XRP Supply Crunch? Binance XRP Reserve Collapses Sharply, But Something Else is Happening

- Binance’s XRP reserves have dropped sharply to 2.7B XRP, signaling strong accumulation by long-term holders.

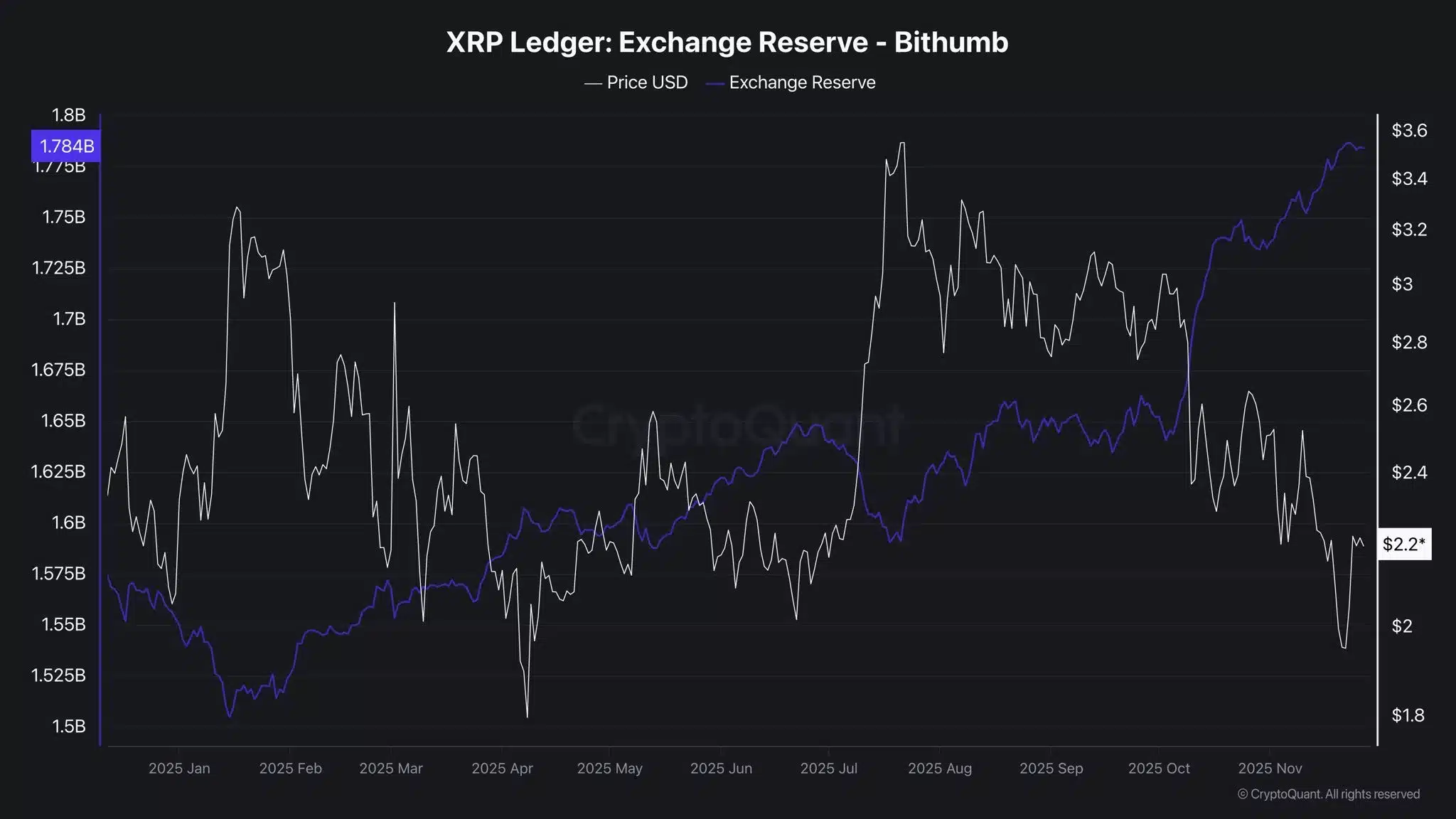

- However, Bithumb’s XRP reserves are increasing, showing that liquidity trends vary by region.

- With shrinking supply on major exchanges, growing ETF demand, and price stability around $2.20, analysts say XRP is nearing a critical inflection point.

XRP’s exchange supply on Binance has fallen sharply, signaling what analysts describe as intensified accumulation by long-term holders and institutional investors. The trend, which aligns with growing spot XRP ETF inflows, is adding new momentum to bullish expectations; however, data from other exchanges reveals a more complex global liquidity picture.

Binance XRP Reserves Fall to 2.7 Billion

New on-chain data shows Binance’s XRP reserves dropping to roughly 2.7 billion XRP, down significantly from the 3 billion XRP level in early October.

A CryptoQuant chart accompanying CryptosRUs’ update highlights a clear downward arc in reserves as the price hovered around $2.20. The decline marks one of the steepest drops in Binance-based XRP liquidity this year.

According to CryptosRUs, shrinking exchange balances typically signal that supply is being absorbed faster than it is being replenished. He notes that long-term holders and institutional buyers appear to be accumulating aggressively during XRP’s multi-month consolidation phase.

Also Read: XRP Forming Bullish Breakout Pattern Amid 80 Million Token Absorption – Here’s the Latest

Moreover, the reduction in reserves coincides with an increase in spot ETF activity. Spot XRP ETFs recorded more than $21.81 million in net inflows on Wednesday, according to Soso Value data, reflecting growing interest among asset managers and structured investment products.

Historically, XRP’s long consolidation periods followed by a squeeze above key moving averages have often preceded strong price movements. Analysts view the current supply drain on major exchanges as part of that pattern.

Something Else Happening: “Binance Isn’t the Whole Market”

In response to CryptosRUs’ interpretation, analyst Arthur offered important context: Binance’s data shows only part of the liquidity landscape. A chart shared by Arthur shows that Bithumb, the leading South Korean exchange, has seen rising XRP reserves even as Binance’s have fallen.

South Korea remains one of the highest-activity regions for XRP trading, making its reserve trends significant. Arthur explains that Binance reserves are collapsing, Bithumb reserves are increasing, and the price continues holding around $2.20. He adds that the next major move in XRP will be driven not by one exchange but by global liquidity across all major markets.

Source: Arthur/X

Converging Signals Point to a Critical Market Moment

The contrasting reserve patterns highlight the complexity of XRP’s market structure. While Binance shows aggressive accumulation and liquidity drain, Bithumb reflects a buildup of exchange supply, possibly from traders positioning for volatility or preparing for local demand surges.

Still, the broader combination of shrinking supply on the world’s largest exchange, increasing ETF inflows, an extended consolidation range, and XRP trading tightly near $2.20, suggests that XRP is approaching a decisive point.

Analysts remain divided on the immediate direction, but both snapshots, Binance’s rapid outflow and Bithumb’s rising reserves, indicate that global liquidity, not isolated exchange data, will determine XRP’s next major trend.

Also Read: Egrag Crypto Says XRP’s Next Move Won’t be Calm – See Key Targets

The post XRP Supply Crunch? Binance XRP Reserve Collapses Sharply, But Something Else is Happening appeared first on 36Crypto.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Fed Decides On Interest Rates Today—Here’s What To Watch For