580K BTC Withdrawn in 6 Days: Is Bitcoin Preparing for a Huge Rally?

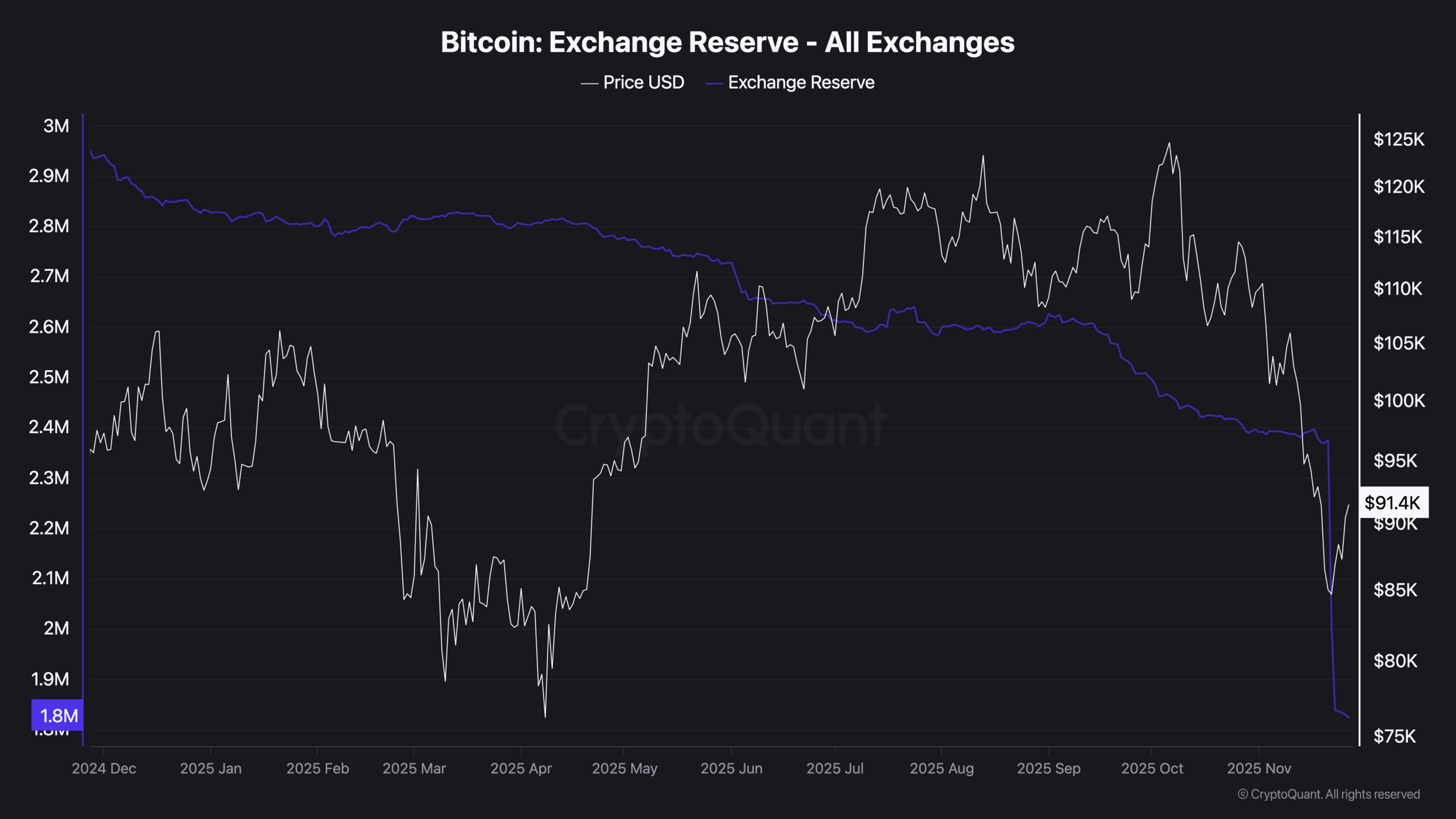

Bitcoin exchange reserves fell sharply between November 21 and November 27, 2025. Data from CryptoQuant shows a drop from around 2.4 million BTC to 1.82 million BTC during that time. This represents a reduction of more than 580,000 units in under a week. The move is one of the largest multi-day outflows seen this year and has raised questions across the market.

Bitcoin is trading near $91,700 at press time. It is up 6% in the past day but slightly down over the week. The recent recovery followed a pullback to below $81,000, but BTC still trades around 27% below its ATH of over $126,000, reached in early October.

Large Wallets Withdraw as Spot Pressure Eases

The fall in exchange reserves followed months of steady outflows. However, the pace of the recent move stood out. It may suggest that larger holders have taken BTC off exchanges, possibly into custody or cold storage.

Source: CryptoQuant

Source: CryptoQuant

Meanwhile, on-chain data from Santiment shows that 91 new wallets holding at least 100 BTC have been added since November 11. Smaller wallet numbers are dropping, pointing to lower participation from retail users.

As reported by CryptoPotato, a key derivatives funding metric on Binance has dropped to levels not seen in nearly two years. This points to increased selling from leveraged positions during the past weeks.

Derivatives Data Show Market Reset

BTC’s aggregated funding rate has turned negative, now at -0.0007. This reflects lower long exposure in the futures market. It also suggests that short positions are increasing, or that longs are being closed.

At the same time, the Coinbase premium is still negative at -0.0135. However, this value has improved from deeper lows earlier in the month. According to Daan Crypto Trades,

Key Price Zones in Focus

Analyst Daan Crypto Trades also pointed to the $89,000 to $91,000 area as a zone to watch. It acted as both support and resistance in earlier cycles. The asset is now trading inside that range.

Elsewhere, Captain Faibik noted that BTC is forming a descending broadening wedge on the 4-hour chart. The analyst said the price “has likely bottomed out,” but added that bulls need to reclaim the $100,000 level for stronger upside.

Lennaert Snyder described $93,000 as a “make or break” level, saying that it could decide whether the trend flips or continues downward.

The post 580K BTC Withdrawn in 6 Days: Is Bitcoin Preparing for a Huge Rally? appeared first on CryptoPotato.

You May Also Like

Moonshot Alert: Pepeto Targets 269x as a Top Crypto 2026 While ETH Holds and Chainlink Powers Infrastructure With $7.391 Million Raised

Next 100x Crypto in Market Turmoil? APEMARS Presale Moves $12.2B Tokens as Shiba Inu Drops & PNUT Rises – Join Stage 10 for 5,900% ROI