Bitcoin Mining Difficulty May Increase Amid Record Low Hashprice

- The hashprice remains near its lows.

- The difficulty of mining bitcoin is preparing for a new increase, which may complicate the situation for miners.

- The latter run the risk of operating at a loss if the hash rate is below $40 PH/s.

The difficulty of bitcoin mining may increase in December 2025, despite the recent decline, while the hash price remains near historic lows.

According to CoinWarz, the next difficulty adjustment is expected on December 10 at block 927,360, where the difficulty may increase from 149.30 trillion to 154.72 trillion at the time of writing.

Bitcoin’s next difficulty adjustment. Data: CoinWarz.

Bitcoin’s next difficulty adjustment. Data: CoinWarz.

The previous adjustment, which took place on November 27, reduced the complexity from 152.2 trillion to 149.3 trillion, which ensured an average block mining time of about 9.97 minutes, slightly faster than the target of ten minutes.

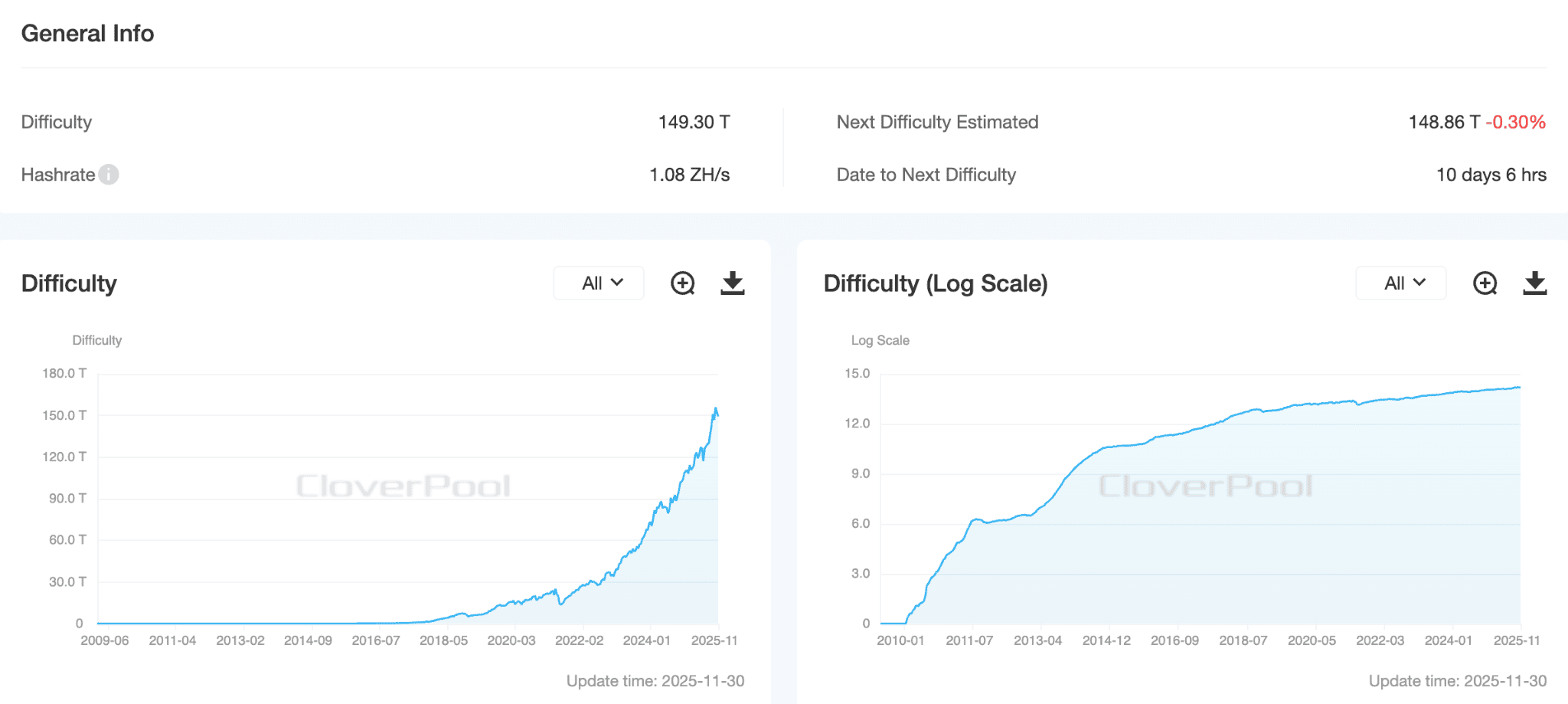

Bitcoin mining difficulty and network hash rate. Data: CloverTool.

Bitcoin mining difficulty and network hash rate. Data: CloverTool.

Despite the decrease in difficulty, the hashprice index, which reflects the expected profitability of miners per unit of power, remains at extremely low levels.

According to the Hashrate Index, it stands at around $38.6 per PH/s per day at the time of writing, recovering from a low of below $35 recorded on 21 November. For comparison, the $40 PH/s level is considered the break-even point, the limit beyond which miners must decide whether to “de-energize” their equipment or continue to operate.

As a reminder, the mining industry continues to face several challenges, including bitcoin miners’ debt of $12.7 billion over the past 12 months, which has increased by 500%, potential taxation of mining companies in New York, and geopolitical tensions between the US and China that could affect the supply chain of equipment.

Meanwhile, China has regained its third place in the global ranking in terms of hash rate, which was over 14% in Q4 2025.

You May Also Like

Morning Crypto Report: 'I Am Capitulating': What's Vitalik Buterin Talking About? Bitcoin Quantum Threat Drama Gets 20,000 BTC Twist, Cardano out of Top 10 as Bitcoin Cash Wins Back 25% of BCH Price

Pi Network Users Criticize Core Team After Celebratory Post