[Weekly funding roundup Nov 22-28] Debt funding grows amid startup ecosystem challenges

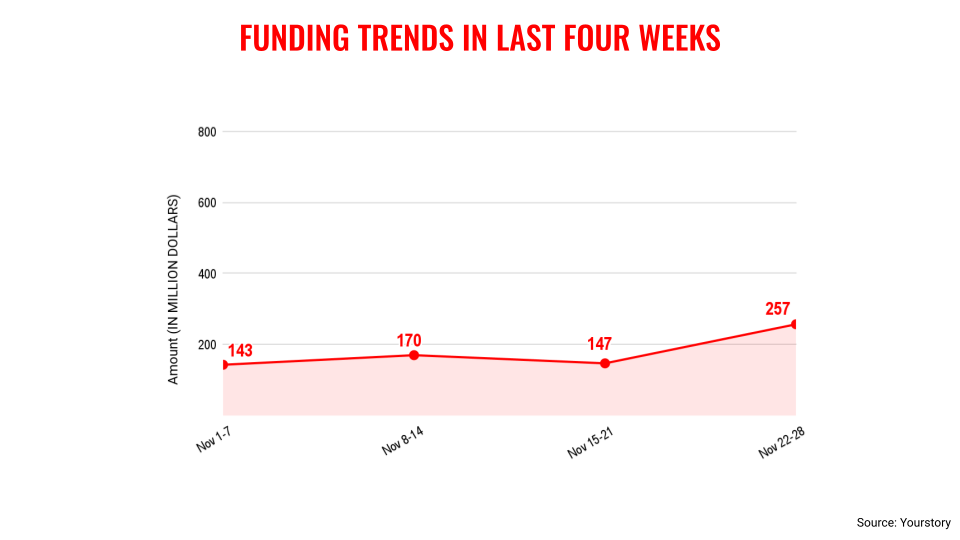

The last week of November saw a marginal increase in venture capital (VC) inflow into Indian startups, with the debt funding emerging as the largest contributor.

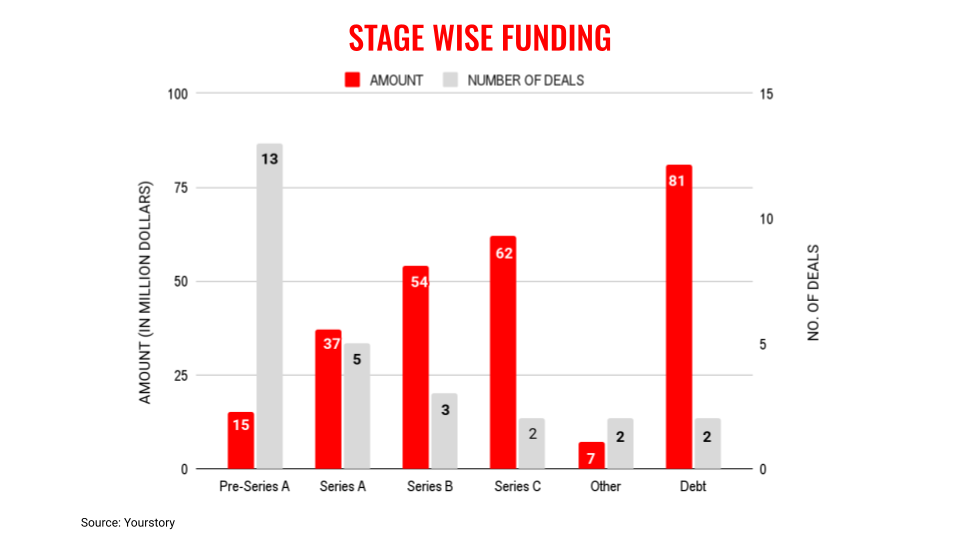

The total VC funding for the week was $257 million across 27 deals. In contrast, the previous week saw a total amount of $147 million. Interestingly, startups raised $81 million in debt, signalling challenges in fundraising.

During this week, deals happened across all stages of funding, starting from pre-Series A to C. However, it was the debt component that gained attention, and this shows that even private banks are willing to bet on these new-age companies.

However, the month of November has not been uplifting for the Indian startup ecosystem, as VC funding was below the $200 million. This comes after a good month of October, where the total funding raised was $1.6 billion.

This actually shows that it is very unlikely that total VC funding raised by Indian startups in 2025 is unlikely to cross the figure of $13.2 billion of 2024. Hope now remains with the new year of 2026.

Key transactions

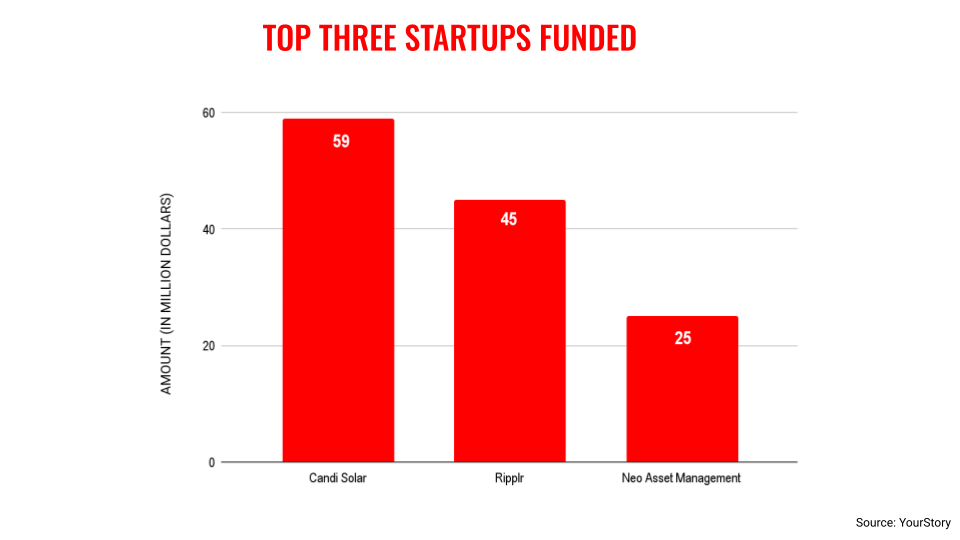

Candi Solar raised $58.5 million in debt from the International Finance Corporation.

Supply and distribution tech startup Ripplr, raised $45 million from existing investors and SBI.

Technology startup CloudExtel raised Rs 200 crore ($22.3 million approx.) in debt from a private-sector bank.

Spacetech startup Agnikul Cosmos raised $17 million from Advenza Global, Atharva Green Ecotech LLP, HDFC Bank, Artha Select Fund, Prathithi Ventures, and 100X.VC.

Wealthtech startup Wealthy.in raised Rs 130 crore ($14.5 million approx) from Bertelsmann India, Alphawave Global, Shepherd's Hill, and angel investors.

OYO parent PRISM-backed OYO Assets raised Rs 125 crore ($14 million approx.) from a group of institutional and private investors.

EV startup 3ev Industries raised Rs 120 crore ($13.4 million approx.) from Mahanagar Gas Ltd, Equentis Angel Fund and Thackersey Group.

Deeptech startup LightSpeed Photonics raised $6.5 million from pi Ventures, 500 Global, Indian Accelerator, 8X Ventures, Java Capital, and angel investors.

Toy tech startup Mirana Toys raised Rs 57.5 crore ($6.4 million approx.) from Arkam Ventures, Accel, Info Edge, and Riverwalk Holdings.

Tech startup Tijori Finance raised $5 million from Zerodha.

Healthtech startup Morphle Labs raised $5 million led by Inflexor Ventures.

Edited by Affirunisa Kankudti

You May Also Like

Vitalik Buterin Reveals Ethereum’s Long-Term Focus on Quantum Resistance

World Bank backs Turkish women and youth with SME funding