Bitcoin and Ethereum Closed November with the Lowest Drop since 2018

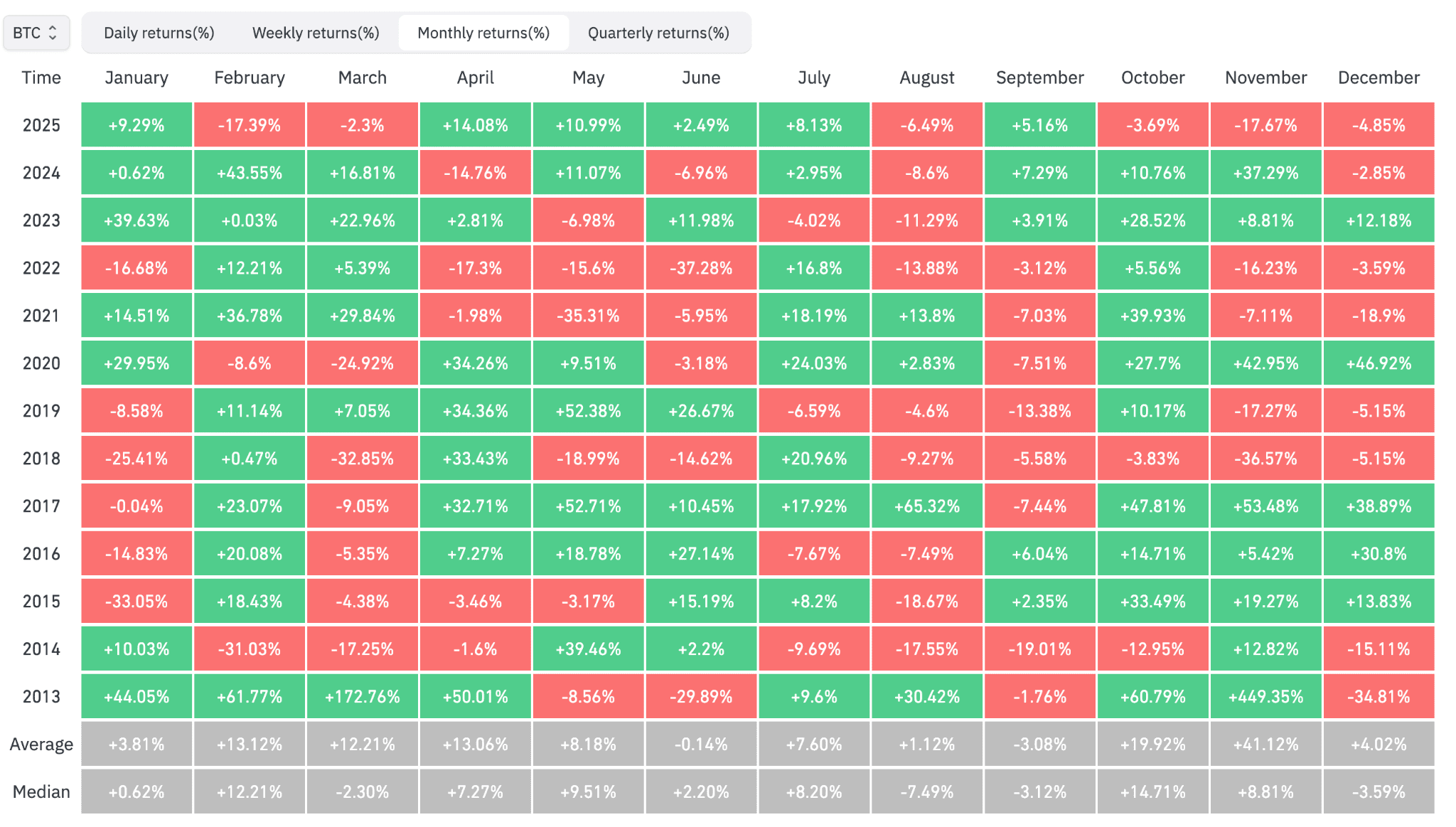

- Over the month, the value of bitcoin fell by 17.67%.

- Thus, November was a negative month for the first cryptocurrency with the lowest value since 2018.

- At the same time, Ethereum showed an even bigger drop — by 22.38%.

Bitcoin ended November 2025 with a drop of 17.67%, continuing the negative trend from last month. This decline characterizes the month as the worst for the asset compared to previous years, with the negative value being even lower in 2018. Meanwhile, Ethereum showed a 22.38% decline, closing the month in the red for the third time in a row.

Bitcoin’s profitability by month. Source: CoinGlass.

Bitcoin’s profitability by month. Source: CoinGlass.

November was unfavourable for the first cryptocurrency. The asset closed the month with a drop for the fifth time in its history.

On November 21, the price of bitcoin fell below $81,000.

On November 27, the asset recovered to almost $92,000, as the market expects the US Federal Reserve to cut interest rates.

At the time of writing, bitcoin is trading at $86,516, according to TradingView.

Daily chart of BTC/USDT on Binance. Source: TradingView.

Daily chart of BTC/USDT on Binance. Source: TradingView.

Against the backdrop of volatility, experts are divided on the prospects of the asset:

- CryptoQuant CEO Ki Young Ju noted that the bull cycle ended after bitcoin reached $100,000, and whales with a balance of more than 1000 BTC continue to sell the asset

- BlackRock considers bitcoin to be a means of preserving value

- Fundstrat co-founder Tom Lee predicted that bitcoin’s value will be fixed above $100,000 by the end of 2025

At the same time, Ethereum fell by 18.78% in November, showing a negative trend for the third month in a row. Historically, November has often ended with growth for the second-largest cryptocurrency by market capitalization, so this year’s result has leveled the playing field.

Ethereum’s profitability by month. Source: CoinGlass.

Ethereum’s profitability by month. Source: CoinGlass.

At the time of writing, the price of Ethereum was $2,841:

Daily chart of ETH/USDT on Binance. Source: TradingView.

Daily chart of ETH/USDT on Binance. Source: TradingView.

Earlier, we wrote that Texas invested $10 million in bitcoin for the first time amid a drop in its value, and the largest corporate owner of Ethereum, BitMine, bought 14,618 ETH worth $44.3 million.

You May Also Like

Subaru Motors Finance Reviews 2026

Shiba Inu Price Prediction: Dubai Cracks Down on KuCoin as Pepeto Outpaces DOGE and SHIB With $7.4M Raised

![[Two Pronged] Teen daughter hates father for cheating and won’t respect him](https://www.rappler.com/tachyon/2026/03/two-pronged-daughter-mad-at-father.jpg)