Bank of Japan Dec. 18 Rate Decision Looms as Crypto Liquidations Hit $643M

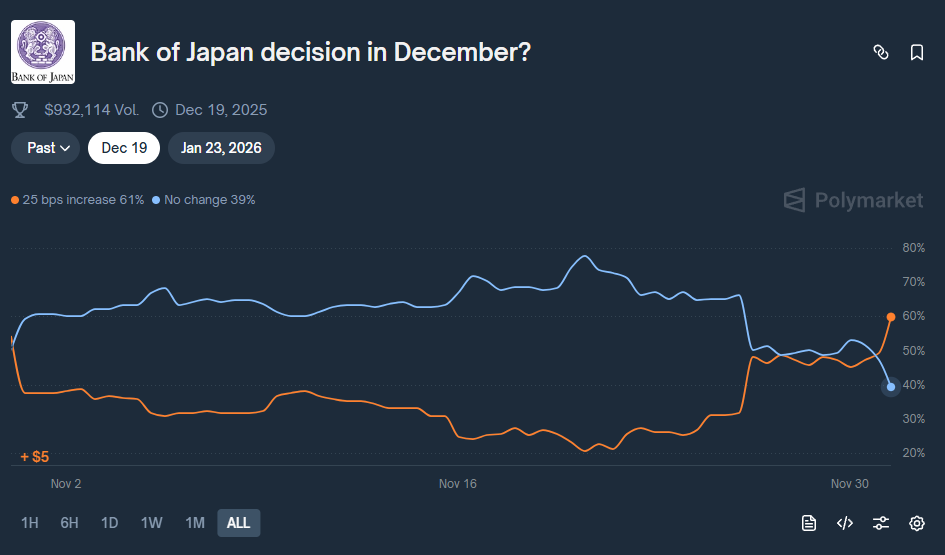

The Bank of Japan meets Dec. 18-19 to decide on interest rates. Prediction markets put the odds at 57% for a rate increase, according to Polymarket.

Bitcoin BTC $85 467 24h volatility: 6.5% Market cap: $1.71 T Vol. 24h: $69.67 B and other crypto face potential volatility. Governor Kazuo Ueda said the BOJ is “actively collecting information regarding firms’ stance toward raising wages” ahead of the Dec. 18-19 meeting, according to a Dec. 1 speech to business leaders in Nagoya. The central bank’s current rate stands at 0.5%.

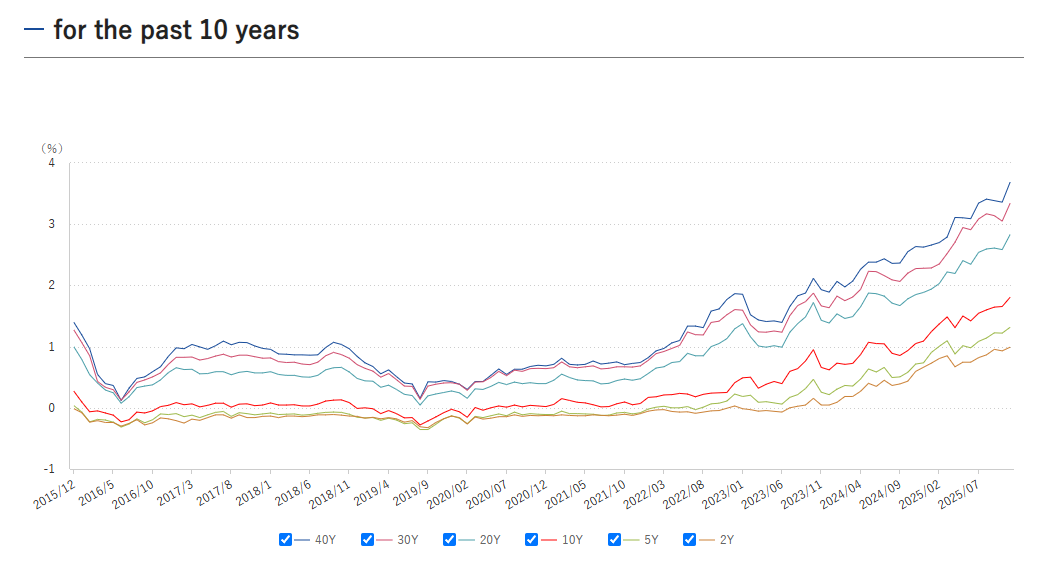

Markets reacted immediately. Crypto liquidations (forced closures of trading positions) hit $643 million on Dec. 1, according to CoinGlass. The liquidations affected 218,844 traders. Bitcoin dropped 5.2% to $86,062. Ethereum fell 5.4% to $2,826. The sell-off came as Japan’s 10-year government bond yield jumped to 1.86% on Dec. 1, its highest since April 2008.

Graph showing the yield rates of Japanese Bonds for the past 10 years Credit: jbts.co.jp

Long positions (bets on rising prices) made up $567 million of the liquidations. Shorts (bets on falling prices) were only $69 million. Bitcoin accounted for $186 million in forced closures. Ethereum represented $138 million. The breakdown shows most traders were positioned for price gains when the sell-off hit.

Liquidation heatmap and data showcasing $636M in liquidations in the past 24 hours. Credit: Coinglass

Bitcoin had rebounded 17% from $82,000 lows through late November, as previously reported by Coinspeaker. That rally left many traders in leveraged positions (using borrowed money to amplify bets).

Yen Carry Trade Under Pressure

Rising Japanese rates threaten the yen carry trade that has funded global risk assets for decades. Investors have borrowed yen at near-zero interest rates to buy higher-yielding assets like US stocks, European bonds, and crypto. If Japanese rates rise and the yen strengthens, the trade stops working. Investors will have to unwind positions.

Crypto liquidations topped $1.33 billion in November during an earlier deleveraging event. The Dec. 1 episode shows the pattern continuing.

Polymarket screenshot showcasing a chart with two lines tracking the % chance based on bets for 25 bps increase at 61% and no change at 39%. Credit: Polymarket

Polymarket odds shifted from roughly 50% before Ueda’s speech to 57% after. Markets price a 40% chance the BOJ holds rates steady. The central bank already doubled rates from 0.25% to 0.5% in January. A December move would be the second hike this year.

The USD/JPY exchange rate traded at 156.58 as of Nov. 21. When it approaches 160, Japanese authorities sometimes intervene to support the currency. Further yen strength after a rate hike would pressure more carry trade unwinding and hit leveraged crypto positions.

nextThe post Bank of Japan Dec. 18 Rate Decision Looms as Crypto Liquidations Hit $643M appeared first on Coinspeaker.

You May Also Like

Pump.fun CEO to Call Low-Cap Gem to Test New ‘Callouts’ Feature — Is a 100x Incoming?

This U.S. politician’s suspicious stock trade just returned over 200% in weeks