Top 4 reasons a crypto market bull run could be near

A crypto market bull run may be on the way as Bitcoin and most altcoins continue their uptrend today, Nov. 27.

- A crypto bull run could be about to start in the coming weeks or months.

- The Federal Reserve will likely maintain a dovish tone in 2026.

- There are signs that the futures open interest retreat is nearing its ending.

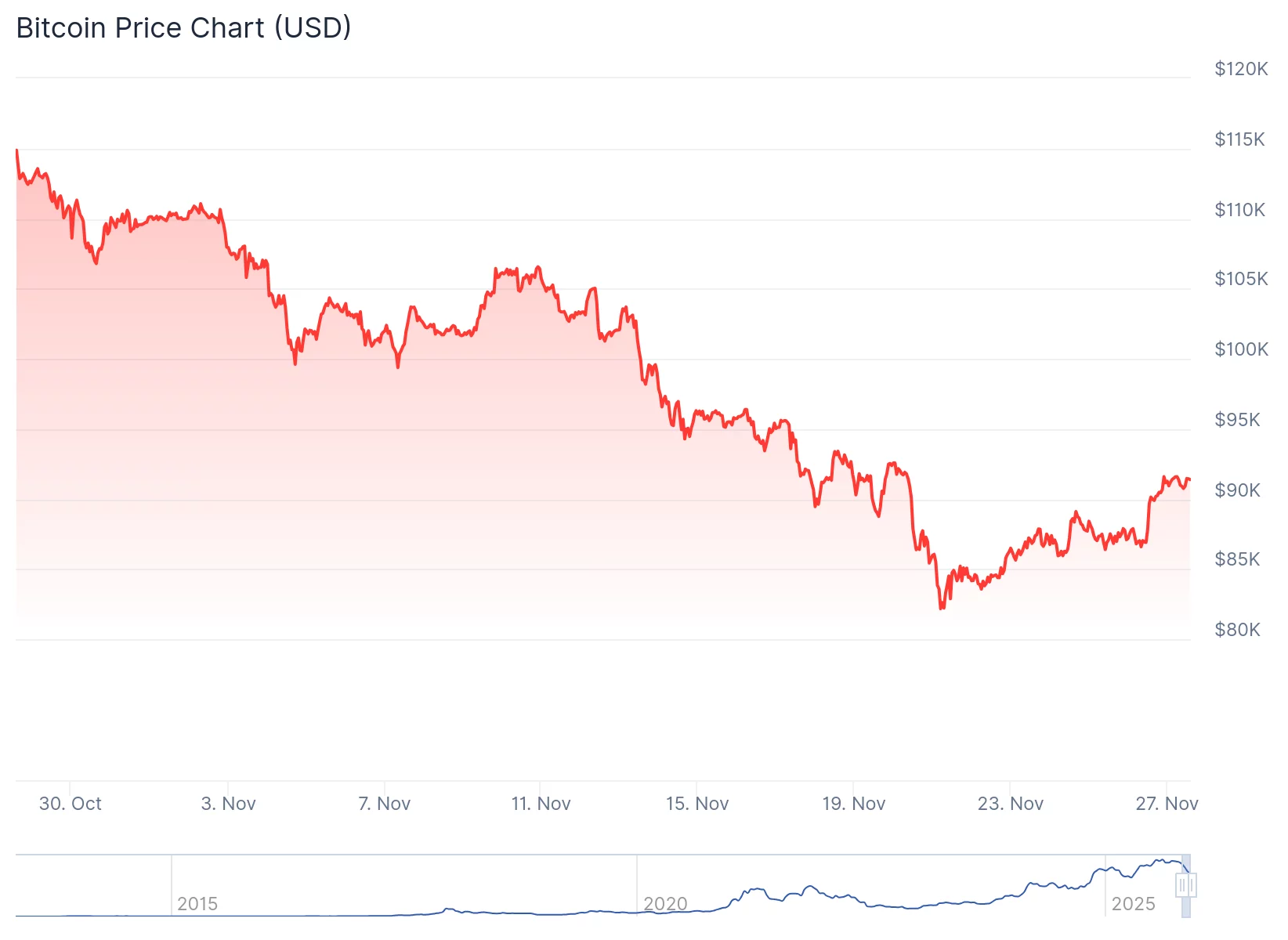

Bitcoin (BTC) price held steady, reaching a high of $91,345, its highest point since Nov. 20, and ~14% above the lowest point this month. Other altcoins, such as Ethereum (ETH) and Dash (DASH), were also rising. Here are the top reasons why a new crypto market rally may be starting.

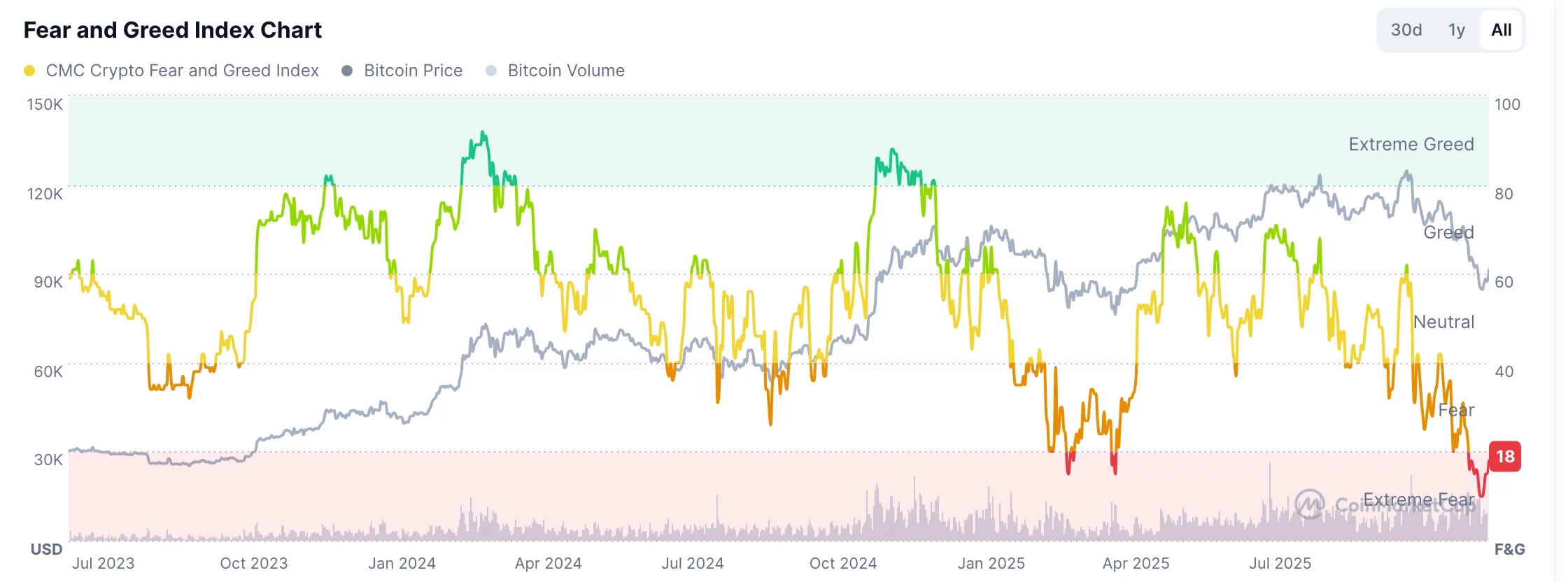

Fear and Greed Index rises

One key reason why the crypto bull run may be around the corner is that the Fear and Greed Index has likely bottomed. It dropped to 8 on Saturday and has since rebounded to 18.

A closer look at the chart below shows that most crypto market rallies begin in periods of panic. A good example of this is the panic that spread through the market after President Trump announced his reciprocal tariffs in April.

These tariffs were a black swan event that led to a major panic among stock and crypto market traders, pushing the Fear and Greed Index to 17. The coin then rebounded and moved to a record high a month later.

Wall Street analysts are bullish

Another sign that a crypto market rally is about to happen is that top Wall Street analysts are highly bullish on the stock market.

In a note on Wednesday, analysts at JPMorgan Private Bank boosted their S&P 500 Index forecast. They now expect that the index will jump by 20% by 2027.

Other Wall Street analysts from companies like ING, Bank of America, Morgan Stanley, and Deutsche Bank are also optimistic about the stock market.

A strong stock market bull run will likely spill over into the crypto industry, as both are often classified as risky assets.

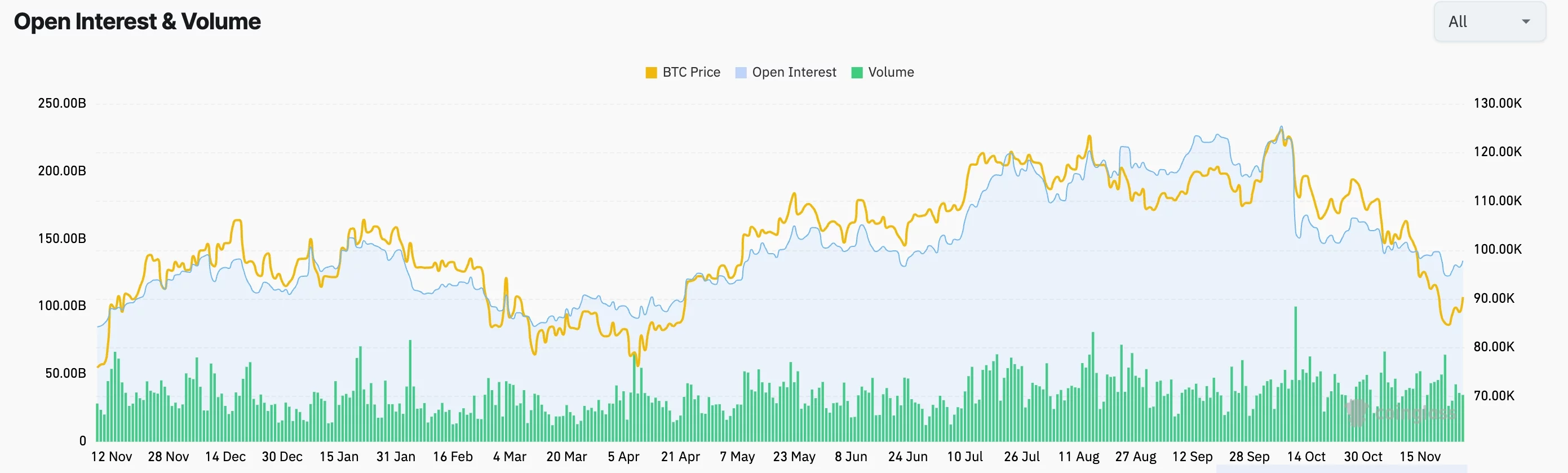

Futures open interest could bottom

Another potential signal that a crypto market rally is about to happen is that futures open interest have plunged in the past few weeks. This crash is now about to end, a move that will boost crypto prices when it starts to rise.

One reason for this is, as the chart below shows, is that the interest always rebounds after falling. For example, it dropped from $141 billion in December last year to $92 billion in March and then rebounded to over $225 billion in October.

Federal Reserve interest rate cuts

Meanwhile, the crypto market bull run will likely be boosted by the Federal Reserve, which is expected to maintain a highly dovish tone in the coming year.

Polymarket odds of a rate cut in December have soared to 84%, while President Trump is considering Kevin Hassett as the next Federal Reserve chair. Odds of Hassett becoming the chair have jumped in the past few days.

Hassett, unlike Jerome Powell, is more aligned with Trump and has expressed hopes that the bank should cut interest rates much more. As such, it will not be a surprise if rates move from the current 3.75% to 1%. This explains why US bond yields have dropped recently.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

XCN Rallies 116% — Can Price Hold as New Holders Gain?