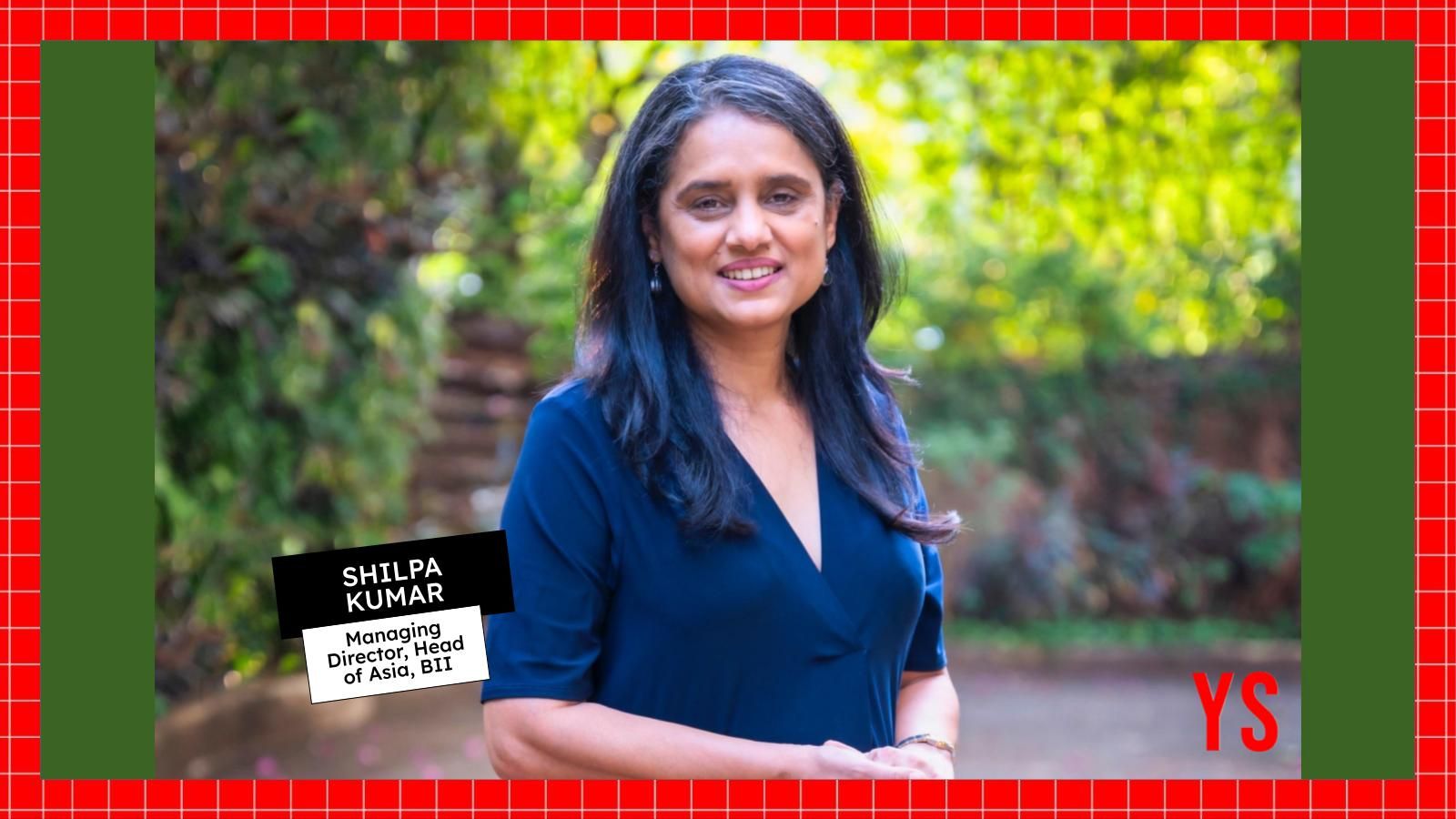

BII’s funding playbook for Indian startups

British International Investment (BII), in its strategy for 2022-2026, had declared that 30% of its investments would be ringfenced for the climate sector. In India, BII’s investment commitment in the space is over 40%, says Shilpa Kumar, BII’s Managing Director and Head of India.

BII—the United Kingdom’s development finance institution and impact investor—has been supporting climate-tech firms in India through a variety of routes: as a limited partner on funds, co-investments, and direct investments.

Key takeaways:

- BII also invests in is clean mobility. The company has directly invested in startups, including commercial EV maker Euler Motors and charging infrastructure companies such as ChargeZone (charge point operator) Battery Smart (and battery-swapping player).

- BII invests about $2 billion annually in the markets of Africa, Asia, and the Caribbean. Of this, $600 million to $700 million is deployed every year in India.

- To date, the firm has allocated $193 million across 19 funds, which include 3one4’s Fund III, Aavishkaar India Fund VI and Blume Ventures India Fund IV, according to its website.

Women Entrepreneurs

Women who defined India’s digital story

Women tech leaders have always been known for their distinct detail-driven leadership and collaborative approach—as they push for equitable tech adoption, transparent processes, and long-term goals. However, despite the emergence of women CTOs, engineering heads, and product leaders, there are deep gaps that continue to hold women back.

In 2025, women leaders have stood out with their ability to navigate the advancement of AI and lead digital transformation across sectors. Here is a list of women leaders in technology HerStory featured this year.

News & updates

- Rare metals: India has approved a $815.74 million rare earth permanent magnets manufacturing programme. India's consumption of rare earth permanent magnets is expected to double by 2030. The country imported 53,748 metric tons of rare earth magnets in the fiscal year ending March 2025.

- Data centre: Reliance Industries, Brookfield Corporation, and Digital Realty have formed a joint venture, called Digital Connexion, that will invest $11 billion over five years to develop 1 gigawatt of AI data capacity in Andhra Pradesh.

- Job cuts: McKinsey & Co. cut about 200 global tech jobs in the past week as the consulting firm joins rivals in using AI to automate some positions. The company isn’t ruling out additional reductions across different functions over the next two years as it ramps up usage of the technology.

What name did Neil Armstrong give to the spot where man first touched down on the Moon?

Answer: Tranquillity Base.

We would love to hear from you! To let us know what you liked and disliked about our newsletter, please mail nslfeedback@yourstory.com.

If you don’t already get this newsletter in your inbox, sign up here. For past editions of the YourStory Buzz, you can check our Daily Capsule page here.

You May Also Like

Husky Inu (HINU) Completes Move To $0.00020688

US Senate Releases Draft Crypto Bill Establishing Clear Regulatory Framework for Digital Assets