BTC Reversal Halted at $93K: What’s Next for Crypto?

Bitcoin Faces Resistance and Consolidation Ahead of Key Federal Reserve Meeting

Bitcoin (BTC) has struggled to sustain a move beyond the crucial $93,000 resistance level, after briefly surging to approximately $93,300 last week. The cryptocurrency encountered a strong reversal and fell below $85,000 on Monday, indicating a pause in its bullish momentum and raising questions about its short-term trajectory.

Key Takeaways

- Bitcoin’s failure to close above $93,000 invalidated the bullish reversal confirmation.

- Market liquidity limitations are hampering further upward movement, with weak on-chain demand between $84,000 and $90,000.

- Extreme stablecoin reserves on Binance highlight potential buying power, yet absorbent demand remains absent.

- Market sentiment suggests sideways trading ahead of the Federal Reserve’s December policy meeting.

Lack of Spot Buyers Limits Bullish Momentum

The current challenge for Bitcoin stems from thin spot liquidity and shallow order books, making it difficult to push past the $93,000 mark. Although a significant cluster of cost basis around $84,000 provides an on-chain support floor, active buying pressure remains subdued in the $84,000 to $90,000 range. This lack of demand is partially driven by investors who bought at higher levels, with many remaining underwater relative to their average entry price of approximately $104,600.

Data from CryptoQuant reveals that Binance’s Bitcoin to Stablecoin Reserve Ratio has plummeted to its lowest point since 2018, indicating a substantial accumulation of stablecoins prepared to buy Bitcoin. Such ratios historically precede rally phases, suggesting that the buying power exists, but remains largely inactive.

Binance Bitcoin/Stablecoin Reserve Ratio. Source: CryptoQuant/XMarket Outlook: Consolidation Expected

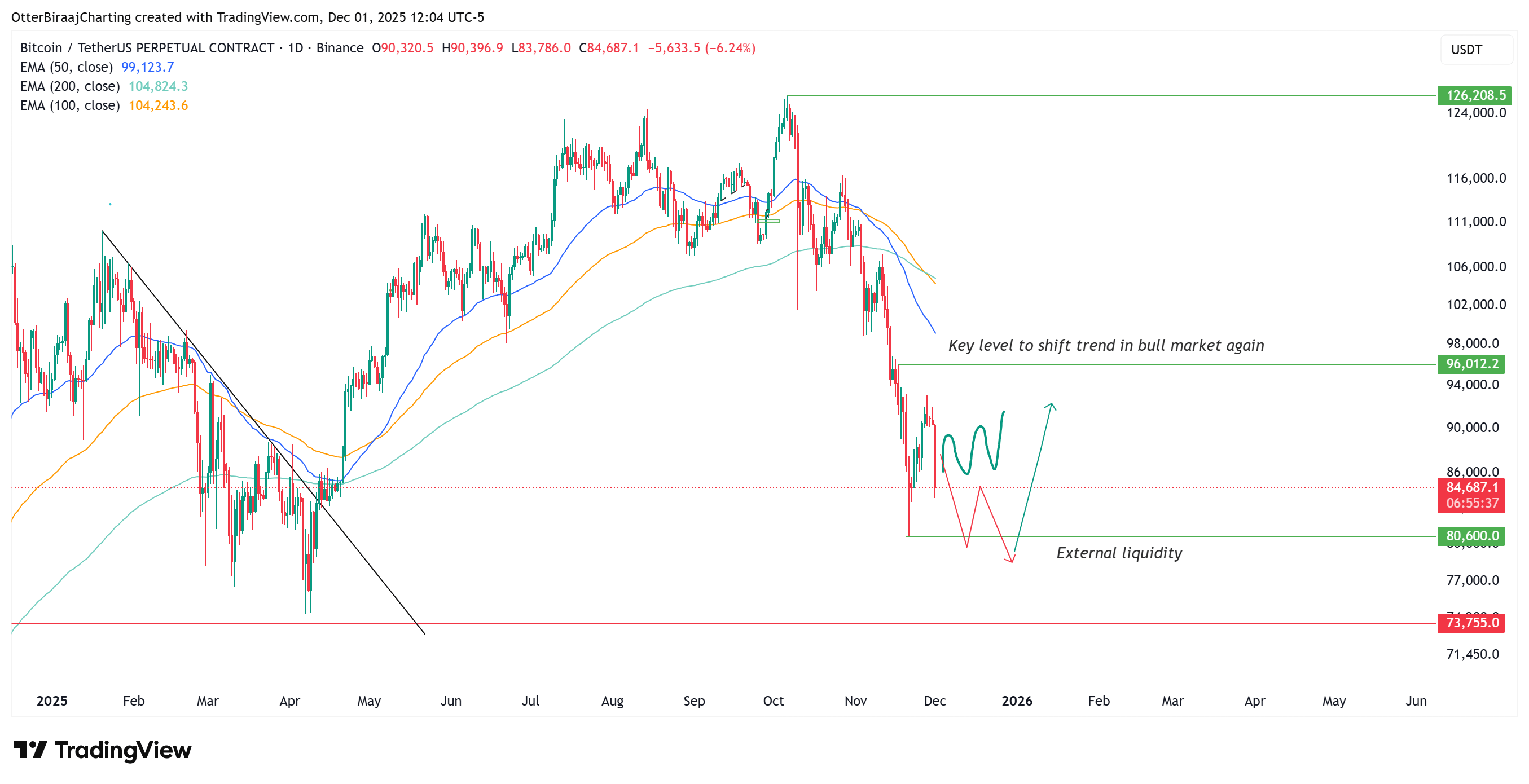

Bitcoin continues to trade within a range bounded by $96,000 on the upside and roughly $80,600–$84,000 on the downside. Liquidity clusters on both ends suggest that a decisive move in either direction could trigger significant price action. A retest of the lower support near $80,600–$84,000 might be constructive, allowing the market to absorb liquidity and potentially set up for a rebound. Conversely, rushing to retest the upper resistance without prior accumulation risks triggering a downward correction amid prevailing bearish tendencies.

Bitcoin one-day analysis. Source: Cointelegraph/TradingView

Bitcoin one-day analysis. Source: Cointelegraph/TradingView

With the upcoming Federal Reserve policy meeting scheduled for December 9–10, traders might adopt a cautious stance, favoring sideways consolidation as markets await clearer signals on U.S. interest rate direction. This period of indecision could maintain Bitcoin within its current range, awaiting a catalyst for a decisive move either upward or downward.

This article was originally published as BTC Reversal Halted at $93K: What’s Next for Crypto? on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Wormhole Unleashes W 2.0 Tokenomics for a Connected Blockchain Future

Utah Man Receives 3-Year Sentence For $3M Deceptive Exchange Scheme