ADA Price Prediction For December: Is Cardano Set for a Breakout or Another Sideways Month in December?

Cardano price is heading into December 2025 with a split personality. On-chain activity appears calm, but traders in the ADA/USD derivatives market remain restless.

As November wraps up, ADA itself is trading near $0.41, and the question is simple: will December bring a breakout, or will price continue to drift sideways? Here’s an ADA price prediction for December.

Cardano remains one of the world’s top 15 cryptocurrencies by market value. It is widely traded on major exchanges and closely followed because of its large staking base and loyal developer community.

DISCOVER: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

What Does Rising Open Interest Say About ADA Price Short-Term Risk?

Data from CoinGecko shows ADA hovering around $0.414 over the past 24 hours.

The token is up about +1% on the day, moving in a narrow range between roughly $0.413 and $0.422. Spot trading volume sits above $540M.

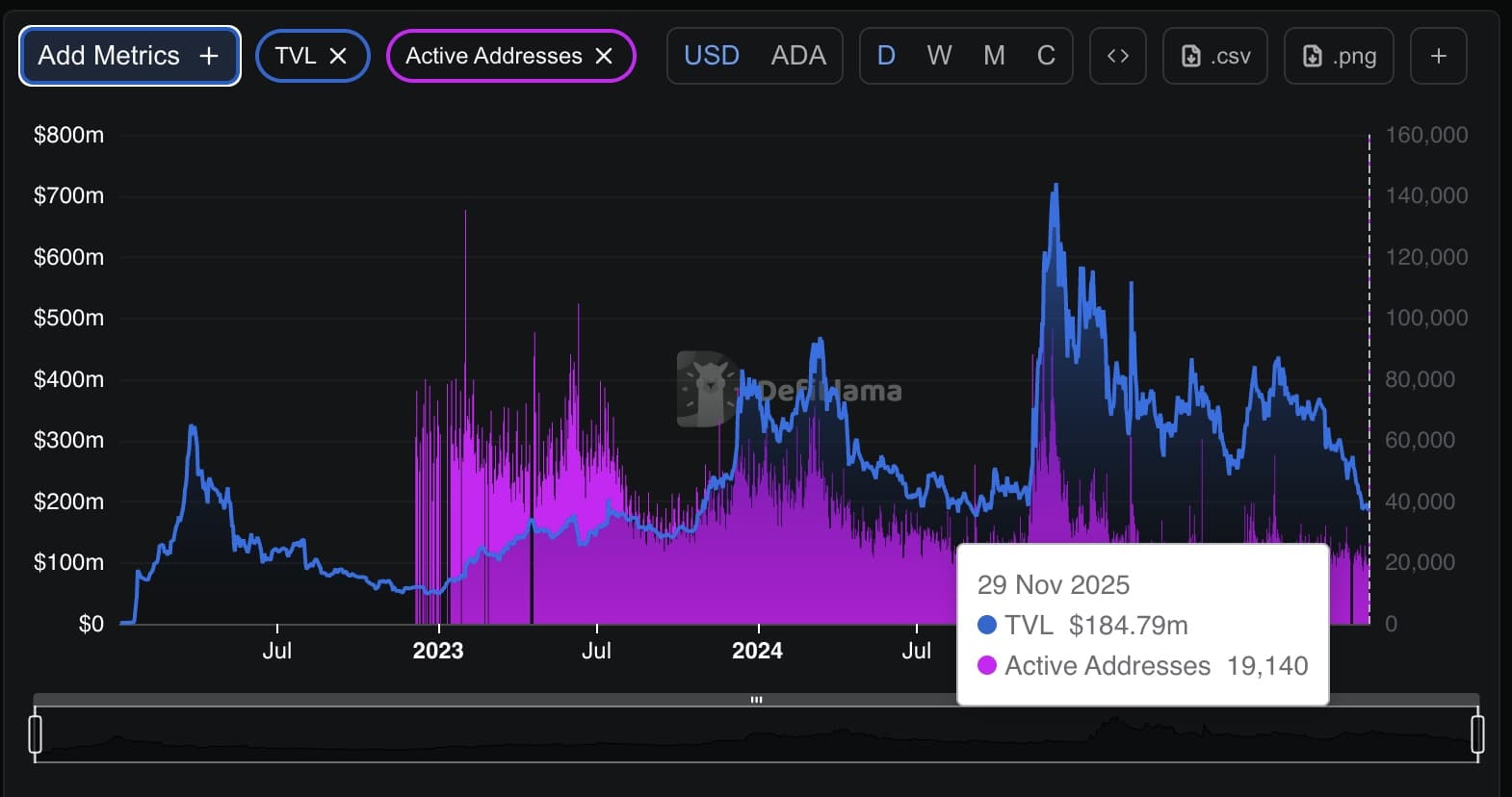

On-chain numbers tell a similar story. Activity is steady, not booming. DeFiLlama reports about $185Mlocked across.

(Source: DefiLlama)

(Source: DefiLlama)

Cardano’s DeFi services with no major change on the day. DEX trading volume is around $1.8M. Stablecoin supply sits close to $40M.

Roughly 19,000 active addresses were recorded in the last 24 hours. That points to a loyal user base, but no surge in fresh demand.

Derivatives are painting a much louder picture than spot markets right now. Data from Coinglass shows ADA futures logged about $670M in 24-hour volume.

(Source: Coinglass)

(Source: Coinglass)

Spot trading, by contrast, came in near $76M. Open interest is also high, sitting close to $735M.

That gap suggests most action is coming from short-term traders using leverage, not long-term buyers building positions.

For December, the base case keeps ADA moving sideways between $0.38 and $0.48. A daily hold above $0.45 could push the price toward the $0.50 to $0.55 range. But if support at $0.40 breaks, price could slide into the mid-$0.30s.

DISCOVER: 20+ Next Crypto to Explode in 2025

ADA Price Prediction: Is Cardano Really Trading at the Same Price as in 2017?

Meanwhile, a chart circulating on X has reignited an old debate about Cardano’s long-term returns. An analyst flagged that ADA is trading near the same zone it reached in late 2017.

The chart tracks the price from December 2017 to now. It shows ADA back near the $0.41 to $0.42 band.

That area marked the first major breakout cycle eight years ago. Now it’s back in focus after two full market cycles.

In between, ADA ran into a steep 2021 peak, then sank through a tough 2022 downturn. The last year brought mostly sideways movement. And that’s why this level feels important again.

(Source: X)

(Source: X)

In 2024, Cardano’s price moved up again, but the recovery did not last. The rally stalled before turning into a real uptrend.

By early 2025, the chart shows a series of lower highs. Price is now slipping back toward a flat support area that has held several times before.

Momentum has cooled, and recent candles show buyers are losing control.

“$ADA is at the same level it was 8 years ago,” the analyst wrote. He said the chart shows just how little progress the token has made after years of trading, despite multiple market cycles.

From a technical view, Cardano remains stuck in a wide range. There is no clear breakout in sight. Volume is thin, and resistance near the 2024 highs has not been tested again.

Until that zone is cleared with strong buying, the market looks more like it is moving sideways than preparing for a new trend.

EXPLORE: What is MegaETH (MEGA): A Beginner’s Guide

The post ADA Price Prediction For December: Is Cardano Set for a Breakout or Another Sideways Month in December? appeared first on 99Bitcoins.

You May Also Like

Moldova to regulate cryptocurrency ownership and trading in 2026

Disney Pockets $2.2 Billion For Filming Outside America