ALT5 Sigma, a crypto treasury firm holding Trump-linked World Liberty Financial (WLFI) tokens, replaced CEO Jonathan Hugh and COO Ron Pitters in November 2025 as part of a leadership overhaul, appointing President Tony Isaac as acting CEO, according to an SEC filing.

-

Leadership Changes at ALT5 Sigma: The firm terminated the CEO and COO without cause, signaling a strategic shift in management amid its focus on WLFI tokens.

-

Regulatory Scrutiny Intensifies: Trump family-linked crypto ventures face investigations from US lawmakers over potential conflicts of interest and national security concerns.

-

Funding and Operations: ALT5 Sigma raised $1.5 billion in August 2025 to build a treasury dedicated to WLFI tokens, with Eric Trump serving on its board until scaling back involvement.

Discover ALT5 Sigma’s recent leadership overhaul and its ties to Trump-backed WLFI amid growing US regulatory scrutiny. Stay informed on crypto treasury strategies and political implications—read more now.

What is the latest leadership change at ALT5 Sigma?

ALT5 Sigma leadership change involves the replacement of CEO Jonathan Hugh and the severance of ties with COO Ron Pitters in November 2025. This move, detailed in a recent Securities and Exchange Commission (SEC) filing, is part of a broader overhaul at the crypto treasury firm known for holding tokens from World Liberty Financial (WLFI), a decentralized finance platform connected to the Trump family. Tony Isaac, the company’s president and board member, has stepped in as acting CEO while finalizing Hugh’s departure terms.

The crypto treasury firm, which holds Trump-linked World Liberty Financial (WLFI) tokens on its balance sheet, has replaced two senior executives.

ALT5 Sigma, a crypto treasury company with ties to US President Donald Trump, replaced CEO Jonathan Hugh and cut ties with chief operating officer Ron Pitters in November as part of a broader leadership overhaul.

Tony Isaac, the president of ALT5 Sigma and a member of the company’s board of directors, has been appointed as acting CEO, while the company works with Hugh to “finalize the terms of his departure,” according to a Securities and Exchange Commission (SEC) filing submitted on Wednesday.

ALT5 Sigma’s crypto treasury strategy includes purchasing tokens from World Liberty Financial (WLFI), a decentralized finance platform tied to the Trump family.

The company said that the departures were “without cause.”

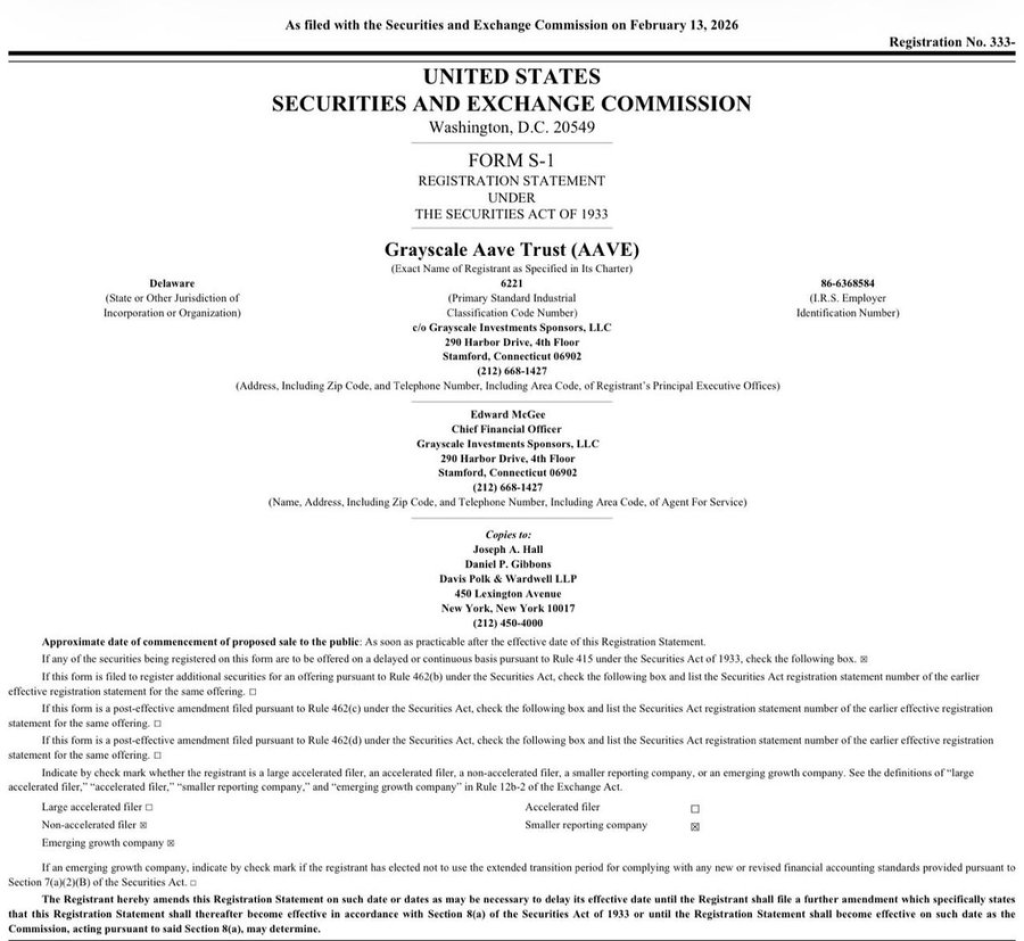

ALT5 Sigma discloses the leadership shakeup in a recent SEC filing. Source: SEC

The company raised $1.5 billion in August to create a crypto treasury dedicated to purchasing WLFI tokens, with Eric Trump, the son of US President Donald Trump, serving as a director on its board.

How has scrutiny from US lawmakers affected Trump-linked crypto projects?

Trump-linked crypto projects, including WLFI, have faced increasing scrutiny from Democratic lawmakers in the United States, who highlight potential conflicts of interest due to the president’s family’s involvement. These ventures are criticized for representing a national security risk and avenues for influence peddling through access sales. In November 2025, lawmakers urged US Attorney General Pam Bondi to probe allegations that WLFI sold tokens to sanctioned entities in North Korea and Russia, potentially generating $1 billion in profits. According to reports from financial analysts, such political entanglements could undermine investor confidence in the broader cryptocurrency sector, with WLFI token prices declining amid the controversy.

World Liberty Financial and other Trump-linked crypto ventures have come under scrutiny from Democratic lawmakers in the United States, who argue that the president and his family’s involvement with the industry represents a conflict of interest.

WLFI’s ‘community governed’ image strained as Trump-backed project freezes wallets

Trump-linked crypto projects come under fire from US lawmakers

In August, rumors surfaced that venture capitalist and ALT5 shareholder Jon Isaac was under investigation by the SEC for earnings inflation and insider sales, which the company denied.

“For the record: Jon Isaac is not, and never was, the president of ALT5 Sigma, and he is not an advisor to the company. The company has no knowledge of any current investigation regarding its activities by the US SEC,” ALT5 Sigma said in response.

The WLFI token has been in decline amid scrutiny from US lawmakers. Source: CoinMarketCap

Eric Trump scaled back his involvement with the company in September to comply with Nasdaq listing rules and was designated as a board observer, according to an SEC filing.

In November, Democratic lawmakers in the US urged Pam Bondi, the US attorney general, to investigate allegations that WLFI sold tokens to sanctioned entities in North Korea and Russia.

The lawmakers said the Trump family’s crypto ventures and the $1 billion in profits from their projects represent a national security threat and a way to peddle influence through selling access to the president.

Trump’s crypto ventures raise conflict of interest, insider trading questions

Experts in cryptocurrency regulation, such as those cited in reports from the Blockchain Association, emphasize the need for clear guidelines to separate political influence from financial innovation. “The intersection of politics and crypto demands heightened transparency to protect market integrity,” noted a senior policy advisor from a leading think tank on digital assets. This scrutiny extends beyond ALT5 Sigma, prompting discussions on how family ties to the executive branch could impact decentralized finance protocols like WLFI, which aim to provide accessible lending and borrowing services without traditional intermediaries.

ALT5 Sigma’s strategy to amass WLFI tokens underscores a growing trend in corporate treasuries adopting cryptocurrencies for diversification. However, the leadership changes come at a pivotal time, as the firm navigates regulatory pressures and market volatility. The SEC filing reveals no specific reasons for the executive departures beyond “without cause,” but insiders suggest a realignment to strengthen compliance frameworks in light of ongoing investigations.

Broader implications for the crypto industry include heightened calls for disclosure rules. Financial watchdogs, including the SEC, have ramped up oversight of politically affiliated ventures to prevent misuse of influence. Data from market trackers shows WLFI tokens experiencing a 15% decline over the past month, correlating with news of these probes, highlighting the sensitivity of investor sentiment to geopolitical factors.

Frequently Asked Questions

What prompted ALT5 Sigma’s executive replacements in 2025?

ALT5 Sigma replaced its CEO and COO in November 2025 as part of a leadership overhaul, with no specific cause cited in the SEC filing. The moves align with efforts to adapt to regulatory challenges tied to its WLFI token holdings and Trump family connections, ensuring stable governance amid scrutiny.

Why are Trump-linked crypto projects facing US regulatory heat?

Trump-linked crypto projects like WLFI are under fire due to concerns over conflicts of interest and national security risks from family involvement. Lawmakers have flagged potential sales to sanctioned countries, urging investigations to safeguard against influence peddling and ensure ethical practices in the crypto space.

Key Takeaways

- Executive Overhaul at ALT5 Sigma: Replacement of key leaders signals proactive management adjustments in response to external pressures.

- Regulatory Spotlight on WLFI: Scrutiny from US lawmakers highlights risks of political ties in crypto, impacting token performance.

- Strategic Implications: Firms must prioritize compliance and transparency to build trust in politically sensitive crypto treasuries.

Conclusion

The ALT5 Sigma leadership change and ongoing scrutiny of Trump-linked crypto projects like WLFI illustrate the evolving challenges at the nexus of politics and digital finance. As regulatory bodies demand greater accountability, these developments could shape future governance in the sector. Investors and stakeholders should monitor SEC updates closely, positioning themselves for informed decisions in this dynamic landscape.

Source: https://en.coinotag.com/alt5-sigma-overhauls-leadership-retains-trump-linked-wlfi-tokens-amid-scrutiny