XRP Reserves on Binance Drop to 2.7 Billion Tokens, Marking Multi-Year Lows

The post XRP Reserves on Binance Drop to 2.7 Billion Tokens, Marking Multi-Year Lows appeared first on Coinpedia Fintech News

According to the CryptoQuant Report, XRP reserves on Binance have dropped sharply to around 2.7 billion tokens, one of the lowest levels ever recorded. Since October 6, over 300 million XRP have been withdrawn from the exchange, signaling strong accumulation by long-term holders and institutional investors.

While some traders worry about the steep drop, cryptoquant analysts Darkfrost view it as a positive trend, as most withdrawals are moving into private wallets rather than being positioned for selling.

XRP is trading steadily around $2.17–$2.20, and the amount of XRP left on exchanges continues to shrink, which supports a stronger long-term outlook. The key level to watch is $2. As long as XRP stays above this level, the trend remains positive, and the structure looks healthy.

But if the price falls below $2, it could trigger another downward move before stabilizing again. Overall, the market is steady, and the lower supply adds to the long-term strength.

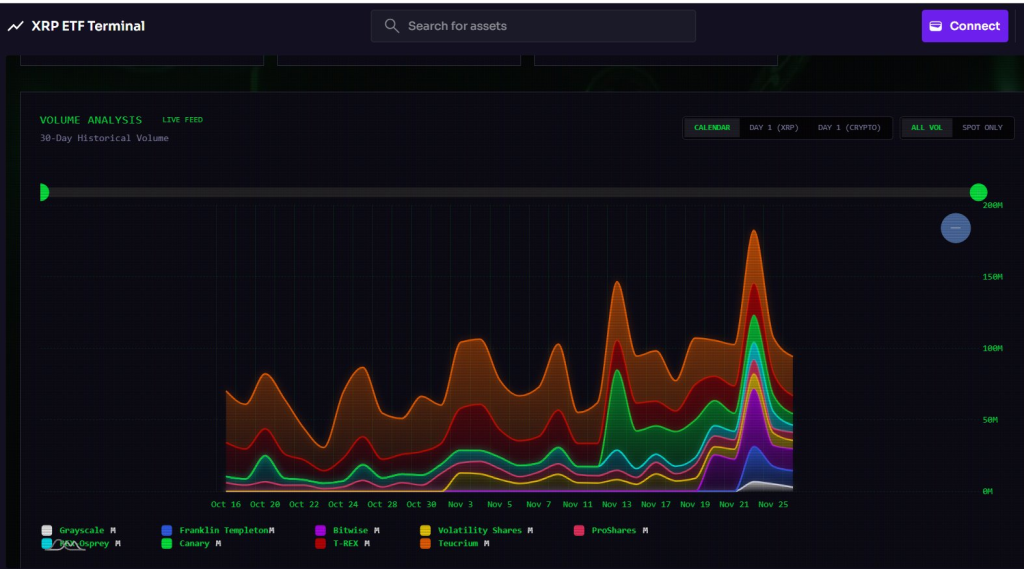

Currently, nine XRP ETFs are actively trading, mainly purchasing tokens through OTC or dark pools, which limits immediate impact on exchange prices. However, ETF inflows are steadily increasing, with reports of $73.9 million in one week and $89.3 million in another.

Four more ETFs are expected to be approved soon, potentially giving XRP more ETFs than Bitcoin. Low-fee ETFs like Franklin Templeton’s XRPZ and Canary Capital’s products are drawing more institutional investors.

At the same time, Ripple’s RLUSD is gaining traction in Abu Dhabi, where its ADGM approval and $1-billion market cap are helping build a regulated payment infrastructure.

- Also Read :

- What Would It Take for XRP Price to Reach $100?

- ,

These developments are gradually locking supply away from exchanges and increasing long-term holding pressure.

Market Implications and Outlook

Shrinking exchange reserves combined with strong ETF inflows indicate that long-term holders and institutions are absorbing available XRP faster than it returns to the market.

Historically, long consolidation periods followed by accumulation and shrinking supply have been precursors to strong price moves. With liquidity shifting across exchanges, institutional demand rising, and sell pressure on Binance falling, XRP’s market structure is tightening. This increasing supply squeeze could lead to a strong price move once demand accelerates.

While Binance shows collapsing reserves, Bithumb in South Korea, the country among the most active for XRP trading, reports rising holdings, highlighting differing liquidity trends across global exchanges.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

XRP reserves are falling because more tokens are moving to private wallets, showing long-term accumulation and reduced short-term selling pressure.

Yes. Lower exchange supply often strengthens long-term price outlooks by reducing sell pressure and increasing the impact of future demand.

XRP ETFs buy mainly through OTC channels, limiting price swings, but growing inflows steadily tighten supply and boost long-term demand.

More ETFs, rising OTC purchases, and expanding payment use cases like RLUSD are attracting institutions and reducing available market liquidity.

You May Also Like

Institute of Museum and Library Services Awards $4.1 Million to Support the Trump AI Action Plan

Unprecedented Surge: Gold Price Hits Astounding New Record High