Ethereum’s Privacy Upgrade Hides Transaction Details Like a Secret Santa Game

Distributed Lab researchers have published a breakthrough protocol demonstrating how Ethereum can implement privacy-preserving games while maintaining participant confidentiality and correctness.

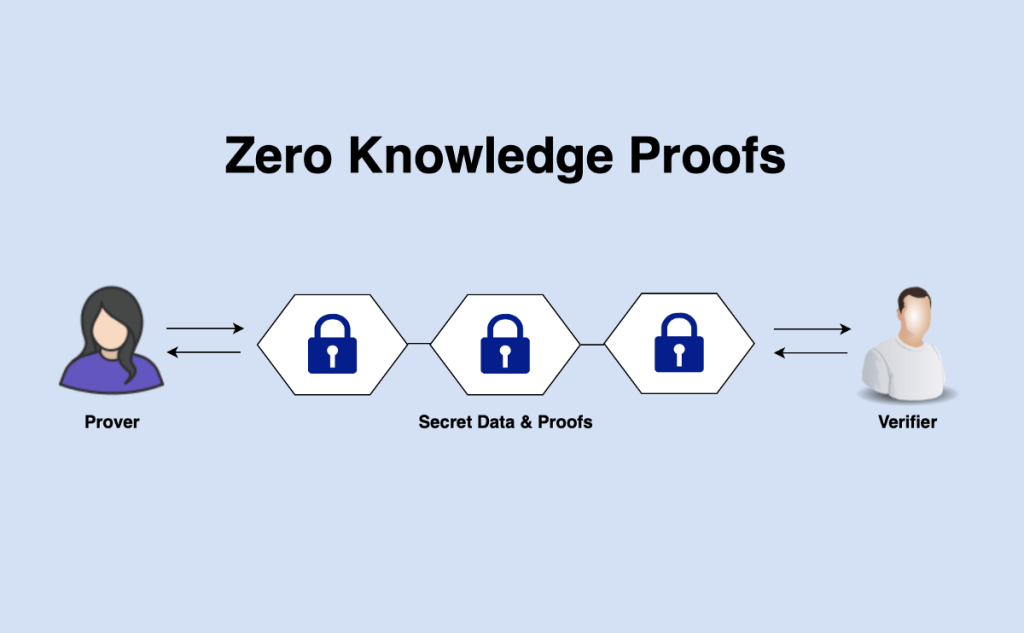

The ZK Secret Santa (ZKSS) system uses zero-knowledge proofs to establish gift sender-receiver relationships without revealing identities, addressing fundamental challenges in executing private transactions on public blockchains.

The timing proves significant as Ethereum accelerates institutional privacy infrastructure following warnings from co-founder Vitalik Buterin that, without robust protections, the network risks becoming “the backbone of global surveillance rather than global freedom.”

The Secret Santa protocol illustrates practical applications of privacy technology that Ethereum desperately needs to unlock enterprise adoption.

Research Tackles Blockchain’s Transparency Problem

The ZKSS protocol solves three critical challenges preventing private on-chain activities.

Ethereum’s transparent ledger prevents concealing participant addresses, forcing researchers to deploy transaction relayers alongside zero-knowledge proofs to protect identities.

The blockchain’s lack of true randomness requires outsourcing gift pair selection to participants with ZKP verification, preventing self-assignment.

The “double voting” problem is resolved through nullifier-based mechanisms that verify participation without compromising confidentiality.

Head of Solidity at Distributed Lab, Artem Chystiakov, proposed a three-step, non-peer-to-peer process that requires the involvement of all participants.

The algorithm leverages cryptographic primitives, including hash functions, ECDSA signature recovery, and Merkle proofs, to ensure the correctness of execution.

Players register addresses in a Sparse Merkle Tree during setup, commit signature hashes, and then anonymously submit randomness values that serve as RSA public keys for encrypted delivery address transmission.

The protocol draws parallels to physical Secret Santa mechanics, where participants secretly place random notes into a hat before drawing assignments.

“Each participant securely places a piece of paper containing their randomness into a hat,” the research states, with transport mechanisms corresponding to relayers ensuring no one observes which note belongs to whom.

The ZKP “magic” guarantees participants cannot retrieve their own notes during the drawing phase.

Privacy Technology Transforms Ethereum Into Surveillance-Free Network

Ethereum’s privacy upgrade fundamentally changes how transactions work by hiding sender and receiver information while still proving transactions are valid.

Think of it like sending a sealed envelope through the postal system, where everyone can verify it was delivered correctly without knowing who sent it or what’s inside.

Zero-knowledge proofs make this possible by proving something is true without revealing the underlying data.

Source: Medium

Source: Medium

The technology addresses Ethereum’s core vulnerability, where every transaction becomes permanently visible to anyone with internet access.

Current blockchain transparency enables competitors to track business deals, governments to monitor spending patterns, and hackers to identify wealthy targets by monitoring wallet balances.

Companies handling millions in transactions face particular exposure since their entire supply chain and financial operations become public records.

Privacy-preserving smart contracts now enable businesses to conduct confidential transactions while maintaining audit trails for compliance.

Projects like RAILGUN and Aztec Network allow users to shield wallet balances and transaction details from public view while still settling on Ethereum’s secure base layer.

Users can create “shielded balances” that function like private bank accounts, with transaction history visible only to the account holder.

The Ethereum Foundation launched a 47-member Privacy Cluster in October, under the coordination of Blockscout founder Igor Barinov, to accelerate development across five key areas, including private transactions, portable verification, and selective identity disclosure.

Regulatory Pressure Intensifies Privacy Development

The Financial Stability Board warned in October that strict privacy laws hinder global crypto oversight, as confidentiality rules prevent data sharing across jurisdictions.

“Secrecy or data privacy laws may pose significant barriers to cooperation,” the FSB wrote, noting delays in addressing cooperation requests that discourage participation in oversight arrangements altogether.

Given the growing concern, the EU introduced sweeping crypto data-sharing rules in November under Implementing Regulation 2025/2263, requiring exchanges and wallet providers to report customer holdings in standardized formats from January 2026.

The framework extends the Transfer of Funds Regulation’s “travel rule” to crypto, mandating sender-recipient identification for all transfers, including self-hosted wallet interactions above €1,000.

Most recently, Vitalik Buterin donated nearly $390,000 to the Session encrypted messaging app in November, highlighting that strong metadata privacy “requires decentralization.”

Session Technology Foundation President Alex Linton explained that permissionless account creation prevents censorship by generating cryptographically secure Account IDs rather than requiring phone numbers or email addresses that introduce surveillance risks.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

‘Groundbreaking’: Barry Silbert Reacts to Approval of ETF with XRP Exposure