SUI Price Analysis, DEC 1st: $82M Unlock Hits Market Today

The post SUI Price Analysis, DEC 1st: $82M Unlock Hits Market Today appeared first on Coinpedia Fintech News

SUI Price today is facing fresh market pressure as $82.81 million worth of tokens are set to be unlocked on December 1, adding new liquidity during a period of already weak buying activity. While the unlock represents a small percentage of the total supply, it is still enough to influence short-term sentiment.

SUI Price Today

| Price | $ 1.34921031 |

| Market Cap | $4.94B |

| Circulating Supply | 3.68B SUI |

Currently, SUI Price is hovering around $1.50, caught in a tight range after multiple failed attempts to break the $1.58–$1.60 resistance zone. Buyers are defending $1.48, keeping the price structure intact, but momentum is fading.

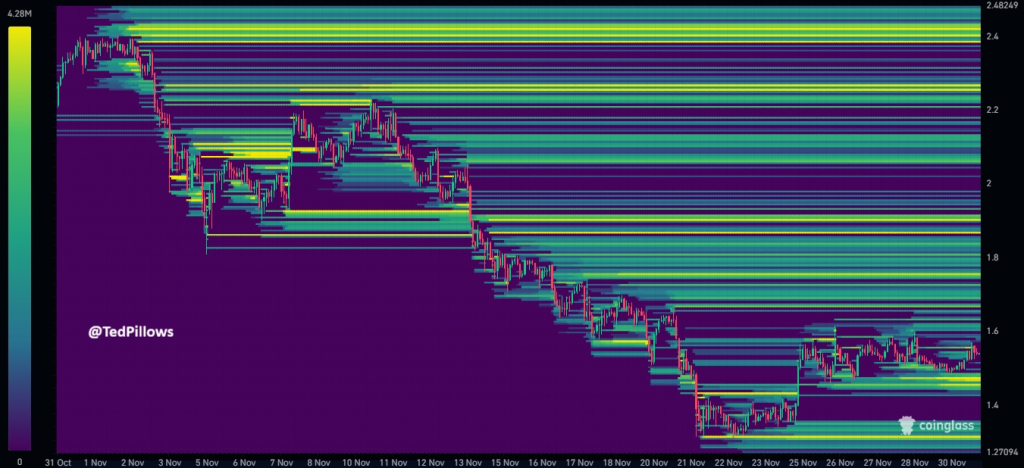

According to analyst Ted Pillows, SUI has good liquidity above, but selling could trigger long liquidations around $1.40–$1.50. Historically, December is often bullish, and BTC tends to rise after Thanksgiving. If this happens again, SUI could see a strong upward move.

Until bulls can push a clean breakout above resistance, SUI is likely to continue chopping between these levels, building pressure for its next major move.

SUI is showing a mild recovery, but the overall trend remains soft. The token is still far below its yearly peak of $5.35, leaving long-term upside potential if momentum returns.

SUI Price Technical View

SUI is currently trading inside a descending channel on the 1-hour chart, with the price recently touching the lower boundary and attempting to move upward. The key support sits at $1.33, a level where the token has bounced multiple times, making it an important zone for buyers to defend.

The RSI is also near its lower range, signaling that a short-term rebound is likely. At the same time, SUI is consolidating close to the 100-period moving average, which supports the possibility of an upward move if momentum strengthens.

A break above the descending channel could trigger a retest of the upper boundary and open the door toward the $1.58 resistance level.

The broader market is showing a risk-off shift. Bitcoin dominance has risen to 58.73%, as investors rotate out of altcoins. Bitcoin miners are selling $172 million worth of BTC, putting additional pressure on altcoins like SUI.

The Fear & Greed Index is at 20, indicating cautious market sentiment. A decisive hold above $1.37 is crucial for any bounce. If Bitcoin slips below $81,600, SUI could retest $1.20.

- Also Read :

- SUI Price Analysis, DEC 1st: $82M Unlock Hits Market Today

- ,

Fundamental Updates

The upcoming Coinbase SUI futures launch on December 5 could drive short-term interest and liquidity. Meanwhile, the gaming ecosystem and Sui Kiosk adoption continue to grow, supporting long-term fundamentals. Traders may look for accumulation near support zones while monitoring BTC and overall market trends for confirmation of a rebound.

Capital inflow into SUI is still unstable. Without strong buying pressure, the price may continue sideways or drop back to key support levels.

SUI remains under pressure from new supply and weak capital inflows, but strong fundamentals and ecosystem growth keep it on the radar. Price action at $1.33 support and $1.58 resistance will guide the next major move.

FAQs

SUI faces pressure from $82.81M in unlocked tokens, weak buying activity, and overall altcoin weakness as Bitcoin dominance rises.

December is historically bullish, and a Bitcoin rally could help SUI rebound if it holds support and gains momentum above resistance.

Coinbase SUI futures launch on December 5 and ongoing ecosystem growth may boost liquidity and interest, impacting short-term price action.

You May Also Like

Pressure Builds on ADA Despite Cardano’s Bold Behind-the-Scenes Push ⋆ ZyCrypto

Pi Network Bank: Pioneering a Human-Centric Financial Revolution in Crypto

In the ever-evolving world of web3 and Crypto, Pi Network is taking a bold step forward. A recent announcement shared by @Fle