Bitcoin Price Plunges 8% to $84,000 as December Opens With More Market Jitters

Bitcoin Magazine

Bitcoin Price Plunges 8% to $84,000 as December Opens With More Market Jitters

Bitcoin price fell sharply to the mid-$84,000s early Monday, sliding 8% over the past 24 hours as a wave of macro anxiety, thin liquidity and fresh crypto-native stress hit markets simultaneously.

The world’s largest digital asset traded between a 24-hour high of $91,866 and a low of $84,722, extending a two-month drawdown that has now erased more than 30% from October’s record highs, according to Bitcoin Magazine Pro data.

The downturn marks a swift reversal from last week’s tentative recovery. After plunging below $81,000 on Nov. 21, the Bitcoin price steadily climbed into the end of November and briefly pushed above $92,500 during Black Friday’s morning session.

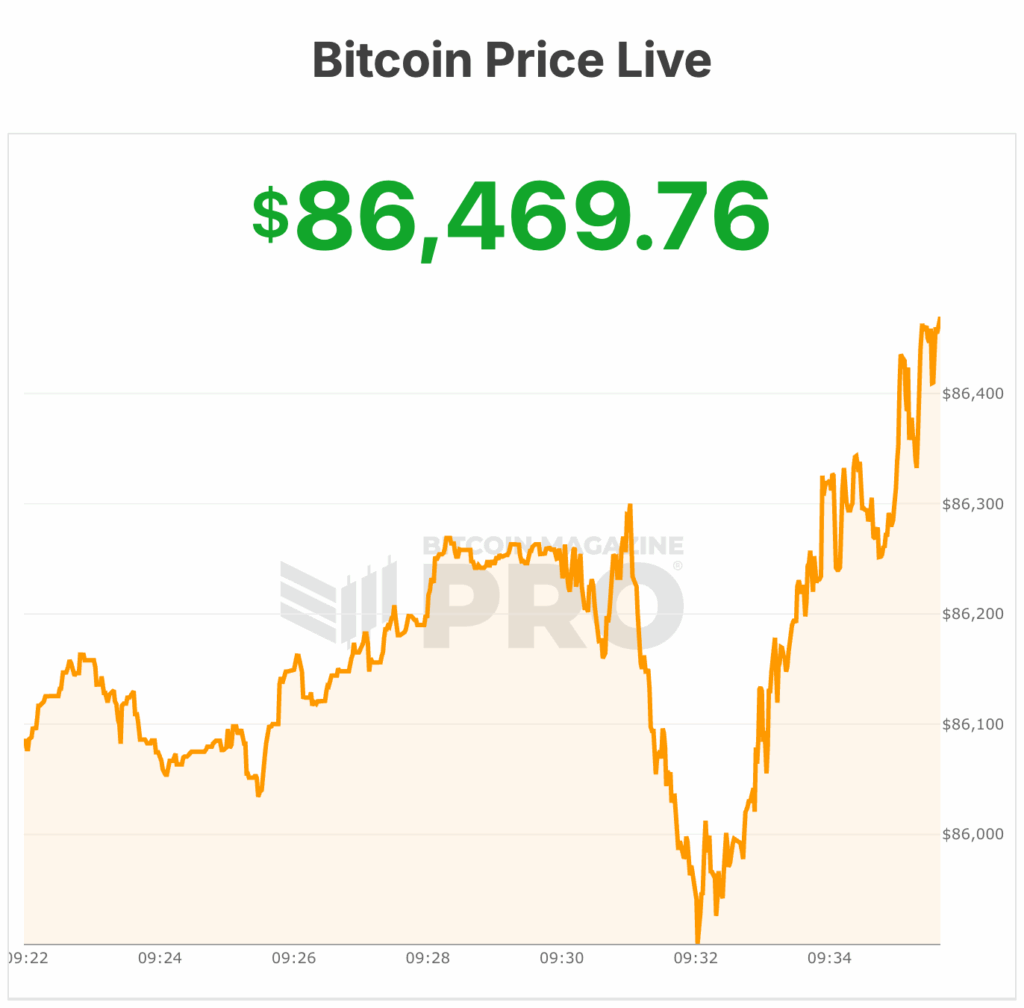

But momentum reversed again Sunday evening, with BTC slipping back below $85,000 early Monday. At the time of writing, the bitcoin price is $86,469.

Why is Bitcoin price dipping?

Multiple forces might be behind the renewed selloff. The most immediate shock could be from a security incident at Yearn Finance, where a flaw in the protocol’s yETH pool allowed an attacker to mint an abnormally large amount of tokens.

The exploit flooded the pool with invalid supply and triggered a rush for the exits across DeFi — spilling over into majors like BTC and ETH.

But macro pressure has been building in parallel. A sharp spike in Japanese government bond yields — part of a broader global repricing of interest-rate expectations—sparked a risk-off move in Asia trading hours, hitting an already fragile, low-volume crypto market.

Comments from Bank of Japan Governor Kazuo Ueda signaled the possibility of a December rate hike — an event that would be Japan’s first move away from negative interest rate policy in years.

The remarks sent Japan’s 30-, 10-, and 2-year government bond yields to their highest levels since 2008. A stronger yen could force hedge funds that borrow cheaply in Japan to unwind carry trades, adding fresh pressure to bitcoin and other risk assets.

According to 10x Research, last week marked one of the lowest-liquidity stretches since July, leaving order books thin and amplifying the impact of institutional selling.

The result was a deeper drawdown than fundamentals alone might suggest. Bitcoin’s market depth evaporated over the weekend, turning what might have been a modest correction into a full-scale liquidity event.

More than 220,000 traders were liquidated over 24 hours, with total losses exceeding $630 million.

The derivatives picture underscores the imbalance: Bitcoin price futures open interest fell by $1.1 billion leading into the decline, suggesting traders had already started de-risking.

Monetary policy uncertainty remains at the center of investors’ anxiety. Markets now assign an 80%–87% probability that the Federal Reserve will cut rates by 25 basis points at its Dec. 9–10 meeting.

Rate cuts would be supportive for the Bitcoin price, boosting liquidity and risk appetite. But if the Fed opts to hold steady, traders fear a sharper unwind across risk assets.

Corporate developments added another wrinkle. Strategy Inc. (formerly MicroStrategy) said Monday it created a $1.4 billion reserve—funded by common-stock sales—to cover at least 21 months of preferred-stock dividend payments amid Bitcoin’s slide.

The company, which now holds 650,000 BTC, also reported purchasing another 130 BTC last week for $11.7 million.

Last week, fresh disclosures showed BlackRock ramping up its exposure to its own spot Bitcoin ETF while JPMorgan rolled out a high-stakes structured note tied to the fund.

Bitcoin price briefly dipped to $86,129 before rebounding above $90,300 amid ongoing Q4 volatility. BlackRock’s Strategic Income Opportunities Portfolio now holds 2.39 million IBIT shares worth $155.8 million, up 14% from June, signaling deeper internal allocation to BTC-linked assets.

Meanwhile, JPMorgan’s new derivative-style note lets institutions bet on IBIT’s future price, offering a 16% fixed return if targets are met next year, and up to 1.5x upside by 2028 if Bitcoin surges.

At the time of writing, the bitcoin price is rebounding up to $86,469.

This post Bitcoin Price Plunges 8% to $84,000 as December Opens With More Market Jitters first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

Once Upon a Farm Announces Pricing of Initial Public Offering

US Senate Ag Committee Chair Reveals Crucial Progress On CLARITY Act