Changpeng Zhao-backed YZiLabs launches boardroom coup at BNB treasury firm BNC

Changpeng Zhao–backed YZiLabs has launched an activist campaign to seize control of CEA Industries, now known as BNB Network (ticker BNC), just months after helping bankroll the company’s $500 million PIPE and its pivot into a leading BNB corporate treasury.

In a preliminary Schedule 14A filed Monday, the firm moved to expand the board, unwind any recent bylaw changes, and install its own slate of directors through a written-consent process. If a majority of outstanding shares sign on, the proposals would effectively hand control of the BNB-focused treasury company to Zhao’s family office without a shareholder meeting.

The coup attempt comes only months after the company was being pitched as the largest publicly traded BNB treasury in the United States.

BNB Network — formerly CEA Industries, a nicotine-vape manufacturer — surged more than 600% in July after 10X Capital and YZiLabs led an upsized private placement that included $400 million in cash and $100 million in crypto. Leadership installed during the PIPE, including CEO David Namdar and former CalPERS CIO Russell Read, framed the pivot as a way to give institutions long-term, transparent exposure to the Binance-linked ecosystem.

YZiLabs now argues the rollout has stumbled.

The filing accuses management of basic execution missteps, including slow filings and incomplete investor-relations materials, and describes a near-total absence of institution-facing marketing. It also alleges Namdar has promoted other digital-asset treasury efforts while BNB Network's rollout struggled for traction.

It further raises concerns about 10X Capital’s dual role as asset manager and a dominant presence on the board.

Down market

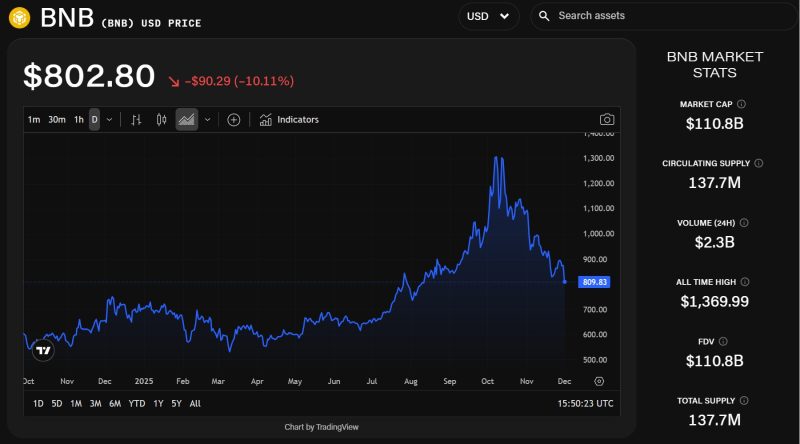

The market backdrop adds another layer of pressure. BNB is trading near a three-month low just above $800, according to The Block's price page, and that is starting to weigh on BNB Network’s treasury.

BNB Price Chart. Source: The Block/TradingView

The current BNB Treasury dashboard shows about 515,000 BNB worth roughly $412 million at an average cost of $851.

BNC shares fell nearly 11% in early Monday trading to $6.35, deepening the discount to its reported NAV of $8.09 per share and pushing its mNAV multiple down to roughly 0.8×.

The Block reached out to Namdar, BNB Network, and a contact at YZi Labs but has not yet received a response.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

You May Also Like

Zcash (ZEC) Price Prediction: ZEC Defends $300 Support as Bullish Structures and Privacy Narrative Return to Focus

The 5000x Potential: BlockDAG Enters Its Final Hours at $0.0005 Before the Presale Ends