First Yield-Generating Avalanche (AVAX) ETF By Bitwise Moves Ahead

-

Bitwise and VanEck now lead competing Avalanche (AVAX) ETF bids, including a staking-yield fund.

-

AVAX price slipped around one dollar in 24 hours despite the ETF headlines.

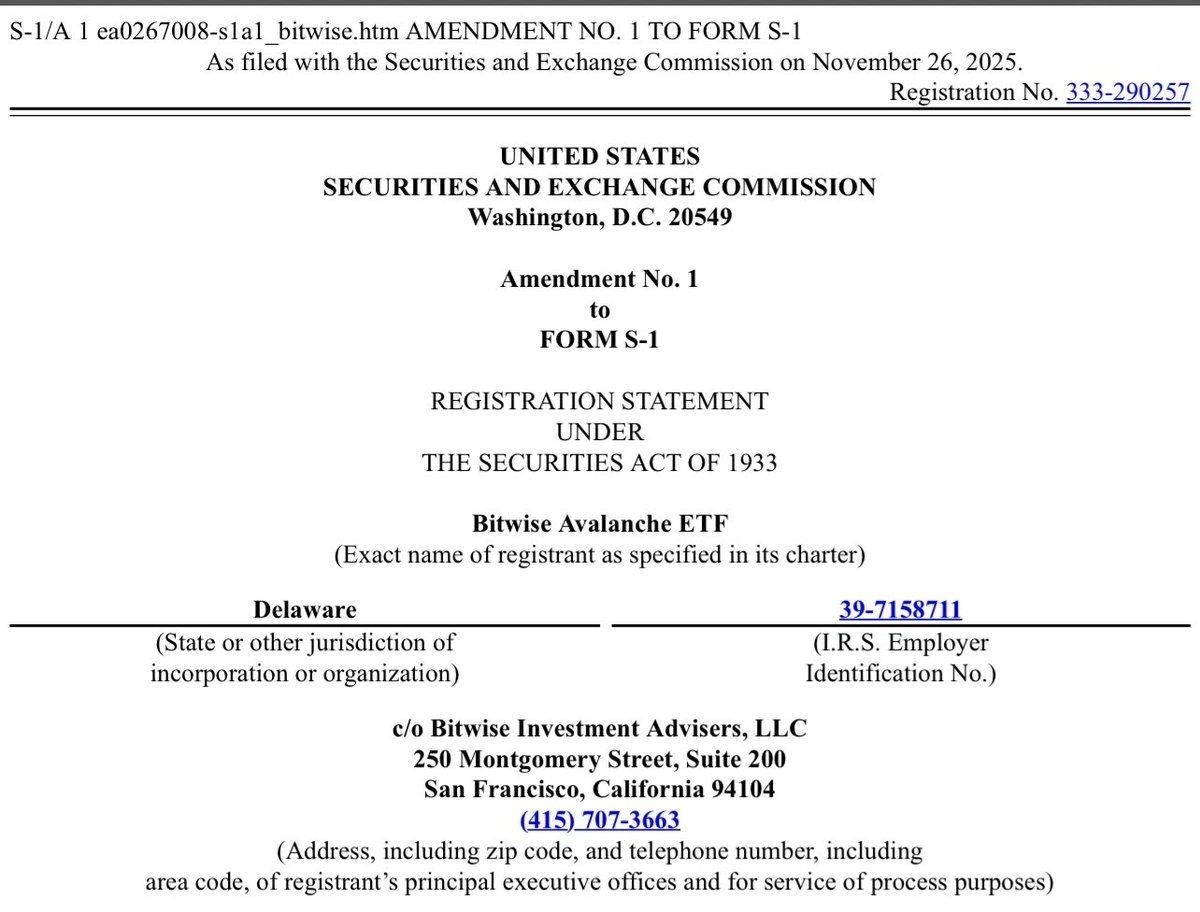

Bitwise Investment Advisers has moved to launch what could become the first U.S. Avalanche ETF that passes on staking yield to shareholders. In an amended Form S-1 filed with the Securities and Exchange Commission on Nov. 26, 2025, the firm updated plans for the Bitwise Avalanche ETF, which would trade under the ticker BAVA if approved.

Source: X

Source: X

Under the new structure, the fund may stake up to 70 percent of its AVAX holdings to earn on-chain rewards. Those rewards would flow back to investors after Bitwise deducts a 12 percent operational fee, according to details circulated by market commentators. The filing positions BAVA as an income-focused crypto product rather than a pure price-tracking vehicle.

At the same time, Bitwise is pitching the ETF as a low-cost option in the Avalanche segment. The management fee is set at 0.34 percent per year, below the 0.40 percent charged by VanEck’s AVAX product and the 0.50 percent fee on Grayscale’s fund. That gap gives Bitwise room to argue for a cost advantage even as it layers staking returns on top.

Bitwise is targeting a launch in the first quarter of 2026, subject to SEC clearance of the amended registration statement and the exchange’s listing process.

Nasdaq Advances VanEck Avalanche ETF Toward SEC Decision

On April 10, 2025, Nasdaq filed a Form 19b-4 rule-change request with the U.S. Securities and Exchange Commission to list the VanEck Avalanche (AVAX) spot ETF, as previously mentioned in our report, about a month after VanEck first lodged its S-1 registration statement in mid-March. Shortly after the exchange’s move, commentator Andres Meneses highlighted the development on X, noting that an AVAX ETF could soon trade on Nasdaq as part of the broader shift bringing crypto products onto traditional markets.

Meanwhile, senior Bloomberg ETF analyst James Seyffart said the market broadly expects both Avalanche and Dogecoin spot ETFs to secure approval. According to Seyffart’s timeline, the SEC could clear the VanEck Avalanche ETF by the end of December 2025, while a DOGE product might receive a decision around mid-October. The filing adds Avalanche to the growing queue of altcoin ETF proposals following the 2024’s launches of spot Bitcoin and Ethereum funds.

AVAX dropped from around $14 to about $13 over the past 24 hours, with most of the slide hitting overnight. After a relatively steady session earlier in the day, the token saw heavy selling that pushed the chart deep into the red.

]]>You May Also Like

Will Bitcoin Make a New All-Time High Soon? Here’s What Users Think

SWIFT Tests Societe Generale’s MiCA-Compliant euro Stablecoin for Tokenized Bond Settlement