LivLive vs Remittix vs Best Wallet Token: Which Best Crypto Presale Stand Out In Q4 2025?

Q4 2025 is becoming a crucial window for presale opportunities, with new projects appearing daily and competition rising fast. Investors are no longer asking what’s new, they’re looking for the few presales that can prove real value, clear mechanics, and a realistic roadmap for growth. In a landscape full of noise, only a handful of tokens are showing the kind of momentum that could translate into major gains next year.

LivLive ($LIVE), Remittix, and Best Wallet Token all sit in that spotlight, but for very different reasons. One leans into real world behavior, one focuses on global money movement, and one tries to own the wallet experience itself. Choosing between them is less about hype and more about understanding how each project claims its spot among the best crypto presales of Q4 2025.

This comparison breaks down LivLive, Remittix, and Best Wallet Token, so readers can judge which has the strongest case as the next 1000x crypto and possibly the best crypto buy under $1 in this cycle.

LivLive ($LIVE): Real Life As A Reward Engine And A Next 1000x Crypto Candidate

Among top cryptos presales, LivLive stands out by turning normal life into a gamified experience that actually pays attention to effort. It is not built as another closed game world. Instead, it uses a Real World Gamification Layer that converts everyday actions like walking, checking in, or reviewing into quests that reward users with $LIVE tokens and XP. The platform replaces vanity style influence metrics with verifiable, measurable achievements that live on chain.

At the heart of this is the Verifiable Trust Protocol. Every action and every reward must be authenticated. Proof of action is recorded on Ethereum, which makes fake participation far harder and builds credibility between users, businesses, and communities. This is where LivLive looks different from many presale pitches. It is not just selling a token, it is selling a trust layer over real life activity. With a total supply of 5 billion tokens and an aim for a $0.2 listing price, LivLive is positioned in many discussions as a serious contender for the next 1000x crypto conversation.

LivLive Presale Numbers, Price, And ROI Scenarios In Q4 2025

What really pushes LivLive into the best crypto presales territory is the combination of narrative and hard numbers. In the current stage of the presale, the price is $0.02 per $LIVE, with more than $2,176,633 already raised and around 328 holders on board. The target listing price sits at $0.2, which means early entries are stepping in at a significant discount. Unsold tokens are scheduled to be burned and liquidity is planned to be locked post launch, two decisions that can help support long term trust if executed as described.

Take a simple scenario. A $5000 allocation at $0.02 buys 250,000 $LIVE tokens. If $LIVE reaches the projected $0.2 listing price, that stack would be worth $50,000. If, at some later stage, the token climbs toward a speculative $1 mark, that same position would translate to $250,000. None of this is guaranteed and the risk remains high, but the math explains why LivLive is often treated as a potential best crypto buy under $1 in Q4 2025.

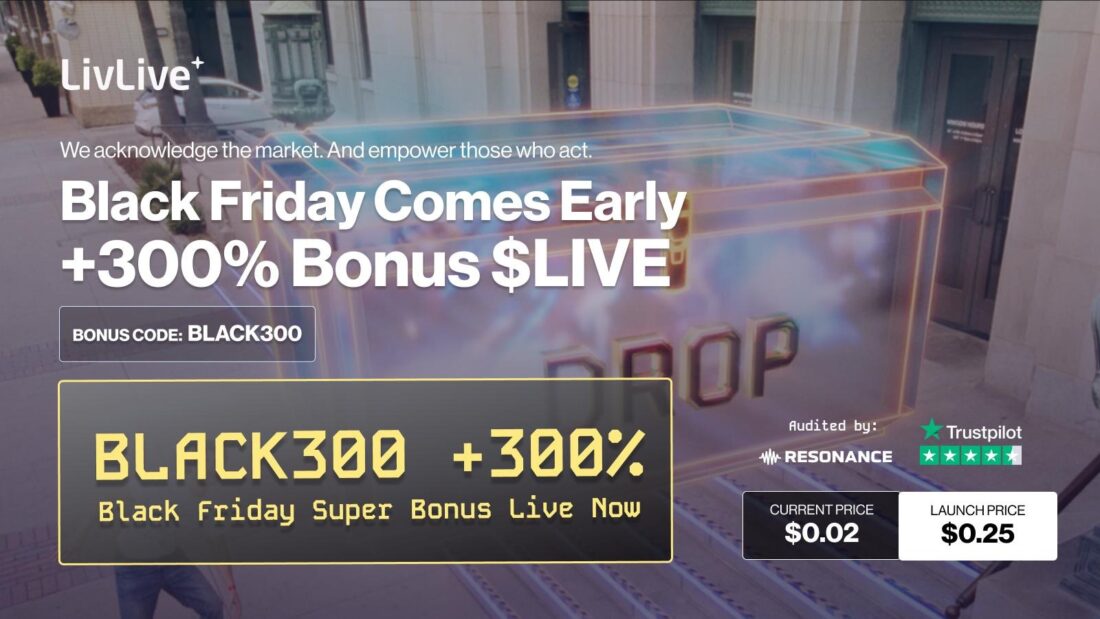

Then comes the seasonal accelerator. LivLive is rolling out a Black Friday 300 percent Power Up Bonus, activated with the code BLACK300 and running until November 30. This promotion multiplies the token amount received on qualifying purchases by three, turning a normal buy into a supercharged entry during a short window. For investors who already liked the core idea, this bonus can make the presale feel like one of the standout top cryptos presales of the quarter, especially for those hunting the next 1000x crypto before it hits exchanges.

Remittix: Cross Border Payments With A Real World Problem To Solve

Remittix enters the scene with a clear and familiar mission. It wants to simplify international money transfers and challenge the traditional remittance rails that many people find slow and expensive. The project is designed around lower fees, faster transactions, and a more transparent process for moving funds across borders. For users sending money home, paying remote workers, or dealing with global invoices, that vision is immediately understandable.

Where Remittix may stand out in Q4 2025 is its focus on a real problem that millions of people already face every month. Instead of inventing a new behavior, it tries to improve one that already exists. That gives it a solid fundamental story. Its potential strengths sit in partnership execution, compliance strategy, and how effectively it can integrate with payment corridors that already move high volume. Among best crypto presales with a utility driven angle, Remittix earns attention as a practical, problem focused project. However, it does not lean as heavily into everyday engagement or gamification, which is where LivLive pulls ahead in user interaction depth.

Best Wallet Token: Utility Driven, Interface Focused, And Built Around Management

Best Wallet Token approaches the market from a different direction. Instead of focusing on movement of funds or behavioral gamification, it aims to become a central hub for asset management. The idea is simple. Many users hold multiple tokens across different chains, and switching between platforms can be confusing and time consuming. Best Wallet tries to solve that by becoming a smooth, organized command center for portfolios, rewards, and tracking.

The token plays into this design as an access and benefit layer, potentially supporting premium features, rewards, or deeper functionality inside the wallet ecosystem. For users who value structure, planning tools, and clean interfaces, Best Wallet Token offers a tangible reason to pay attention. In the context of top cryptos presales, it speaks to those who want a more streamlined relationship with DeFi and crypto holdings. Compared to LivLive and Remittix, Best Wallet leans more into ongoing utility than narrative buzz, which may appeal to more methodical investors who like tools that make daily management easier.

Head To Head: Which Best Crypto Presale Stands Out In Q4 2025?

Looking across LivLive, Remittix, and Best Wallet Token, each project brings something distinct to the table. Remittix attacks the global transfer problem. Best Wallet Token focuses on simplifying portfolio management. LivLive turns real life itself into a rewardable experience and backs it with authenticated on chain proof.

From a pure narrative plus numbers angle, LivLive currently has the most aggressive upside story. A $0.02 presale price, a target $0.2 listing, more than $2.17 million raised, hundreds of holders already involved, and a Black Friday 300 percent Power Up Bonus together create a powerful proposition. That is why many observers put LivLive in the next 1000x crypto watch category, while still acknowledging that all presales carry real risk and should be approached with careful research and responsible allocation size.

Remittix and Best Wallet Token deserve respect for their clear, utility anchored approaches. Neither should be dismissed. Still, when the question is specifically which best crypto presales stand out in Q4 2025 based on current positioning, LivLive has a sharper combination of tokenomics, user centric mechanics, and promotional fuel driving attention its way.

Conclusion: Why Joining The $LIVE Presale Could Be A Smart Move

Participation in the $LIVE presale is not just about chasing short term flips. It connects directly to a system that rewards real movement, real actions, and real engagement with businesses and communities. Because LivLive uses verifiable chain proof, each rewarded action is tied to something concrete, which supports a stronger trust model than many abstract reward systems. For investors who value transparent mechanics and clearly defined participation rules, that is a compelling foundation.

On top of that, the combination of a $0.02 entry price, a $0.2 listing goal, structured burning of unsold tokens, locked liquidity plans, and the limited time Black Friday 300 percent Power Up Bonus sets $LIVE apart from many other presales. While Remittix and Best Wallet Token offer solid, utility driven stories, LivLive blends narrative, mechanics, and incentives into a package that feels built for both engagement and potential upside. Among the top cryptos presales of Q4 2025, LivLive currently looks like the project most likely to convert real world behavior into real digital opportunity, making it a strong candidate for anyone exploring the best crypto buy under $1 with a careful, research driven mindset.

For More Information:

Website: http://www.livlive.com

X: https://x.com/livliveapp

Telegram Chat: https://t.me/livliveapp

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release

The post LivLive vs Remittix vs Best Wallet Token: Which Best Crypto Presale Stand Out In Q4 2025? appeared first on Live Bitcoin News.

You May Also Like

Crucial US Stock Market Update: What Wednesday’s Mixed Close Reveals

Forbes' 2026 Crypto Investment Trends Outlook: Institutionalization, Tokenization, Stablecoins, and the AI Machine Economy